Stablecoins Outpace Solana in Adoption and Real-World Utility: A Sign of Crypto Maturity?

- Why Are Stablecoins Leading the Charge as Crypto Matures?

- Regulation Fuels the Stablecoin Boom: Banks and Big Tech Jump In

- JPMorgan vs. the Optimists: Is a $2 Trillion Stablecoin Market Realistic?

- Ethereum’s Dominance and the Layer-1 Race

- FAQs: Your Stablecoin Questions Answered

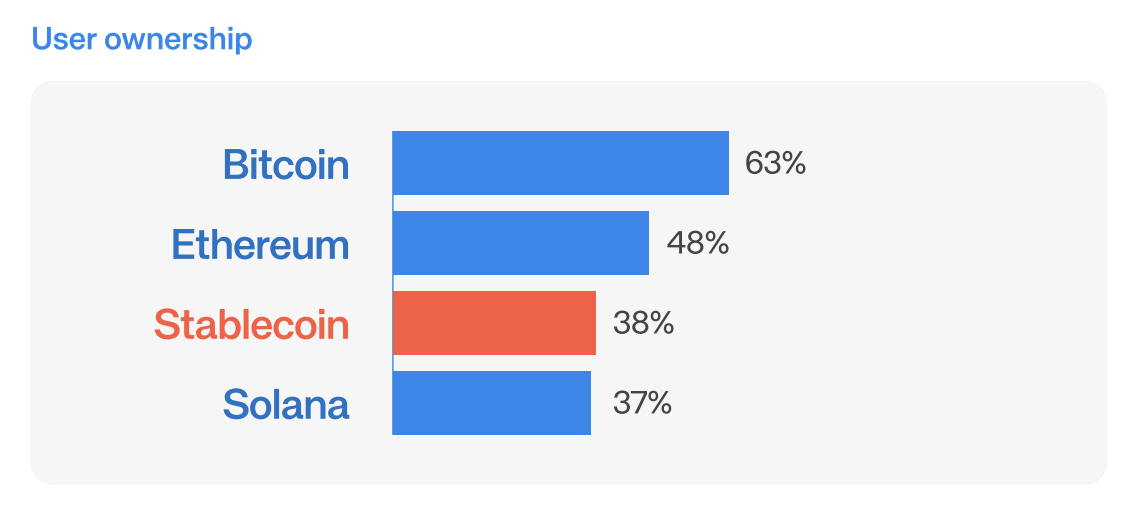

Stablecoins have officially surpassed Solana's SOL in wallet ownership, signaling a shift toward practical crypto applications. With 38% of wallets holding stablecoins compared to 37% for SOL, this trend reflects growing regulatory clarity and institutional interest. While JPMorgan remains skeptical, platforms like ethereum dominate transactions, though scalability challenges persist. Dive into the data, drivers, and debates shaping this pivotal moment in crypto evolution.

Why Are Stablecoins Leading the Charge as Crypto Matures?

Gone are the days when crypto was dismissed as a speculative playground. The latest data reveals a watershed moment: stablecoins now occupy more wallets (38%) than Solana’s native token SOL (37%). This isn’t just a stat—it’s proof that crypto is shedding its "tech toy" image for real-world utility. Stablecoins have become the backbone of Web3, powering everything from cross-border payments to DeFi, without the volatility that scares off everyday users.

Regulation Fuels the Stablecoin Boom: Banks and Big Tech Jump In

The U.S. Genius Act has turbocharged stablecoin adoption, with banks, asset managers, and even tech giants now issuing them. chainlink calls this a "stablecoin issuance boom," driven by regulatory momentum and traditional finance’s FOMO. "Legislation is unlocking institutional participation," notes a Chainlink report. Meanwhile, in emerging markets, stablecoins are becoming the de facto dollar alternative for treasury management and remittances—what Sardine’s Simon Taylor dubs a "game-changer for the Global South."

JPMorgan vs. the Optimists: Is a $2 Trillion Stablecoin Market Realistic?

Not everyone’s buying the hype. JPMorgan recently scoffed at projections of a $2 trillion stablecoin market by 2028, suggesting $500 billion is more plausible. Yet nearly half of 295 global institutions surveyed already use stablecoins for payments, with another 41% testing them. The disconnect? Maybe Wall Street underestimates how deeply stablecoins are embedding in B2B workflows—especially where traditional banking fails.

Ethereum’s Dominance and the Layer-1 Race

Despite Solana, Tron, and BNB Chain muscling in, Ethereum remains the stablecoin heavyweight—for now. High gas fees and congestion, though, leave the door wide open for high-performance blockchains. "It’s like watching highways compete to host the most trucks," quips a BTCC analyst. "Ethereum built the roads, but newer chains are offering toll-free lanes."

FAQs: Your Stablecoin Questions Answered

Why do stablecoins matter more than SOL’s adoption?

Stablecoins solve real problems—price stability and liquidity—while SOL’s value hinges largely on network speculation. Their growth signals crypto’s shift from "number go up" to actual utility.

Could U.S. regulation stifle stablecoin innovation?

Unlikely. The Genius Act provides clarity, attracting institutional capital. Heavy-handed rules might emerge, but the cat’s out of the bag—stablecoins are now systemic.

Which chains will dominate stablecoins long-term?

Ethereum’s first-mover advantage is strong, but scalability solutions (and competitors like Solana) could redistribute the pie. Watch where devs build next.