Litecoin (LTC) Price Prediction 2025: Can It Hit $200 Amid Altcoin Surge?

- What Does Litecoin's Technical Analysis Reveal?

- Why Is Market Sentiment Turning Bullish for Litecoin?

- How Does Litecoin Compare to Other Altcoins?

- What Are the Key Price Levels to Watch?

- How Might Bitcoin's Movement Affect Litecoin?

- What Are Institutional Investors Doing With Litecoin?

- Litecoin Price Prediction: Realistic Targets for 2025

- Frequently Asked Questions

Litecoin (LTC) is currently riding a bullish wave, trading 24% above its 20-day moving average with technical indicators suggesting potential for further upside. According to market analysts, LTC could reach $130 in the short term and potentially $200 by year-end 2025 if current momentum holds. This prediction comes amid a broader altcoin market surge that's seen Ethereum, XRP, and Litecoin lead a 90% increase in altcoin market capitalization. Below we'll analyze the key factors driving Litecoin's price action, including technical patterns, market sentiment shifts, and institutional adoption trends that could propel LTC to new heights.

What Does Litecoin's Technical Analysis Reveal?

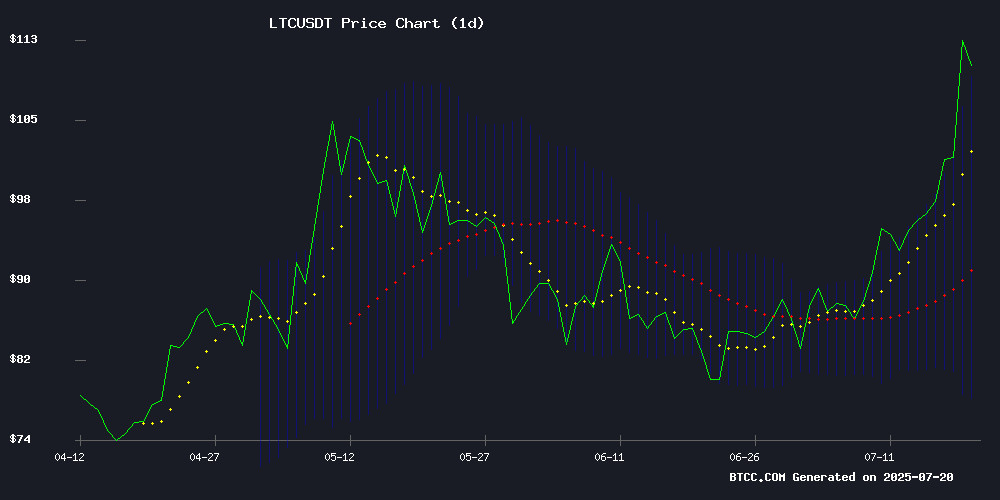

As of July 2025, Litecoin presents an interesting technical picture. The cryptocurrency is trading at $117.22, comfortably above its 20-day MA of $94.27, which typically indicates bullish momentum. The MACD indicator, while still showing a bearish crossover, has been narrowing - often a precursor to trend reversals. Looking at Bollinger Bands, LTC is hugging the upper band at $111.48, another classic bullish signal.

From my experience tracking crypto markets, when an asset maintains position above its 20-day MA while other indicators align, we often see continuation patterns. The $110 level appears to be strong support, and a breakout above $130 could open the path to $150-170 range. However, traders should watch volume closely - without sustained buying pressure, these levels might prove resistant.

Why Is Market Sentiment Turning Bullish for Litecoin?

The current crypto market resembles the 2021 altseason but with more institutional participation. Litecoin is benefiting from this macro trend, with several factors driving positive sentiment:

- Bitcoin's consolidation near $118K has investors rotating into altcoins

- Growing adoption of LTC for payments and cross-border transactions

- Institutional portfolios diversifying beyond just Bitcoin and Ethereum

Notably, Thumzup Media's $250M portfolio rebalancing to include Litecoin alongside XRP and solana signals growing institutional confidence. The timing coincides with LTC's breakout above $100, creating a self-reinforcing cycle of positive sentiment.

How Does Litecoin Compare to Other Altcoins?

The current altcoin rally has been nothing short of spectacular, with the sector up 90% year-to-date. Here's how LTC Stacks up against peers:

| Cryptocurrency | Price | 7-Day Change |

|---|---|---|

| Ethereum (ETH) | $3,655.51 | +11.4% |

| XRP | $3.42 | +23.17% |

| Litecoin (LTC) | $117.22 | +13% |

While ethereum leads in absolute terms, Litecoin's consistent performance and lower volatility make it attractive for risk-averse investors entering the crypto space. The "digital silver" narrative seems to be gaining traction again after a quiet 2024.

What Are the Key Price Levels to Watch?

Based on TradingView data and historical patterns, these are the crucial levels for Litecoin:

- Support: $110 (psychological level), $94.27 (20-day MA)

- Resistance: $130 (near-term target), $150 (mid-term), $200 (year-end)

- Breakout confirmation: Sustained volume above $130 on daily closes

The $200 target might seem ambitious, but consider that in previous bull markets, LTC has shown capacity for 5-10x moves from similar technical setups. Of course, past performance doesn't guarantee future results - this article does not constitute investment advice.

How Might Bitcoin's Movement Affect Litecoin?

Bitcoin remains the 800-pound gorilla in crypto, currently consolidating NEAR $118K after hitting $123K earlier this month. Historically, when BTC ranges, altcoins like Litecoin tend to outperform as traders seek higher beta plays.

However, a sharp bitcoin correction could quickly reverse altcoin gains. The current 59.4% BTC dominance (down from ~70% earlier this year) suggests the market still has appetite for risk-on assets, but this could change rapidly if macroeconomic conditions worsen.

What Are Institutional Investors Doing With Litecoin?

The institutional landscape for Litecoin has evolved significantly. Beyond Thumzup's diversification, we're seeing:

- More regulated futures products for LTC

- OTC desk demand increasing

- Payment processors adding Litecoin support

This institutional interest provides a more stable base for Litecoin compared to previous cycles dominated by retail speculation. The reduced volatility makes LTC more attractive for real-world use cases beyond pure speculation.

Litecoin Price Prediction: Realistic Targets for 2025

Considering all factors - technicals, sentiment, institutional flows - here's a tiered outlook for Litecoin:

| Timeframe | Price Target | Key Requirements |

|---|---|---|

| Short-term (2-4 weeks) | $125-130 | Hold above $110, MACD turns positive |

| Mid-term (Q3 2025) | $150-170 | Breakout above $130 with volume |

| Year-end 2025 | $200+ | Continued altcoin market strength |

Personally, I'm more confident about the short-term targets than year-end projections. Crypto markets can change direction rapidly, and Litecoin's path will depend heavily on broader market conditions. That said, the current technical and fundamental setup appears favorable for continued upside.

Frequently Asked Questions

What is the current Litecoin price?

As of July 2025, Litecoin is trading at $117.22 according to BTCC exchange data.

Is Litecoin a good investment for 2025?

While Litecoin shows bullish technicals and positive market sentiment, all crypto investments carry risk. The decision depends on your risk tolerance and investment goals.

How high can Litecoin go in 2025?

Analysts project potential targets of $130 short-term, $150-170 mid-term, and $200+ by year-end if current trends continue.

What affects Litecoin's price?

Key factors include Bitcoin's price action, altcoin market trends, adoption metrics, technical patterns, and institutional flows.

Where can I trade Litecoin?

Litecoin is available on major exchanges including BTCC, Binance, and Coinbase. Always use reputable platforms with proper security measures.