Canada Prepares to Roll Out Solana ETF Products – Could This Mark a Pivotal Moment for SOL’s Market Trajectory?

The Canadian financial market is poised to introduce exchange-traded funds (ETFs) centered on Solana (SOL), signaling a potential watershed moment for the cryptocurrency. This development could significantly influence SOL’s adoption, liquidity, and price dynamics, as ETFs typically attract institutional and retail investors seeking regulated exposure to digital assets. The move aligns with Canada’s progressive stance on crypto innovation, following its earlier approvals of Bitcoin and Ethereum ETFs. Market analysts are closely monitoring whether this will catalyze broader global acceptance of Solana-based investment vehicles, potentially reshaping its competitive position against other smart contract platforms.

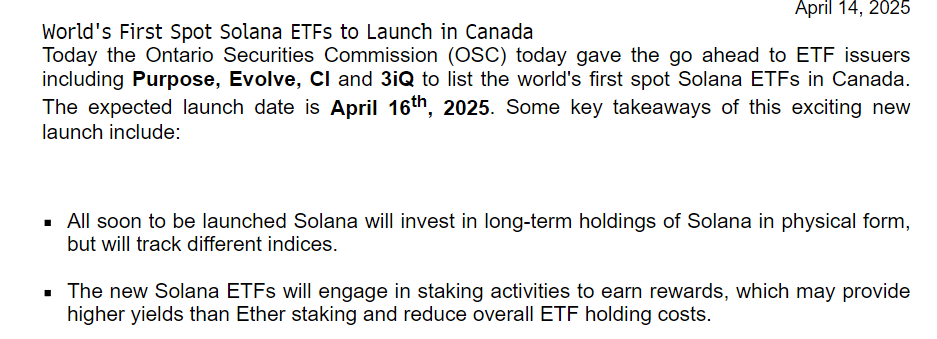

Source: X

SOL vs. XRP ETFs

In addition, the products will have staking provisions.

