IBM Reveals Why AI Agents Have Fallen Short of Expectations

AI's promise meets reality's hard limits.

IBM's latest analysis cuts through the hype surrounding artificial intelligence agents, pinpointing exactly why these digital assistants keep underperforming despite massive investments.

The Execution Gap

Current AI systems struggle with real-world complexity—they can process data but fail at adaptive decision-making. IBM researchers found existing architectures simply can't handle unpredictable environments that require human-like judgment calls.

Infrastructure Limitations

Legacy systems and fragmented data sources create integration nightmares. Without seamless connectivity, AI agents operate with blind spots that undermine their effectiveness. The technology exists in theory but collapses in practice against corporate tech stacks.

The Training Paradox

Massive datasets don't necessarily translate to practical intelligence. IBM's study shows current training methods produce brittle systems that excel in controlled environments but falter when faced with novel scenarios—like a quant model that works perfectly until market conditions shift.

Meanwhile, venture capitalists keep pouring billions into AI startups that promise revolutionary returns. Because nothing says 'sound investment' like betting on technology that can't reliably complete basic tasks without human supervision.

The path forward requires fundamental architectural shifts, not just bigger models. Until then, AI agents will remain promising tools that deliver disappointing results—much like most blockchain projects claiming to revolutionize finance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In reality, the most successful AI projects often start with cost savings. These benefits are easier to measure, come more quickly, and help make the business case to increase its use. For example, an industrial company could use AI agents to analyze millions of documents, cutting down on costly manual work while improving decisions. To get real value from AI, companies need a clear and disciplined plan. As a result, IBM suggests starting with specific, high-impact use cases and then setting a baseline to measure cost, time, and quality improvements.

It’s also important to build flexible technology that avoids locking in with a single vendor and that allows integration across multiple systems. Finally, ROI should be measured not only by speed and cost savings but also by new capabilities, such as unlocking insights from old data or fixing outdated code. These harder-to-measure benefits can be the most powerful. Therefore, IBM stresses that AI agents are not a silver bullet or a side project, and that they work best when tied directly to business strategy.

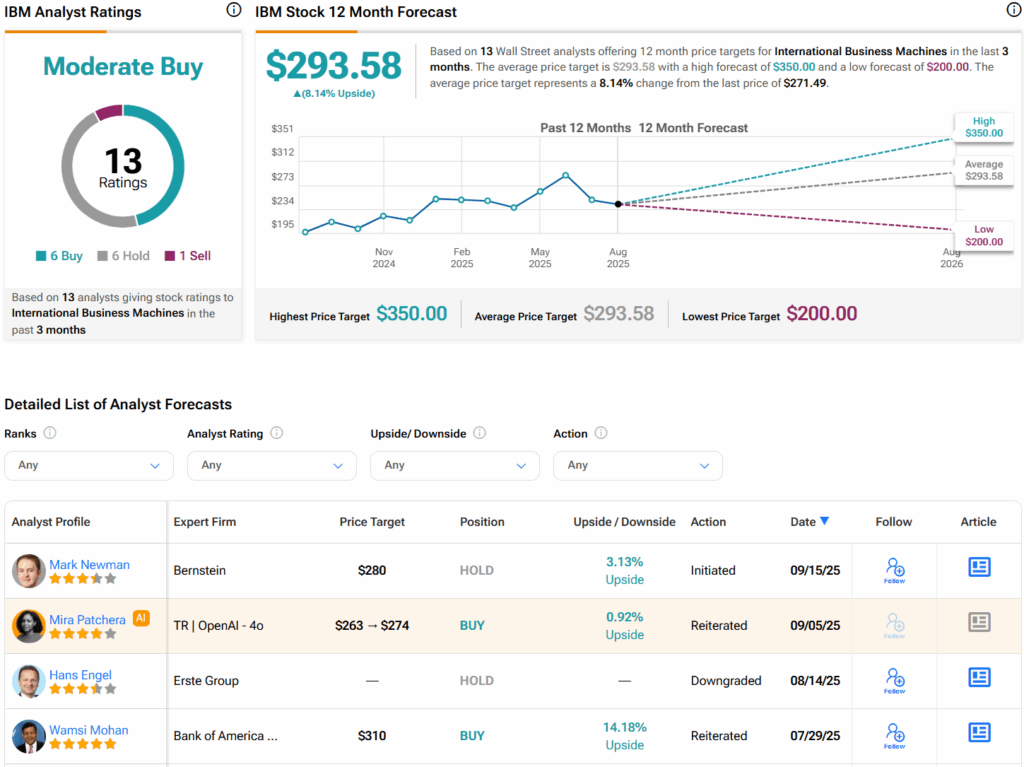

Is IBM a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IBM stock based on six Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average IBM price target of $293.58 per share implies 8.1% upside potential.