MYX Crypto Explodes: What Is It and Why Did Price Just Surge +173%?

MYX just ripped through the charts with a jaw-dropping 173% surge—leaving traditional finance in the dust. Here’s what’s fueling the frenzy.

What Is MYX Crypto?

MYX operates as a decentralized exchange protocol built on BNB Chain, focusing on zero-slippage trading and leveraged positions. It’s designed to give traders an edge—cutting through market noise and bypassing centralized bottlenecks.

Why the Sudden Pump?

The spike isn’t random. MYX hit a new ATH amid bullish sentiment across crypto markets, paired with fresh protocol upgrades and climbing trading volumes. No magic—just momentum meeting opportunity. And let’s be real: in crypto, even a whiff of hype can move numbers faster than a hedge fund dumping retail bags.

Where It Stands Now

Active development continues, with the team pushing for deeper liquidity and broader adoption. Whether it holds or corrects—only time tells. But one thing’s clear: in a world obsessed with instant gains, MYX just gave traders a shot of adrenaline.

How Did MYX Price Jump Over +173%?

MyohoPriceMarket CapMYX$0.0024h7d30d1yAll timeThe token has experienced a significant surge, blasting over +173% in 24 hours.

In the last 24 hours, volumes topped $250M, led by Bitcoin ($160M) and ethereum ($122M) pairs. Smaller markets such as BNB ($98,000) and MYX’s own token ($41,000) saw little activity.

Analysts say the figures underline investor preference for major coins, while minor tokens remain on the sidelines.

One analyst argued that the rally shows a strong appetite from venture capital and family funds for new perpetual DEX projects. Some even suggested that if momentum continues, the project could target a $10Bn valuation.

https://twitter.com/derteil00/status/1964752204180373805

Charts from Toknex show that funding rates on MYX perpetual contracts briefly hit +80% before easing to around -31%.

https://twitter.com/Toknex_xyz/status/1964758520781574441

Such levels signal aggressive long positioning, a sign that traders are heavily betting on upside, and this often precedes a reversal.

(Source – MYX perpetual contract funding rates on Binance and Bybit – Tokenix)

Open interest climbed sharply during the rally. Binance futures OI ROSE to $101.6M, while Bybit reached $42.5M.

The increase shows fresh capital entering the market, but also raises the risk of liquidation cascades if prices turn lower. In short, enthusiasm is high, but so is the downside risk.

(Source – MYX open interest vs. price action – Tokenix)

MYX Price Analysis: Will MYX Price Hold $3.00 Support After Its +150% Breakout?

The MYX/USDT 4-hour chart reveals a decisive breakout after weeks of calm trading. MYX stayed in a narrow band between $1.20 and $1.40 from late August through early September with little movement or volume. That changed on September 7, when the token shot from $1.40 to above $3.60 within an hour, a more than +150% surge.

When writing, MYX price trades NEAR $3.50, just under the $3.70 session high.

(Source – MYX USDT, TradingView)

The breakout is clear: price has moved well above the 50-EMA ($1.43) and 100-EMA ($1.32), signaling strong upward momentum. Trading volume jumped to 1.47M, showing heavy participation from retail and institutional players.

This setup reflects a textbook accumulation-to-breakout move. Long periods of sideways trading often end with a sudden spike, sometimes driven by short squeezes or coordinated buying.

Still, the vertical nature of the rise raises the chance of a pullback.

Traders are watching whether MYX can hold $3.00 as new support. A failure to do so could send the price back toward the earlier range of $1.50-$2.00.

Why Are Analysts Warning of Manipulation?