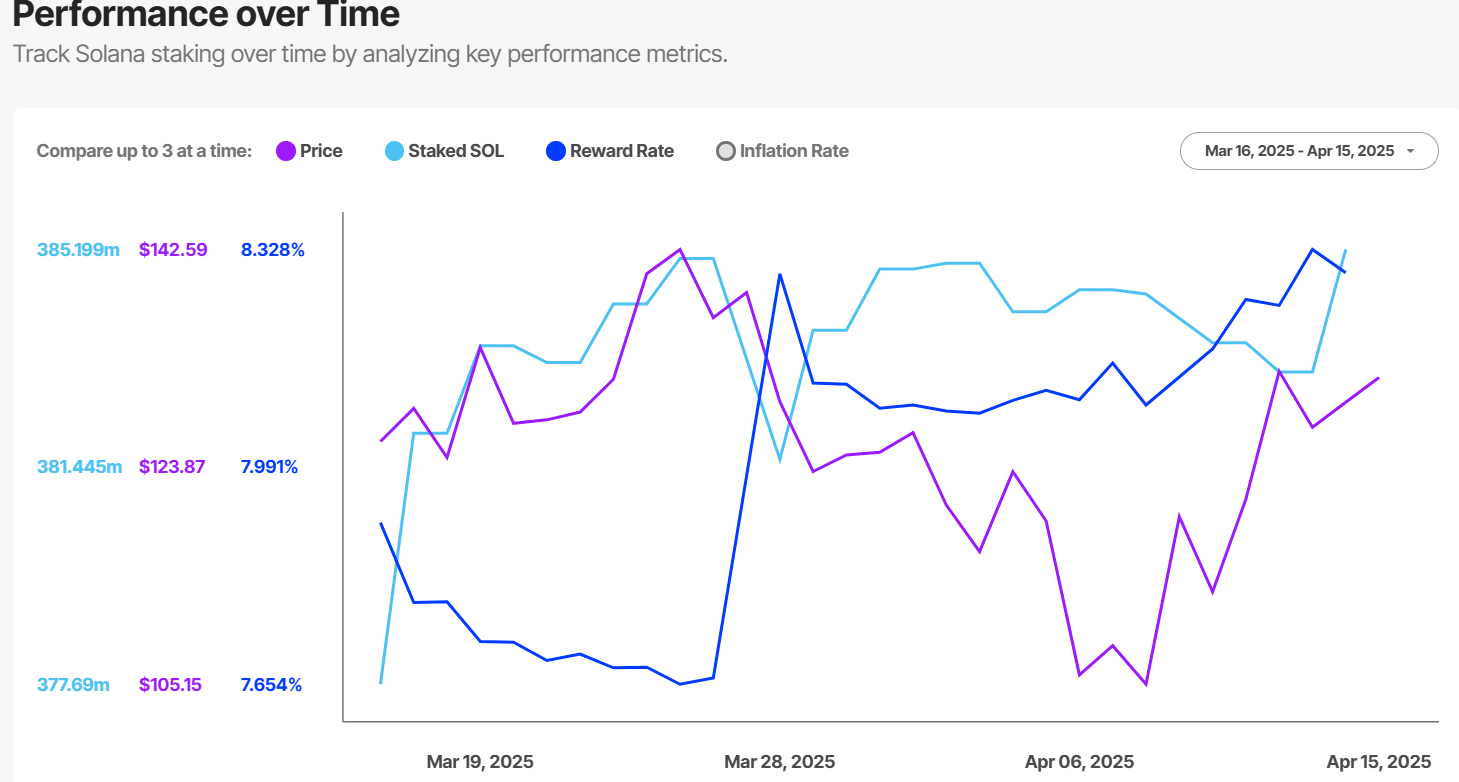

At the time of writing, Solana staking fetched an 8% annualized yield, nearly triple the ETH staking rewards. It remains to be seen how the staking rewards will boost product demand.

Source: Staking Rewards

However, Balchunas downplayed the product’s potential performance, highlighting the strong interest in the U.S.-based Tecrium XRP ETF. Comparing U.S.-based SOL and Ripple [XRP] ETFs, Balchunas said,

“FWIW, the 2 Solana ETFs in U.S. (which track futures so not a perfect guinea pig) haven’t done much. Very little in AUM. The 2x XRP already has more AUM than both the Solana ETFs and it came out after.”

He added,

“Wouldn’t read a TON into it, but it’s our first look at the alt coin race.”

That said, several issuers, including Grayscale, have applied for U.S. spot SOL ETFs. The potential deadline for the SEC decision on the products could be between May and October 2025.

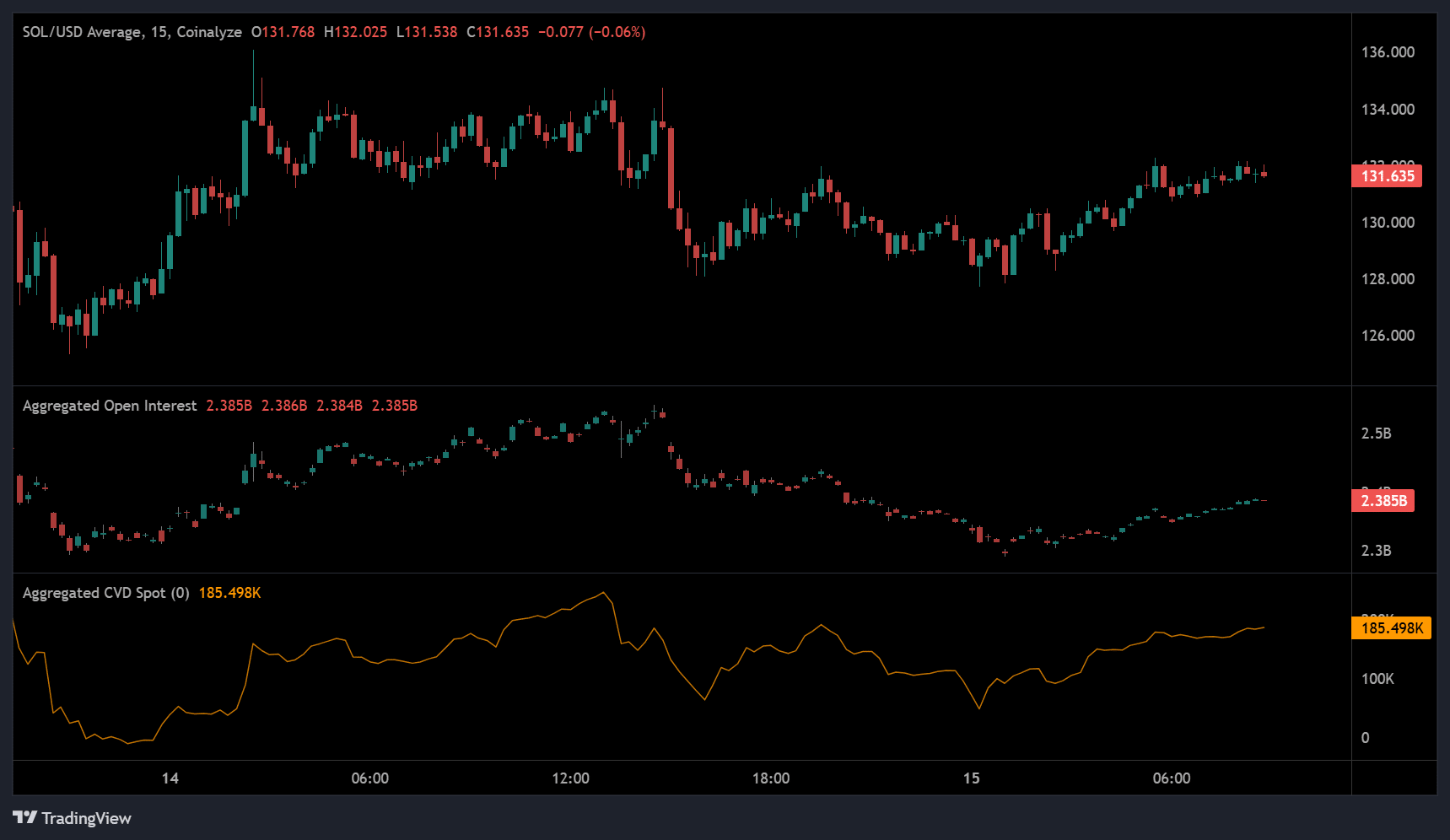

Source: Coinalyze

Meanwhile, the ETF update saw a slight uptick in spot demand, as shown by the slight surge in spot CVD (Cumulative Volume Delta).

