🚀 BlackRock’s Crypto Rocket Accelerates: KAIO Expands to Sei Network in Strategic Power Move

BlackRock just shifted its crypto ambitions into hyperdrive.

The investment titan's digital asset division is expanding its KAIO infrastructure to the Sei Network—a move that signals institutional adoption is no longer creeping forward but charging ahead at breakneck speed.

Strategic Expansion Unleashed

This isn't just another partnership announcement. BlackRock's decision to deploy KAIO across Sei Network represents a calculated power play in the blockchain interoperability space. The integration positions the financial behemoth to capture emerging opportunities across multiple blockchain ecosystems simultaneously.

Institutional Domination Accelerates

While retail investors debate market cycles, BlackRock continues building the infrastructure that will ultimately control crypto's future. The expansion demonstrates that traditional finance isn't just dipping toes in digital assets—they're constructing the plumbing that will run the entire system.

Another day, another step toward the inevitable institutional takeover of decentralized finance. Because nothing says 'financial revolution' like Wall Street giants controlling the rails.

Here’s what’s next for SEI:

BlackRock Crypto: Institutional Capital Finds Its Way to SEI

KAIO’s expansion introduces tokenized versions of feeder funds from BlackRock, Brevan Howard, Hamilton Lane, and Laser Digital. These instruments allow institutional and accredited investors to handle subscriptions, redemptions, and reporting entirely onchain — a fundamental shift toward programmable capital markets.“By using the Sei Network, we’re bringing composable access to leading fund strategies entirely onchain,” said Olivier Dang, COO of KAIO, calling the integration a “foundation for real-time, programmable financial infrastructure built for the next era of capital markets.”

$SEI up 140% from my initial entry, but I'm targeting an 800% gain from current levels![]()

Looking at $2 as a key target in this bull run — strong support, bullish structure, and key levels lined up.

Let’s see if #SEI can make this move![]() @SeiNetwork pic.twitter.com/mbEBeeWqDT

@SeiNetwork pic.twitter.com/mbEBeeWqDT

— crypto Patel (@CryptoPatel) October 9, 2025

Justin Barlow, Executive Director of the Sei Development Foundation, described the partnership as “another important step toward Sei becoming the institutional settlement LAYER for all digital assets.”

The integration comes just months after Securitize launched the $112 Mn Apollo Diversified Credit Fund on Sei, confirming the network’s growing reputation for high-speed, low-latency financial execution.

SEI to $2? The Data Behind the Tokenization Boom

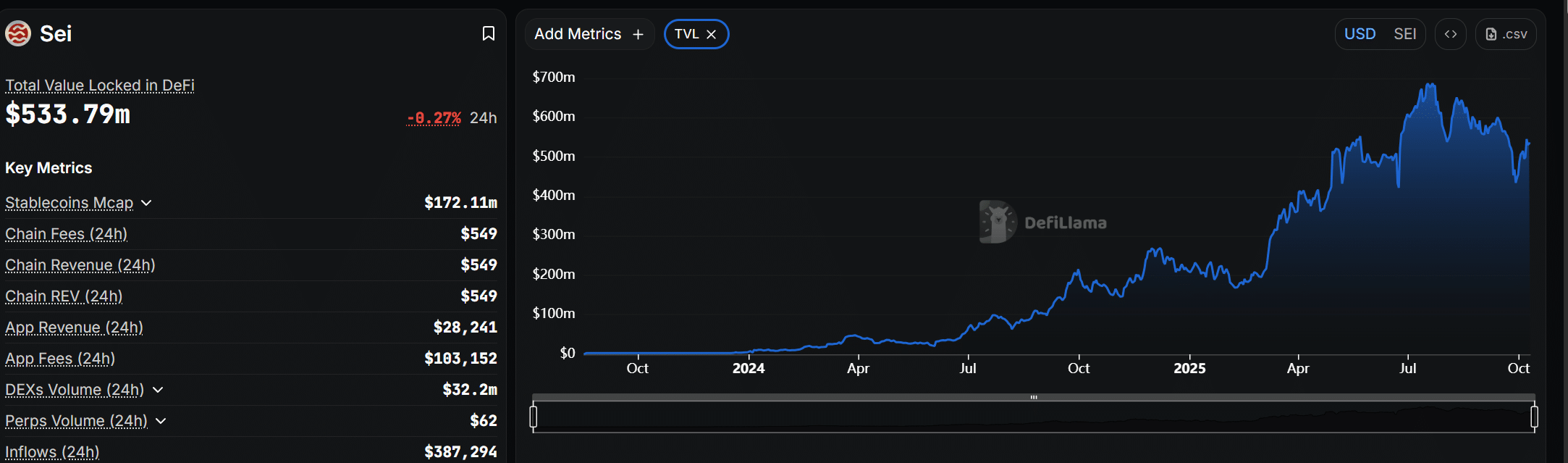

Sei’s numbers are starting to look serious. DeFi Llama data shows its total value locked climbing past $530 Mn, one of the fastest growth streaks of any layer-1 this year. Daily transactions now top 1.6 Mn, with over 600,000 active wallets fueling the rise, much of it tied to institutional flows and DeFi deployments.

Zoom out, and the timing couldn’t be sharper. Boston Consulting Group estimates tokenized real-world assets could hit $16 Tn by 2030. KAIO’s integration drops Sei right into that current.

The SEI Equation: Wall Street Meets Web3

Institutional flow means one thing for SEI: revenue. More on-chain activity drives staking, burns, and liquidity, tightening supply as adoption rises. It’s the same playbook that lifted solana from niche to mainstream during its last cycle.

As one analyst at the Sei Development Foundation put it this week:

If they’re right, this may be the beginning of Sei’s institutional breakout, and far from its peak.

Key Takeaways

- The walls between Wall Street and DeFi keep thinning. KAIO, backed by Brevan Howard and BlackRock Crypto is investing in SEI Crypto.

- As for SEI, more on-chain activity drives staking, burns, and liquidity, tightening supply as adoption rises.