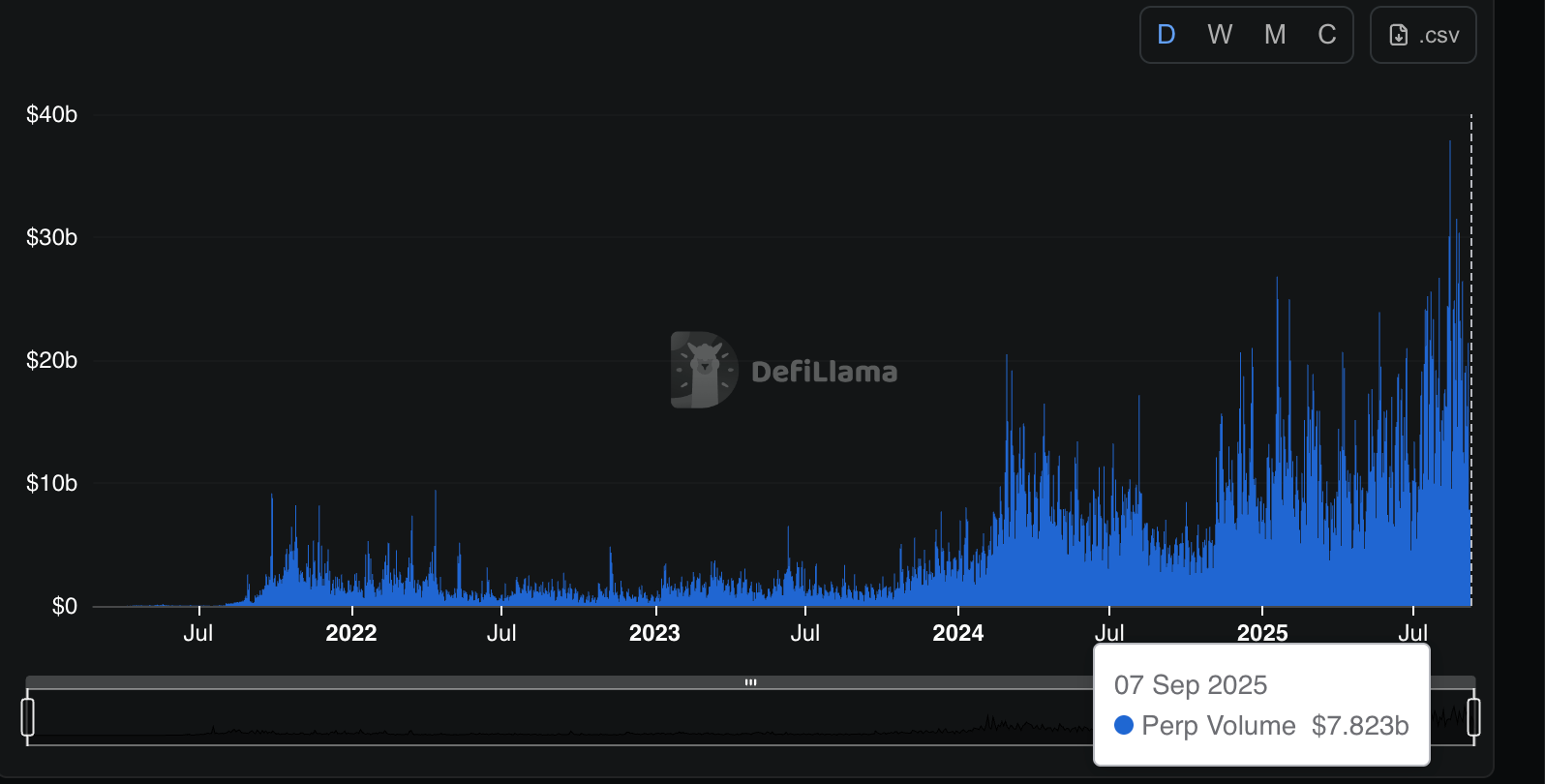

Concerns are growing that MYX’s latest rally may not have been entirely organic. DefiLlama data shows daily perpetual volumes jumping between $6Bn and $9Bn, which is out of line with the token’s actual market size.

