Bitcoin’s Future: Price Predictions 2025-2040 as Institutional Adoption Accelerates

- Is Bitcoin Primed for Another Major Breakout?

- Why Are Institutions Suddenly Bullish on Bitcoin?

- What Technical Signals Suggest About Bitcoin's Next Move

- Bitcoin Price Projections: 2025 Through 2040

- Contrarian Views: Are the Bears Missing Something?

- FAQ: Your Bitcoin Price Prediction Questions Answered

As bitcoin continues its march toward mainstream adoption, institutional players are making bold moves that could reshape its long-term trajectory. From corporate treasuries to Wall Street banks, the smart money is positioning itself for what many believe could be Bitcoin's most explosive growth phase yet. This analysis examines BTC's technical setup, institutional catalysts, and price projections through 2040, revealing why this might be just the beginning of Bitcoin's financial revolution.

Is Bitcoin Primed for Another Major Breakout?

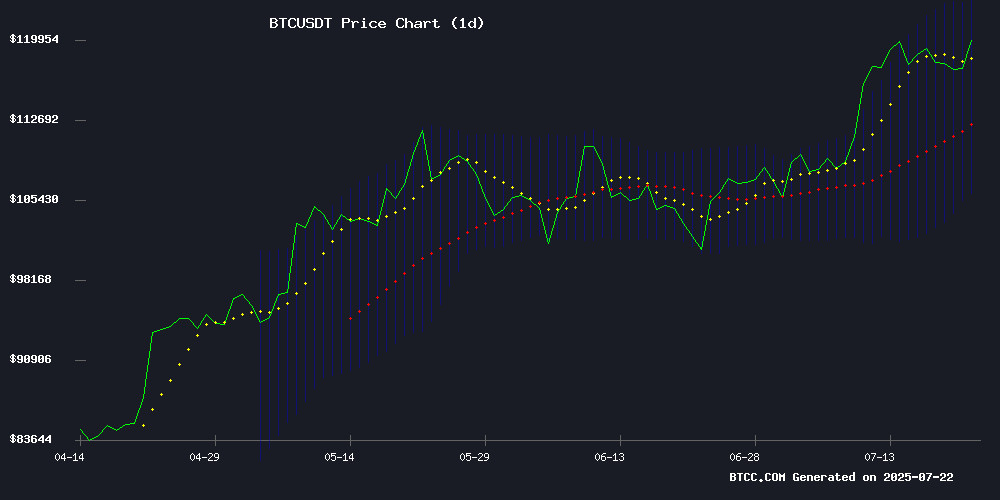

BTC currently trades at $118,480, comfortably above its 20-day moving average of $114,886. The Bollinger Bands are tightening - historically a precursor to significant volatility. "This consolidation NEAR the upper Bollinger Band at $123,671 often precedes major breakouts," notes the BTCC research team. The MACD histogram shows weakening downward momentum at -870, suggesting bears are losing control.

Source: BTCC Market Data

Why Are Institutions Suddenly Bullish on Bitcoin?

The institutional floodgates have opened wider than ever before:

- Trump Media's $2B Bitcoin Bet: The Truth Social parent company now holds BTC representing two-thirds of its $3 billion assets, with CEO Devin Nunes teasing plans for a platform token.

- Sequans' Strategic Pivot: The semiconductor firm added $150 million in BTC to its treasury, funded through a complex capital raise showing institutional comfort with crypto financing.

- JPMorgan's Surprising Move: Despite Jamie Dimon's skepticism, the banking giant is preparing Bitcoin-backed loan services for 2026, following Bank of America and Citigroup into crypto products.

These moves create an interesting dynamic where institutional accumulation offsets retail profit-taking. Exchange reserves have hit their highest level since June 25, typically a warning sign, but the depth of institutional demand appears to be absorbing the selling pressure.

What Technical Signals Suggest About Bitcoin's Next Move

The Spent Output Profit Ratio (SOPR) for long-term holders has consistently exceeded 3.0 since early July - historically a precursor to corrections. Similar spikes preceded February's 12.55% drop and June's 4.81% decline. However, we're still well below the SOPR 4.0 threshold that typically signals market tops.

Derivatives markets tell an equally nuanced story. Open interest remains elevated while funding rates have normalized, suggesting traders are positioning for volatility rather than outright bearishness. "This looks like healthy consolidation, not capitulation," observes a BTCC market analyst. "The real test comes if we retest $110,000 support."

Bitcoin Price Projections: 2025 Through 2040

| Year | Conservative | Base Case | Bull Case | Key Catalysts |

|---|---|---|---|---|

| 2025 | $95,000 | $135,000 | $180,000 | ETF inflows, halving aftermath |

| 2030 | $250,000 | $400,000 | $750,000 | Global reserve asset status |

| 2035 | $600,000 | $1.2M | $2.5M | Full monetary network adoption |

| 2040 | $1.5M | $3M | $5M+ | Scarcity premium dominance |

These projections assume 15-20% annualized growth post-2025 halving cycles. As the BTCC team notes, "The $2T corporate treasury market shifting just 1% to BTC WOULD add $20K to each coin's value."

Contrarian Views: Are the Bears Missing Something?

Robert Kiyosaki's recent warnings about an impending collapse across gold, silver, and Bitcoin markets have drawn skepticism. The crypto community has pushed back, with Brew Markets explicitly cautioning against following his investment advice. Historical patterns show similar assets often rebound strongly after sharp corrections.

Meanwhile, Tyler Winklevoss has accused JPMorgan of attempting to stifle crypto innovation through proposed API fees that could impact fiat-to-crypto transactions. This clash highlights the growing tension between traditional finance and the crypto ecosystem.

FAQ: Your Bitcoin Price Prediction Questions Answered

What's driving Bitcoin's institutional adoption?

The combination of macroeconomic uncertainty, Bitcoin's finite supply, and growing recognition of its store-of-value properties has made it increasingly attractive to corporations and financial institutions as a treasury asset and hedge against inflation.

How reliable are long-term Bitcoin price predictions?

While historical patterns and adoption curves provide frameworks, cryptocurrency markets remain volatile. Projections should be viewed as potential scenarios rather than guarantees, with actual outcomes depending on adoption rates, regulatory developments, and macroeconomic conditions.

Why do Bitcoin halvings matter for price?

Halvings reduce the rate of new Bitcoin creation by 50% approximately every four years, creating supply shocks that historically precede major bull markets as demand outstrips reduced supply.

What are the biggest risks to Bitcoin's price growth?

Potential risks include regulatory crackdowns, technological vulnerabilities, competition from other cryptocurrencies, and macroeconomic factors that could reduce risk appetite among investors.

How should investors approach Bitcoin in their portfolios?

This article does not constitute investment advice. Many financial professionals suggest treating Bitcoin as a high-risk, high-reward portion of a diversified portfolio, with allocation sizes based on individual risk tolerance and investment horizons.