U.S. Stock Futures Soar to Record Highs—Is Bitcoin Primed for a Historic Breakout?

Wall Street’s futures market just punched through all-time highs—again. Traders are piling into risk assets, but the real question is: When does Bitcoin join the party?

The crypto crowd’s favorite narrative—‘digital gold’ catching up to traditional markets—might finally get its moment. If equities keep melting up, speculative capital could flood into BTC faster than a hedge fund dumping bags on retail.

Key triggers to watch:

- Liquidity tides: Fed pivot rumors are back. Easy money = rocket fuel for crypto.

- Institutional FOMO: BlackRock’s ETF inflows hit $1B daily? Suddenly everyone ‘believes in blockchain’.

Of course, this being crypto, the breakout could vaporize tomorrow. Nothing moves in a straight line—except maybe bankers’ bonuses during a bubble.

U.S. stocks break records

Notably, S&P 500 Futures surged to a fresh all-time high of 6,145, eclipsing February’s previous peak, while Nasdaq Composite futures also reached a new high at 20,180.

Source: The Kobeissi Letter/X

This bullish sentiment reflected a market recovery, with the S&P 500 rebounding by 23% since its plunge on the 8th of April, as fears over trade tariffs and conflict-driven volatility began to subside.

What’s more

As expected, the recent surge in U.S. equities has fueled speculation that the Federal Reserve may initiate interest rate cuts as early as July, a move that has energized both traditional and crypto markets alike.

Echoing similar sentiments was Bill Northey, senior investment director at U.S. Bank Wealth Management, Billings, Montana, who added,

“Clearly, the pull forward of rate cuts into 2025 is one of the more significant factors. Expectations now point to three rate cuts this year.”

In response, many in the crypto space are anticipating a bullish breakout for Bitcoin [BTC], with expectations that it could soon follow the stock market’s lead and chart a new all-time high.

Mixed community reaction

Echoing this sentiment, BitMEX founder Arthur Hayes confidently predicted that bitcoin ATHs are on the horizon, tying crypto’s trajectory closely to Wall Street’s record-breaking rally.

He said,

Source: Arthur Hayes/X

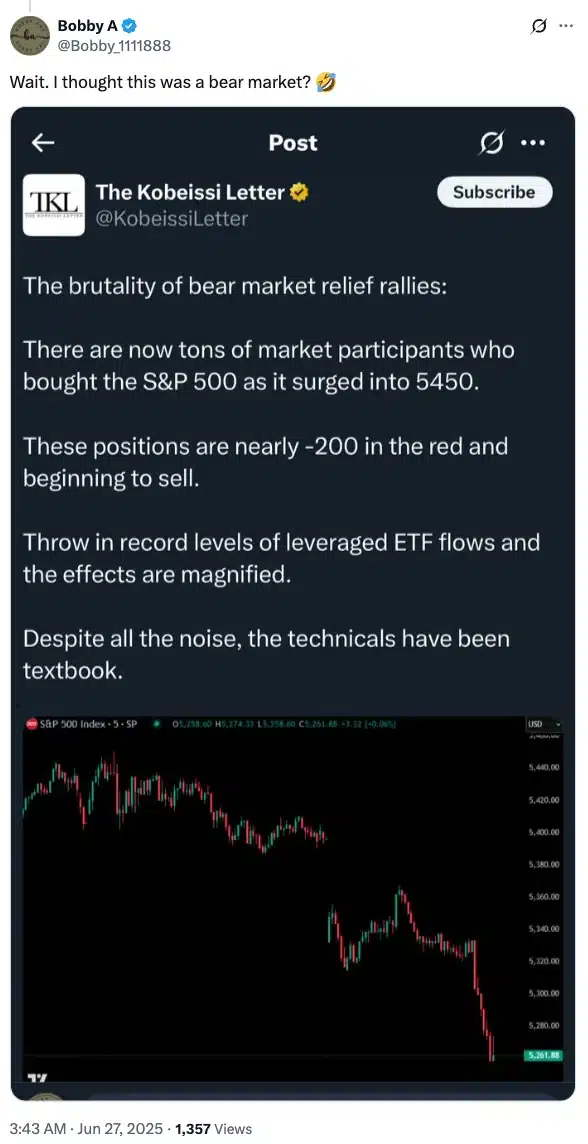

However, not everyone is cheering for Bitcoin to reach a new all-time high. As one X user pointed out, skepticism remains.

