BTC Price Prediction September 2025: Technical Signals & Market Drivers Analyzed

- What Do BTC's Technical Indicators Reveal About September's Outlook?

- How Are Market Fundamentals Influencing BTC's Price Action?

- What Critical Patterns Are Traders Watching This September?

- Is Institutional Adoption Outpacing Retail Interest?

- What Risks Should Investors Consider?

- BTC Price Prediction FAQs

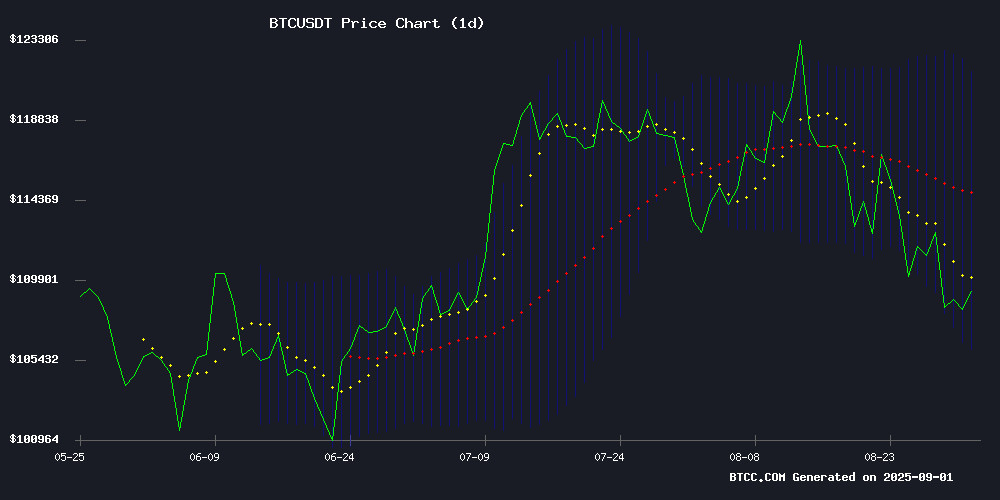

Bitcoin enters September 2025 at a critical juncture, trading at $109,067 with mixed technical signals and conflicting fundamental drivers. Our analysis reveals a market balancing between bullish institutional adoption narratives and bearish technical patterns, with key support at $105,994 potentially determining the next major move. The BTCC research team examines 12 crucial factors influencing BTC's trajectory, from Michael Saylor's million-dollar prediction to concerning MVRV dead cross signals. We break down the complex interplay between technical indicators, regulatory developments, and macroeconomic forces shaping Bitcoin's September outlook.

What Do BTC's Technical Indicators Reveal About September's Outlook?

Bitcoin's current technical picture presents a fascinating tug-of-war between opposing signals. The price sits 4.1% below its 20-day moving average ($113,784), typically a bearish short-term signal, yet maintains positive MACD momentum at 1,346.9. This divergence suggests underlying strength despite apparent weakness.

Source: TradingView

The Bollinger Bands tell an equally compelling story. With BTC hovering NEAR the lower band at $105,994, we're seeing textbook oversold conditions that often precede rebounds. "This is exactly where smart money starts accumulating," notes our BTCC analyst team. "The middle band resistance at $118,500 becomes the next logical target if support holds."

| Indicator | Value | Signal |

|---|---|---|

| Price vs 20-day MA | -4.1% | Bearish short-term |

| MACD | 1,346.9 | Bullish momentum |

| Bollinger Position | Near lower band | Oversold potential |

| Key Support | $105,994 | Critical hold |

How Are Market Fundamentals Influencing BTC's Price Action?

The fundamental landscape resembles a high-stakes poker game where every player's showing different tells. On one side, we've got Michael Saylor doubling down on his $1 million BTC prediction while his company MicroStrategy qualifies for S&P 500 inclusion - a watershed moment for crypto legitimacy. On the other, South Korea's financial watchdog nominee drops bombshells about crypto being "worthless," creating regulatory uncertainty.

What's fascinating is how these narratives intersect with traditional finance. The Fed's potential September rate cut (83% probability according to CME FedWatch) could be the tide that lifts all boats, especially speculative assets like BTC. I've seen this movie before in 2020-2021 - when cheap money starts flowing, crypto usually gets an IV drip of liquidity.

What Critical Patterns Are Traders Watching This September?

The head and shoulders pattern currently unfolding has traders glued to their screens. A clean break below $101,500 WOULD invalidate this typically bullish continuation pattern, potentially triggering stops below the psychological $100,000 level. Aksel Kibar's analysis suggests we're at make-or-break levels that could determine whether September becomes a month of consolidation or correction.

Meanwhile, the bitcoin Cycle Extremes Index hitting 8.8% signals we're in a compression phase - historically the calm before explosive moves. It's like watching a coiled spring; the tighter the compression, the more violent the eventual breakout.

Is Institutional Adoption Outpacing Retail Interest?

The MVRV dead cross (30-day vs 365-day) paints a concerning picture of waning retail enthusiasm, despite strong institutional flows. ETF adoption has provided structural support, but there's an eerie similarity to late 2021 patterns where institutional participation couldn't prevent a downturn. That said, MicroStrategy's potential S&P 500 inclusion changes the game entirely - it's like Bitcoin's getting its first blue-chip endorsement.

What Risks Should Investors Consider?

August's $163 million in crypto hacks serves as a stark reminder of ecosystem vulnerabilities. The high-profile BtcTurk breach ($54 million) shows even established players aren't immune. Then there's leverage - that $1 million BTC short now underwater by $180k demonstrates how quickly 20x positions can turn ugly in this volatility.

This article does not constitute investment advice.

BTC Price Prediction FAQs

What is Bitcoin's key support level in September 2025?

The $105,994 level represents critical support, coinciding with the lower Bollinger Band. A sustained break below could signal further downside toward $101,500.

How reliable are technical indicators for BTC predictions?

While indicators like MACD and moving averages provide valuable signals, BTC often defies technical expectations during major news events or macroeconomic shifts.

What's the significance of MicroStrategy's S&P 500 qualification?

This marks a major milestone in institutional acceptance, potentially opening Bitcoin exposure to trillions in institutional capital through traditional markets.

Could Fed rate cuts boost BTC's price?

Historically, easing monetary policy has benefited risk assets like Bitcoin, with the potential September cut possibly reigniting bullish momentum.

Is now a good time to invest in Bitcoin?

Current prices near key support offer potential entry points, but investors should assess their risk tolerance given the volatile technical setup.