Bitcoin Nears $86K: Caution Advised as Bull Trap Risks Emerge – Prepare for Possible Liquidity Sweep

As Bitcoin approaches the $86,000 mark, traders should remain vigilant for potential bull trap scenarios. Market dynamics suggest a heightened risk of a liquidity sweep, which could trigger short-term volatility. Technical indicators recommend closely monitoring order book depth and key support/resistance levels to navigate this critical price zone effectively. Institutional and retail traders alike are advised to assess risk management strategies in case of a sudden reversal or fakeout breakout.

Market makers set to exploit overcrowded long positions

At press time, Bitcoin was closing in on a key liquidity zone near $86.50k. However, there seemed to be signs of weakness underneath.

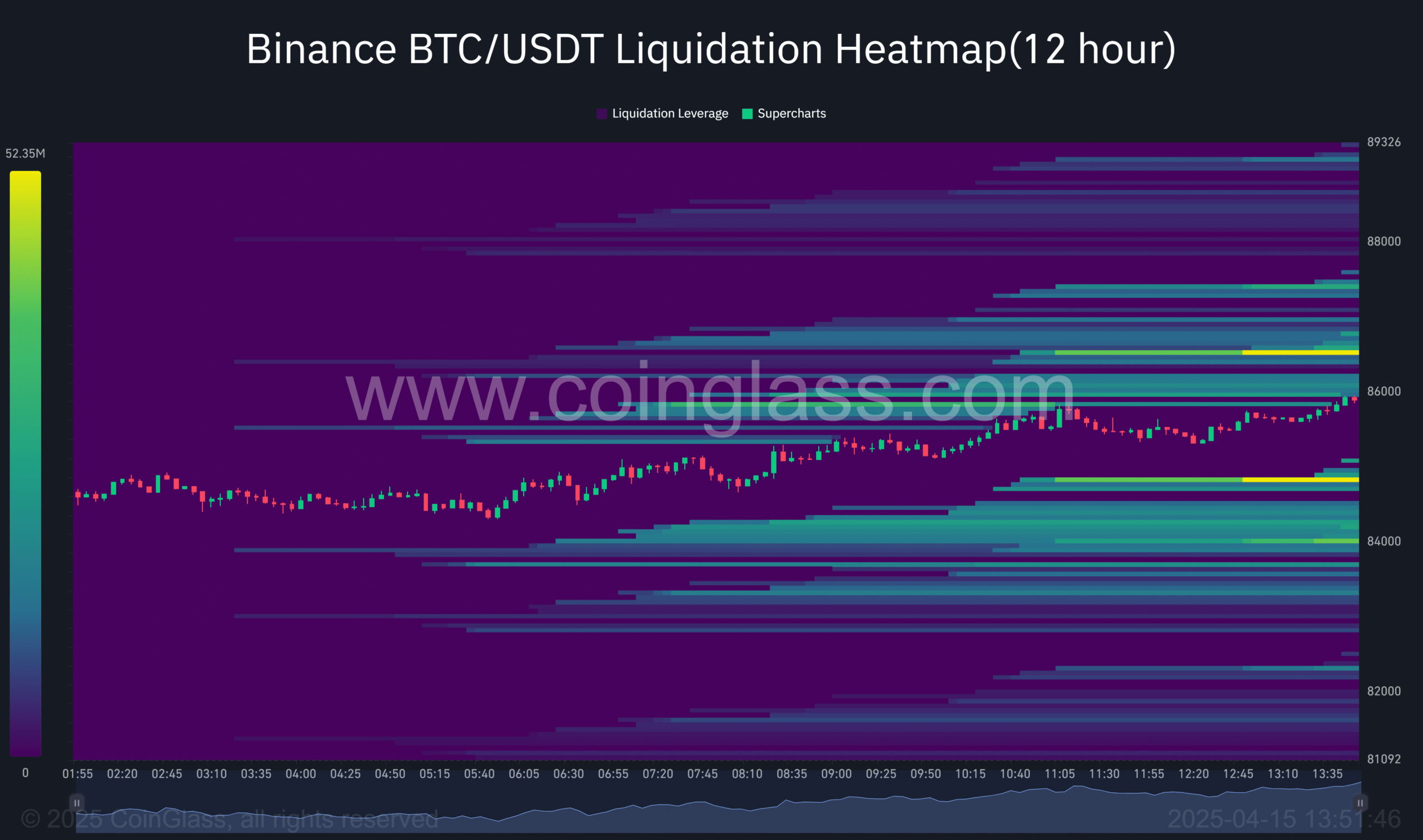

Source: Coinglass

The retail long positioning has been relatively low, with bid-ask ratios in the negative to signal fading demand. Additionally, the flat Open Interest (OI) indicated a lack of fresh capital inflows to support the move.