Source: Bobby A/X

Bitcoin’s current trend and what lies ahead

Meanwhile, at the time of writing, Bitcoin was trading at $106,996.63 after a minor 0.38% dip over the past 24 hours, according to CoinMarketCap.

While the Bulls And Bears indicator showed a NEAR deadlock, with bears slightly ahead at 122 compared to bulls at 120, on-chain data pointed to a more optimistic outlook.

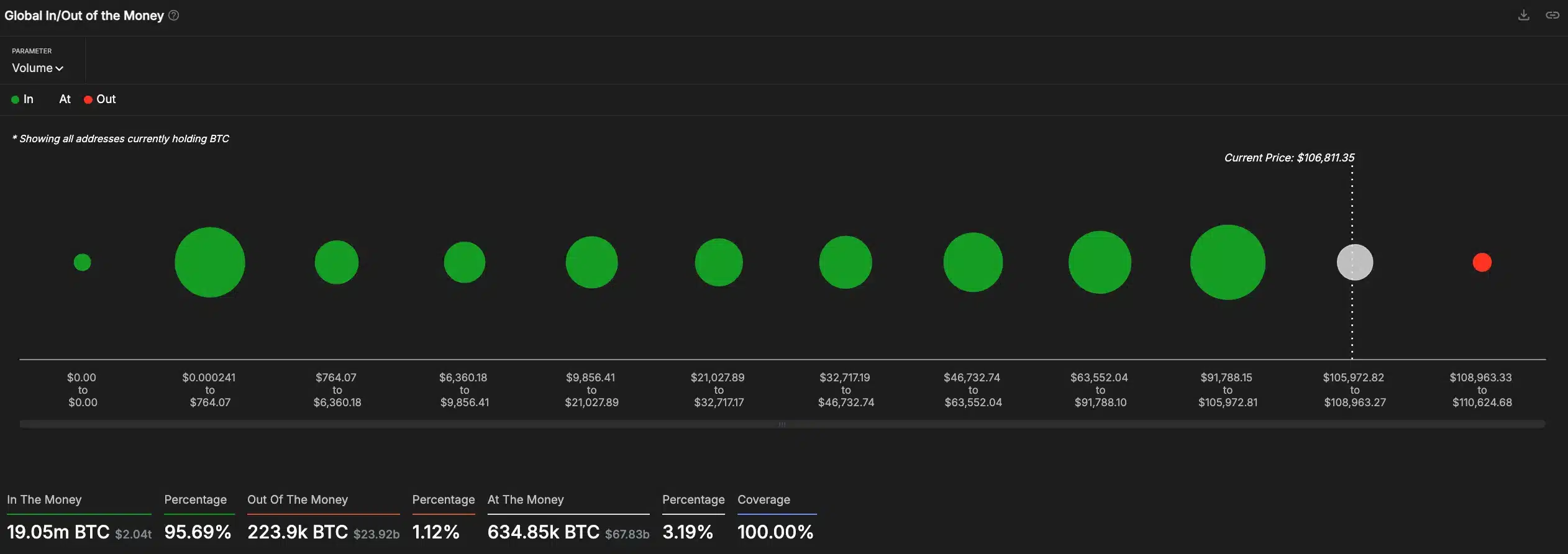

Source: IntoTheBlock

AMBCrypto’s analysis of IntoTheBlock data revealed that nearly 95.69% of BTC holders were in profit, signaling strong bullish sentiment and the potential for further upward movement.

Source: IntoTheBlock

However, seasonal trends could temper expectations. Historically, Q3 has been Bitcoin’s weakest quarter, with average returns of just 6%, according to CoinGlass.

Whereas, July often defies this trend with an average gain of 7.5%, while August and September tend to underperform.

Analysts attribute this seasonal dip to reduced trading volume during summer holidays.

Therefore, while historical patterns suggest a cautious approach, the current profitability of holders and market sentiment could tilt the balance in favor of further gains.

But investors should remember that past trends are no guarantee of future performance.

Subscribe to our must read daily newsletter