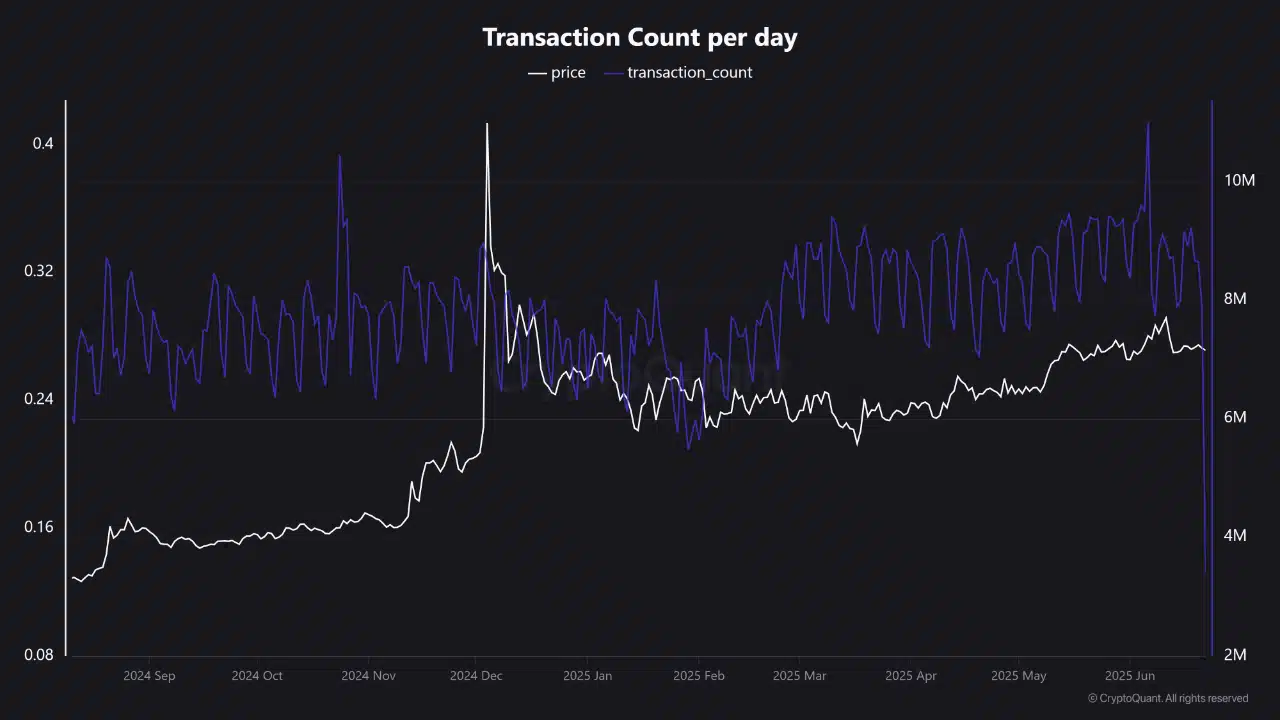

TRON in Trouble? When Will TRX’s Price Finally Reflect Its Plummeting Network Activity?

TRON's network usage is nosediving—but its token price hasn't gotten the memo yet. How long before reality bites?

Signs of strain

The once-booming dApp platform shows decaying fundamentals. Daily active wallets? Down. Transaction volume? Shrinking. Yet TRX keeps trading like it's 2021 all over again.

The coming reckoning

History shows crypto prices eventually sync with network health. When traders wake up to TRON's fading utility, that resistance level won't look so strong. (Cue the 'we're building for the long term' tweets from the team.)

Just another day in crypto—where fundamentals are optional until suddenly they're not. Maybe they'll launch another algorithmic stablecoin to fix everything?

Source: CryptoQuant

Are TRX whales and investors quietly positioning while retail stays passive?

TRON’s holder distribution has been undergoing a strategic realignment recently. Over the last 30 days, for instance, whale holdings increased by 9.36% and investor positions surged by 41.82%. On the contrary, retail participation climbed by just 3.79%.

This divergence could be a sign that large players are actively accumulating TRX, despite declining activity. Such behavior often precedes major directional moves, especially when the price remains relatively stable.

The growing concentration among smart money participants points to confidence in TRON’s recovery or future use cases. Therefore, retail’s lag may leave them vulnerable to late entries when volatility returns.

Source: IntoTheBlock

Can rising social chatter offset the silence on-chain?

TRX’s Social Dominance hasn’t been far behind either, climbing from below 0.3% to 1.37% within just days. This surge hinted at renewed community engagement and rising curiosity about TRON’s divergence between price and usage.

Often, heightened attention precedes momentum shifts. Especially when paired with whale accumulation.

While social HYPE alone cannot sustain price action, it can play a key role in driving short-term interest and speculative rallies.

As such, TRON’s growing visibility may attract new participants, even if on-chain fundamentals appear to weaken in the background.

Source: Santiment

Why do funding rates suggest caution despite price stability?

Although TRX has remained within a familiar price band, derivatives tell us a different story. Binance’s funding rate dipped to -0.022%, revealing that traders have been paying to hold short positions.

This persistent negative trend throughout June could be a sign that bears still expect downside.

While funding doesn’t always predict immediate moves, consistent negativity usually alludes to an undercurrent of bearish conviction.

Therefore, despite the spot price holding firm, Leveraged players might be unconvinced of bullish continuation. This could suppress breakout potential, unless sentiment shifts rapidly.

Source: Santiment

Will TRX break out of consolidation or remain trapped below resistance?

TRX has continued to trade within a tight range, struggling to escape the $0.2422 to $0.2967 corridor. At the time of writing, it sat NEAR the 0.382 Fibonacci level at $0.2631, just under the $0.2754-resistance.

Its price action seemed to have stalled after multiple failed attempts to clear overhead levels. However, strong support was present at $0.2422, guarding against a deeper breakdown. Unless momentum improves and volume returns, TRX may remain range-bound.

A decisive breakout above $0.2967 or a breach below $0.2422 will determine the next trend direction.

Source: TradingView

Will TRON’s price eventually reflect its fading utility?

The disconnect between TRON’s price and its plunging transaction count remains unresolved. While whales accumulate and social sentiment grows, the Core network activity has cratered. This divergence cannot last indefinitely.

Either usage must recover to justify the current valuation, or the market will catch up to the chain’s declining fundamentals.

Subscribe to our must read daily newsletter