Why Is Quantum Computing Stock (QUBT) Getting Hammered Today?

Quantum Computing Inc.'s stock just hit a quantum decoherence event—and investors are feeling the collapse.

The Technical Breakdown

QUBT shares are getting crushed in Monday's session, shedding value faster than a qubit loses superposition. The quantum computing play—once hyped as the next frontier in computational power—is now facing the cold, hard reality of market physics.

Market Forces vs. Quantum Hype

Traders are bypassing the usual 'quantum supremacy' buzzwords and focusing on actual revenue streams. The disconnect between theoretical potential and practical applications is widening faster than expected. One analyst quipped that QUBT's financials are 'in a state of quantum uncertainty—both profitable and bankrupt until you actually look at them.'

The Institutional Chill

Big money is pulling back from speculative tech plays as interest rates reshape risk appetites. Quantum computing requires massive capital with timelines measured in decades—not exactly Wall Street's favorite timeframe. The sector's 'build it and they will come' narrative is colliding with quarterly earnings pressure.

Retail Investor Exodus

Main street traders who chased the quantum dream are now cutting losses. The stock's volatility makes crypto look stable by comparison. When your investment thesis requires explaining quantum entanglement to your broker, maybe it's time to reconsider.

Quantum Winter Coming?

The selloff raises questions about whether quantum computing stocks are entering their own version of 'AI winter.' The technology remains revolutionary—but the path to commercialization keeps stretching further into the future. Sometimes the market's impatience isn't irrational—it's just properly discounted.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

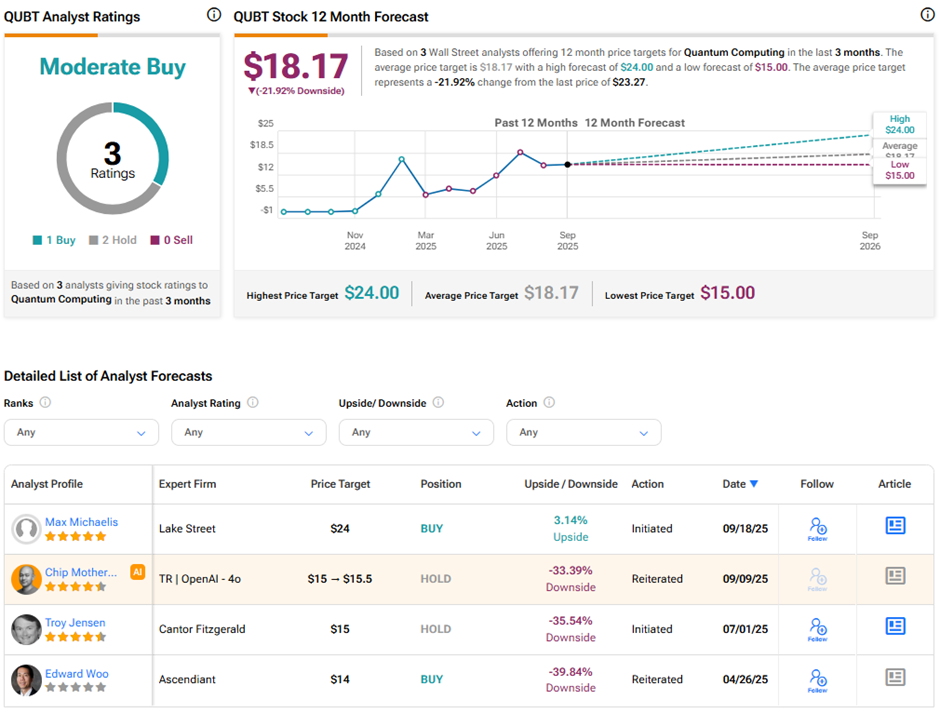

The share price decline follows a 26.8% surge on Friday, September 19. Lake Street analyst Max Michaelis initiated coverage of QUBT with a “Buy” rating and a new Street-high price target of $24, implying 3.1% upside potential.

QUBT Attracts Strong Investor Interest

The private placement includes participation from several major existing shareholders, along with a first-time investment from a leading global alternative asset manager. QUBT expects to raise gross proceeds of $500 million, with closing expected to occur on or about September 24, subject to closing conditions.

The company plans to use the funds to fast-track commercial rollouts, pursue strategic acquisitions, expand its sales and engineering teams, support working capital needs, and cover general corporate purposes.

QUBT Wins a New Street-High Price Target

Michaelis describes QUBT as a “compelling way to participate in the rapidly growing market of quantum computing.” He acknowledges that the broader adoption of quantum computing is still in its early stages, yet believes that the company is nearing a turning point, with revenue expected to increase significantly in 2026 and 2027.

This growth outlook stems from ongoing industry advancements and Quantum’s early leadership, which Michaelis sees as positioning the company for continued expansion.

Michaelis is a five-star analyst on TipRanks, ranking #163 out of the 10,050 analysts tracked. He boasts a 90% success rate and an impressive average return per rating of 136.80%.

Is QUBT Stock a Buy, Hold, or Sell?

On TipRanks, QUBT stock has a Moderate Buy consensus rating based on one Buy and two Hold ratings. The average Quantum Computing price target of $18.17 implies 21.9% downside potential from current levels. Year-to-date, QUBT stock has gained 40.6%.