More crucially, 77% of liquidation levels clustered around this liquidity zone were long positions. Consequently, this liquidity cluster could act as a magnet, potentially triggering a downside sweep as market makers capitalize on forced liquidations.

In fact, this level also represents the Alpha Price zone, a key area that has historically acted as both support and resistance. There’s a risk Bitcoin might briefly go above this level, only to fall back down – Setting up a bull trap.

Bitcoin needs real conviction-backed hard data

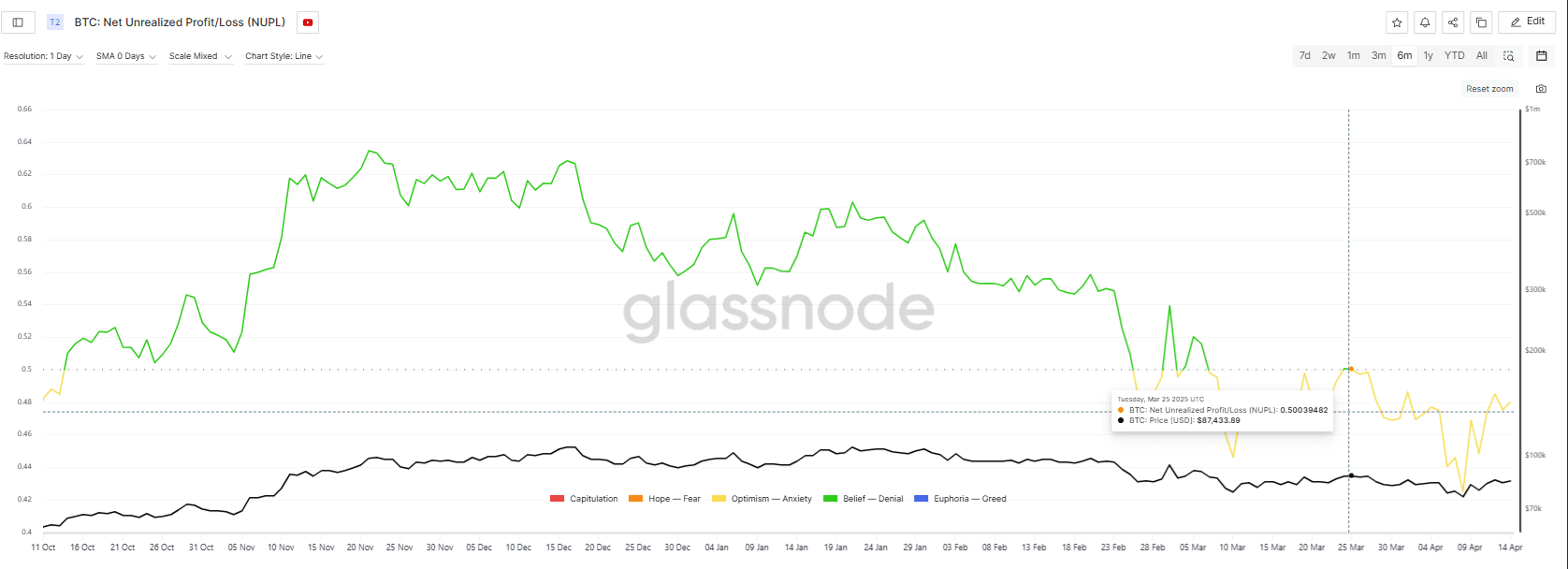

The NUPL (Net Unrealized Profit/Loss) metric reveals the state of BTC’s current erratic price action.

Since 07 March, it has stayed within the ‘Optimism’ phase. This hinted that a significant portion of the market is in unrealized profit, with large holders likely accumulating.

However, every time BTC approaches the $86k–$87k zone, the NUPL shifts into ‘Anxiety’, showing that a growing number of market participants are starting to feel uneasy about their unrealized gains.

This shift suggests that profits, though not yet realized, are being pressured and could soon be taken off the table.

Source: Glassnode

For instance, on 25 March, Bitcoin briefly reclaimed $87.5k. However, before the NUPL could enter the Belief phase, it reversed into Anxiety. This pointed to market participants increasingly realizing or hedging against unrealized profits.

As Bitcoin revisits this zone, a similar pattern could drive the NUPL lower, signaling a shift in market sentiment.

As a result, with 77% of liquidations concentrated in long positions around this critical liquidity cluster, a downside sweep could be triggered. This would lead to forced liquidations, potentially driving BTC lower.

Unless Bitcoin decisively breaks out of this range-bound structure, the risk of further volatility and liquidation cascades remains elevated. This will leave the market vulnerable to a bearish leg.

Take a Survey: Chance to Win $500 USDT