Additionally, the Open Interest (OI) rate surged minimally from $2.30B to $2.38B, suggesting that speculative interest in the derivatives market wasn’t aggressive after the update.

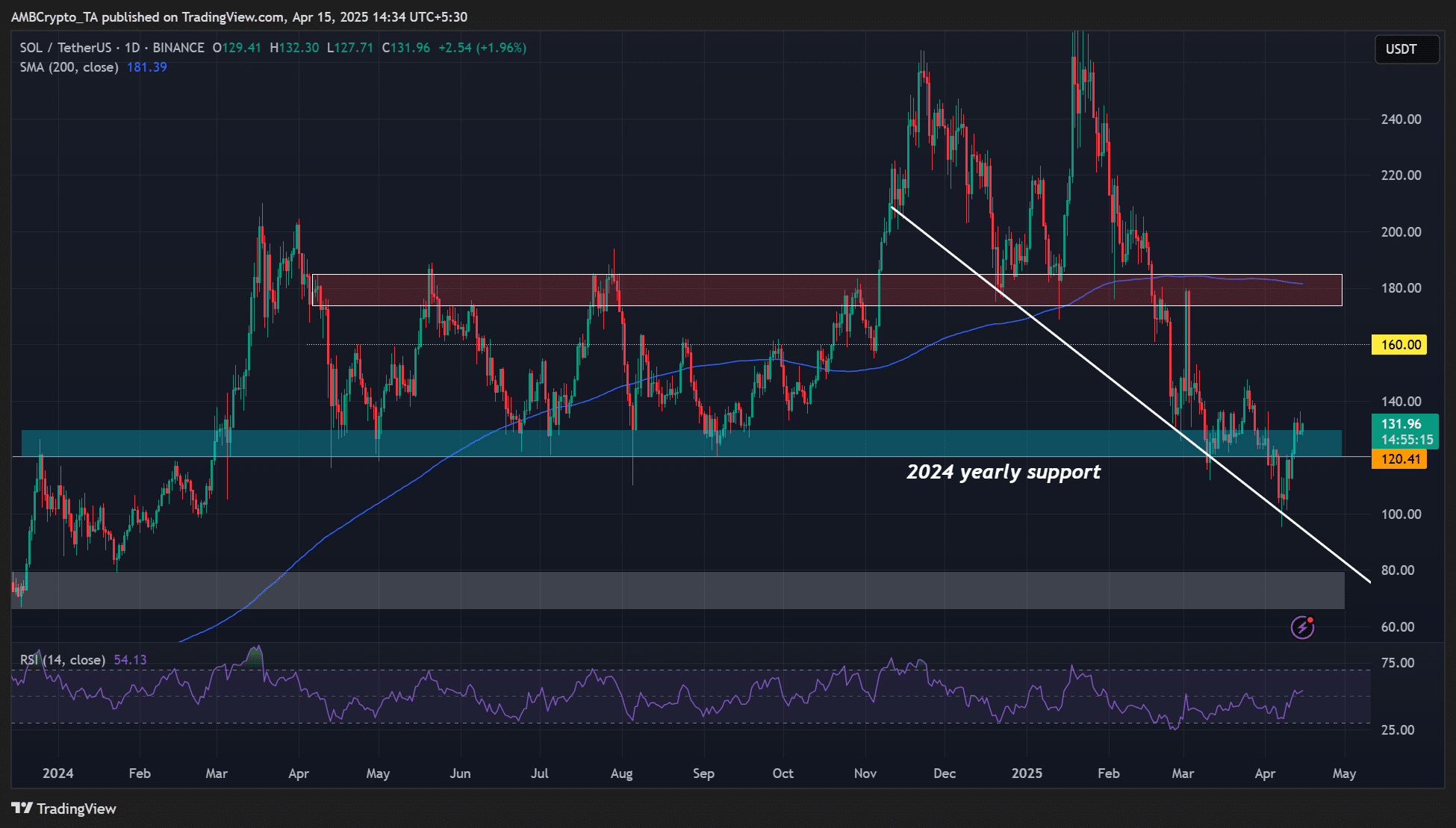

Despite the lukewarm demand, SOL’s price was back above its 2024 yearly support of $120. Should the support hold, the altcoin could eye $140 or $160 levels.

Source: SOL/USDT, TradingView

Take a Survey: Chance to Win $500 USDT