Ethereum Price Prediction 2025: How High Can ETH Really Go in This Bull Market?

- Ethereum Technical Analysis: Is $4,000 Just the Beginning?

- Institutional Demand: The Hidden Engine Behind ETH's Rally

- Kaia Chain Upgrade: Boosting Ethereum's Ecosystem Value

- Elliott Wave Theory: The Case for $10,000 ETH

- Risk Factors: Why the Rally Might Stall

- ETH Price Prediction: Three Potential Scenarios

- Frequently Asked Questions

Ethereum (ETH) is currently riding a massive bullish wave, breaking through key resistance levels and showing no signs of slowing down. As institutional adoption accelerates and technical indicators flash green, analysts are debating just how high ETH can climb in this cycle. From whale accumulation patterns to spot ETF inflows and critical network upgrades, multiple factors suggest Ethereum's rally might have significant room to run. This in-depth analysis examines ETH's price trajectory, technical setup, and fundamental drivers to help you understand where the smart money is betting.

Ethereum Technical Analysis: Is $4,000 Just the Beginning?

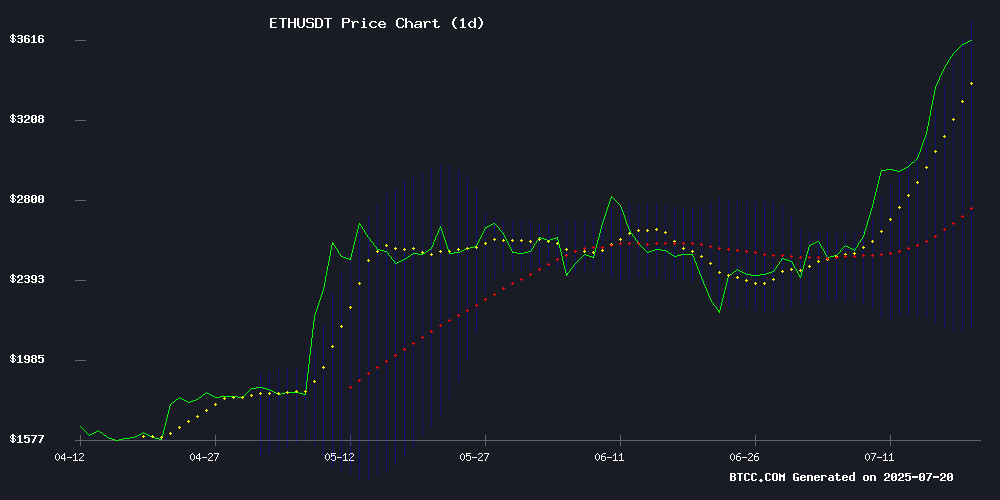

According to the BTCC research team, Ethereum's technical structure paints an overwhelmingly bullish picture as we approach mid-2025. ETH currently trades at $3,767.05, comfortably above its 20-day moving average of $2,940.91 - a strong indicator of sustained upward momentum. The MACD histogram, while still negative, shows narrowing bearish divergence suggesting weakening downward pressure.

Bollinger Bands reveal price action hugging the upper band at $3,757.97, typically signaling overbought conditions that often precede consolidation. However, in strong bull markets, assets can remain overbought for extended periods. "ETH's technical structure favors continuation toward $4,000 if it maintains above the $3,500 support level," notes Olivia from BTCC's analytics team.

Source: BTCC TradingView

Institutional Demand: The Hidden Engine Behind ETH's Rally

Spot ETH ETFs recently celebrated their one-year anniversary with record inflows, marking a dramatic turnaround from their lukewarm debut. Single-day inflows hit $402 million in July - nearly quadruple initial figures - with BlackRock's ETHA maintaining dominance since launch. This institutional adoption wave mirrors Ethereum's maturation as an asset class.

Whale activity tells a similar story. Two newly created wallets acquired 58,268 ETH ($212 million) sourced from Galaxy Digital and FalconX, while another whale scooped up 13,462 ETH ($50 million) from Binance at $3,714. SharpLink Gaming has been particularly aggressive, accumulating 157,140 ETH this month alone at an average price of $3,136.

Kaia Chain Upgrade: Boosting Ethereum's Ecosystem Value

The recent Kaia Chain v2.0.3 upgrade represents a significant leap forward for Ethereum-compatible infrastructure. This EVM-compatible LAYER 1 solution focuses on three key improvements:

- Enhanced network performance and validator rewards

- Improved interoperability with Ethereum mainnet

- Prague hardfork compatibility for seamless dApp integration

The broader v2.0 series (versions 2.0.0 through 2.0.3) introduces user experience innovations and scalability enhancements that could drive more developers to build on Ethereum's ecosystem.

Elliott Wave Theory: The Case for $10,000 ETH

Dutch analyst Gert Van Lagen's Elliott Wave analysis suggests ethereum is entering the fifth and final wave of a bull cycle that began in 2022. "We're entering the fifth wave," Van Lagen noted, projecting a potential rise to $10,000. The current "subwave a" phase might see a minor correction before the final upward push.

This technical framework aligns with Ethereum's 45.48% monthly gain and the Altcoin Season Index jumping to 47 from 29 last week. The combined altcoin market cap now stands at $1.55 trillion, with ETH leading the charge.

Risk Factors: Why the Rally Might Stall

While the bullish case appears strong, several warning signs merit attention:

| Risk Factor | Impact | Key Metric |

|---|---|---|

| Exchange Reserves | Increased selling pressure | Binance ETH reserves at all-time high |

| Open Interest | Potential liquidation cascade | $50B in ETH derivatives open interest |

| RSI Levels | Overbought conditions | 4-hour RSI at 78.54 |

Historical patterns suggest that when Binance reserves reach these levels, price corrections often follow as traders take profits. The record $50 billion in open interest also signals potential volatility ahead.

ETH Price Prediction: Three Potential Scenarios

Based on current market conditions, here are the most likely paths for Ethereum:

- Base Case ($4,200-$4,500): 60% probability if $3,500 support holds

- Bullish Case ($5,800-$6,200): 25% probability with break above $4,800 resistance

- Parabolic Case ($9,000-$10,000): 15% probability requiring sustained institutional inflows

"The $4K threshold looks increasingly like a stepping stone rather than a ceiling," observes Olivia from BTCC, pointing to ETH's 180-day peak as confirmation of trend strength.

Frequently Asked Questions

What's driving Ethereum's current price surge?

Three primary factors: 1) Institutional demand through spot ETFs, 2) Whale accumulation patterns, and 3) Positive technical structure with clear breakout above key moving averages.

How does Kaia Chain's upgrade benefit Ethereum?

The v2.0.3 update improves Ethereum compatibility, network performance, and validator rewards - making the broader ecosystem more attractive to developers and users.

What's the biggest risk to Ethereum's rally?

The record $50 billion in open interest could lead to violent liquidations if price moves sharply in either direction. Exchange reserves at all-time highs also suggest potential selling pressure.

Is it too late to buy Ethereum?

While ETH has seen significant gains, the technical structure suggests this bull cycle may have further to run. However, always conduct your own research and consider dollar-cost averaging to mitigate timing risk.

What price targets are analysts watching?

Key levels include $4,000 (psychological resistance), $4,800 (previous cycle high), and $10,000 (Elliott Wave projection). Support sits at $3,500 and $3,000.