SoundHound Stock (SOUN) Explodes as Top Analyst Dubs It the Ultimate ’Growth Compounder’

SoundHound AI just shattered expectations—and Wall Street's taking notice.

Why Analysts Are Buzzing

One heavyweight analyst slapped a 'growth compounder' label on SOUN, sending shockwaves through trading floors. The stock's surging on pure algorithmic momentum—not the kind of boring fundamentals your grandfather would recognize.

The AI Voice Revolution

SoundHound's voice recognition tech is quietly embedding itself everywhere—from drive-thrus to smart homes. They're not just selling software; they're building the audio layer for the next internet.

Street Sentiment vs. Reality

Sure, analysts love a good narrative—but this isn't just hype. Real revenue growth meets speculative frenzy. For once, the suits might actually be right.

Bottom line: In a market obsessed with AI, SoundHound’s not just riding the wave—it’s building the damn surfboard. (And if it crashes? Well, that’s what stop-losses are for—unless you’re a hedge fund, then you just get a bailout.)

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, SoundHound AI specializes in voice recognition and natural language processing, offering AI-driven solutions across industries.

Analyst Praises for Long-Term Growth Potential

Schwartz believes SoundHound’s conversational AI platform is strong and trusted by customers, who see it as a leader in speech-to-meaning technology, data analysis, and overall innovation. Additionally, he highlighted the company’s advantages in the Voice AI market. It includes a clear value proposition, a healthy backlog compared to current revenue, and strong management.

Notably, Schwartz is a five-star analyst on TipRanks, ranking #732 out of 10,026 analysts tracked. He boasts a 52% success rate and an average return per rating of 11.10%.

Oppenheimer Opted for Hold-over-Buy Rating

Despite the long-term potential, Schwartz opted for a Hold rating on SOUN instead of a Buy. He cautioned that new competitors and the speed at which SoundHound is growing into current and new markets might not be fast enough to match the high expectations investors have.

Right now, the stock is valued at 26 times its expected 2026 revenue, which is very optimistic, and he thinks the growth may not fully justify that price.

Overall, SoundHound’s valuation remains an area of concern among several experts. Critics worry that competition and the pace of expanding into new markets may not keep up with these optimistic expectations, making the stock appear expensive relative to its current and near-term performance. SOUN stock has gained nearly 200% over the last 12 months.

Is SOUN Stock a Good Buy?

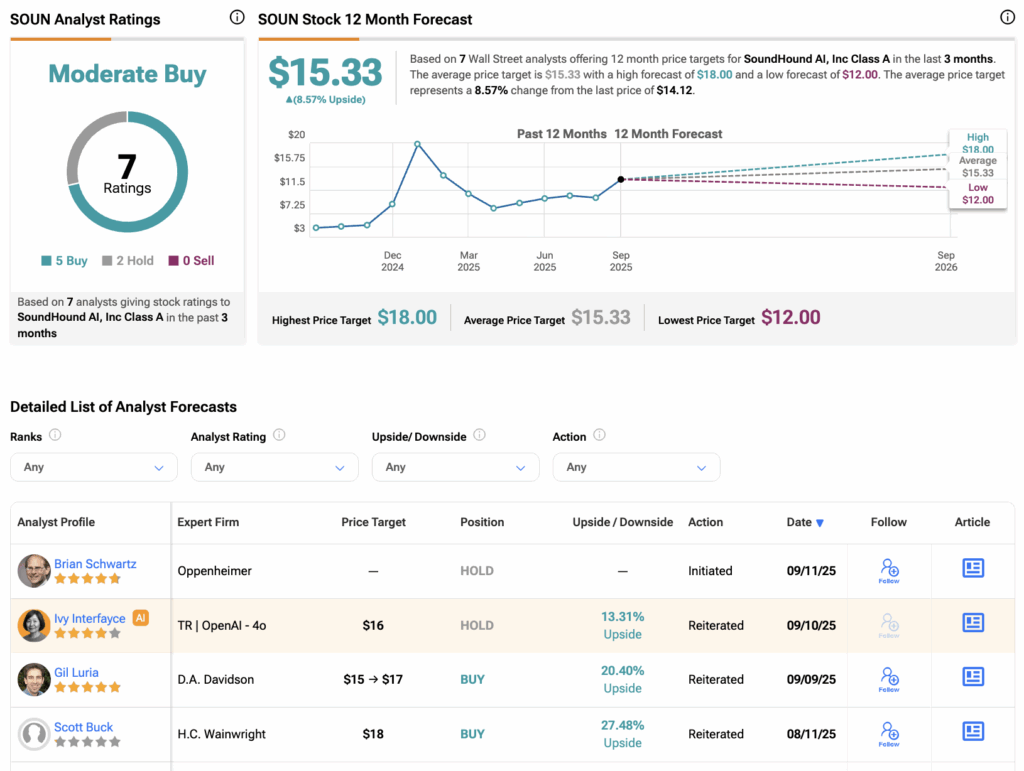

According to TipRanks, SOUN stock has received a Moderate Buy consensus rating, with five Buys and two Holds assigned in the last three months. The average SoundHound stock price target is $15.33, suggesting a potential upside of 8.5% from the current level.