AMD Stock Rockets to $200 Forecast - Bank of America Says AI Boom and CPU Market Gains Make It Inevitable

AMD's stock trajectory just got a massive Wall Street endorsement.

Bank of America analysts are betting big on the chipmaker's dual-engine growth story.

AI Acceleration Meets Market Share Momentum

The $200 price target isn't just optimistic—it's built on concrete expansion metrics. AMD keeps snatching CPU market share while its AI division explodes.

Silicon Supremacy

They're not just competing anymore. AMD's technology now bypasses legacy limitations that held back previous generations.

Wall Street finally acknowledges what tech insiders knew for quarters—these gains aren't temporary. The infrastructure shift toward accelerated computing plays directly into AMD's architectural advantages.

Of course, analysts needed three consecutive earnings beats to validate what the engineering teams demonstrated years ago. Typical finance—always late to the innovation party.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

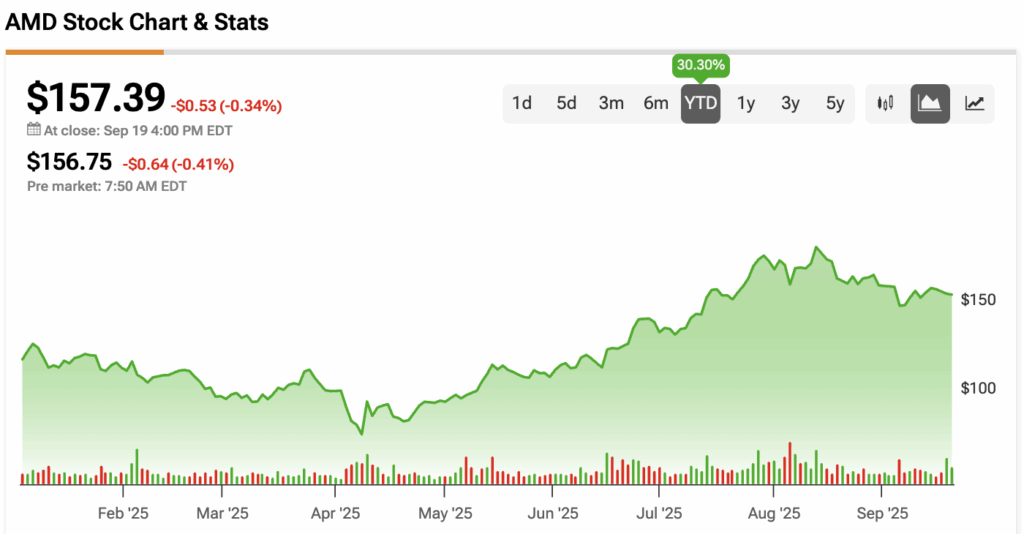

The momentum has been very evident. AMD shares are up more than 30% year-to-date, even while data-center results wobbled and U.S. export rules created turbulence. The stock has traded in a wide $76–$187 band over the past year, reflecting just how volatile the AI trade has become.

Arya Says $200 AMD Price Is “Justified by AI Growth

Enter the Nvidia-Intel shock. Earlier this week, Nvidia (NVDA) revealed a $5 billion investment in Intel (INTC) and a product pact spanning data-center CPUs and PC SoCs. The deal instantly raised alarms about AMD’s positioning.

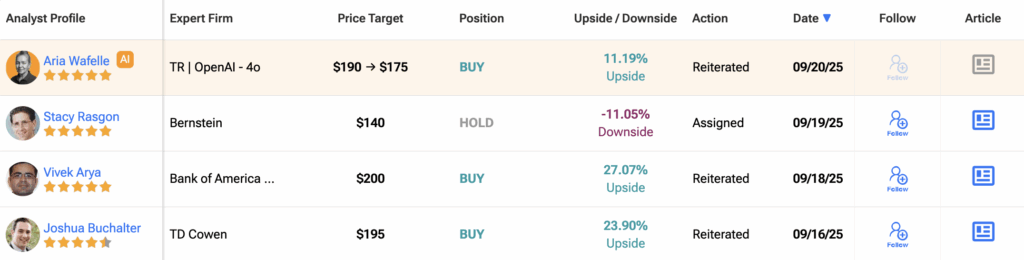

But Bank of America’s Vivek Arya isn’t concerned. He reiterated a Buy rating on AMD and set a $200 AMD stock forecast, roughly 27% above current prices.

Arya put it bluntly: the price target is “justified by AI growth and CPU share gains offset by slower growth in cyclical embedded/console markets.”

And in a twist, he argued the Nvidia-Intel collaboration might even become a positive. Because it reinforces the x86 ecosystem, which Intel licenses to AMD, Arya believes the partnership “essentially underpins PCs and servers, meaning a more robust ecosystem aids both.”

AMD stock dipped this week on fears that Nvidia and Intel had effectively teamed up against it. But Arya’s note reframes the story. Nvidia’s new Intel-powered chips are years away, leaving AMD room to expand market share now.

More importantly, Arya sees AMD’s AI accelerators and CPUs as central to the industry’s next wave. That combination, in his view, outweighs slower cycles in consoles and embedded markets.

Is AMD Stock a Buy, Hold, or Sell?

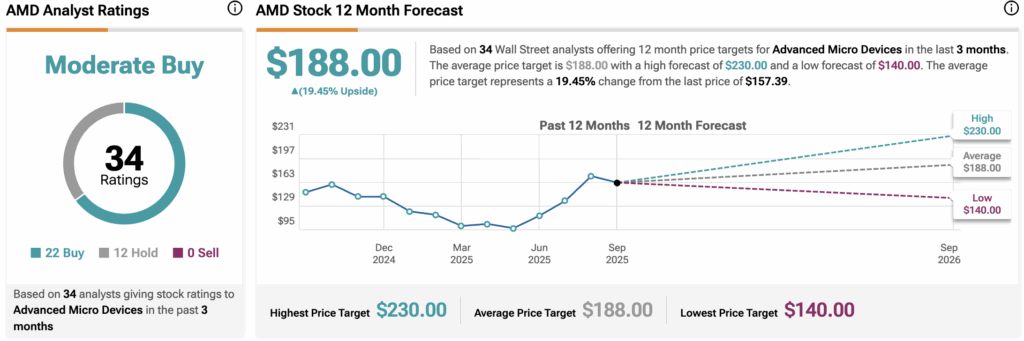

Turning to Wall Street, the analysts’ consensus rating for AMD is Moderate Buy, based on 22 Buy and 12 Hold ratings over the past three months. With that comes an average AMD stock price target of $188, representing a potential 19.17% upside for the shares.