(Source: Perpetual Volume, DeFiLlama)

Some analysts say the pattern suggests possible wash trading designed to exaggerate activity.

https://twitter.com/0xD0M_/status/1964725748687901053

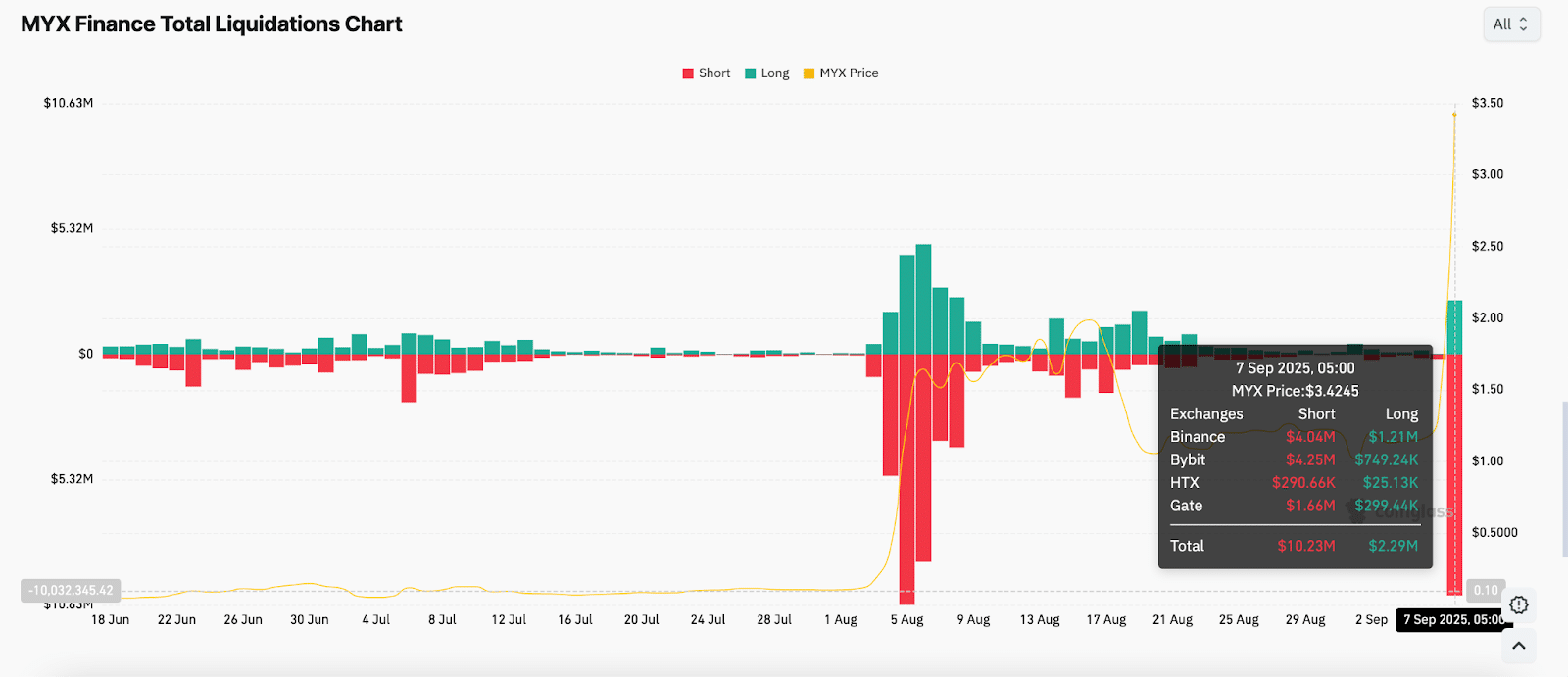

According to Coinglass data, more than $10M in short positions were wiped out in one session.

(Source: MYX Liquidation Chart, Coinglass)

Observers believe large players may have pushed prices higher on purpose, triggering a wave of forced short squeezes.

Adding to the unease, roughly 39M tokens were unlocked during the rally. Critics argue that early holders used the surge to cash out while retail buyers rushed in.

On-chain activity also shows wallet flows being funneled through central addresses on PancakeSwap, Bitget, and Binance. To many, that looks less like natural demand and more like a coordinated move.