KR Earnings: Kroger Stock Surges Despite Mixed Q2 Results - Here’s Why Investors Are Buying

Grocery giant Kroger just delivered a classic Wall Street head-scratcher—beating expectations in some areas while missing in others, yet watching its stock climb higher.

Revenue Reality Check

Same-store sales growth came in lighter than projected, suggesting consumers might finally be pushing back against those relentless price hikes. But don't tell that to shareholders—they're focusing on the upside.

Margin Magic

Operational efficiencies and private-label strength boosted profitability beyond forecasts, proving once again that cutting costs beats growing sales in today's market. Because why invest in expansion when you can just squeeze existing operations harder?

The Street's Selective Vision

Analysts quickly overlooked the disappointing top-line numbers to celebrate the bottom-line beat—a familiar pattern where earnings quality takes a backseat to earnings manipulation. Another quarter, another example of markets rewarding financial engineering over fundamental growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Kroger posted revenue of $33.94 billion in its most recent earnings report, which was below analysts’ estimate of $34.1 billion. Investors will note the company’s revenue only slightly increased year-over-year from $33.91 billion. Gross margin for the quarter was 22.5% of sales, compared to the 22.1% reported in Q2 2024.

Kroger stock was up 1.85% in pre-market trading on Thursday, following a 0.89% fall yesterday. The shares have also increased 11.25% year-to-date and 21.43% over the past 12 months.

Kroger Guidance

Kroger provided an update to its full-year 2025 guidance in its latest earnings report. The company expects adjusted EPS for the year to range from $4.70 to $4.80, compared to its prior guidance of $4.60 to $4.80. Unfortunately, with a midpoint of $4.75, this could see the retailer miss Wall Street’s adjusted EPS estimate of $4.78 for the period.

Kroger also included several other 2025 outlooks in its most recent earnings report. It expects identical sales without fuel to increase 2.7% to 3.4%, operating profit of $4.8 billion to $4.9 billion, free cash FLOW of $2.8 billion to $3.0 billion, capital expenditures of $3.6 billion to $3.8 billion, and a tax rate of 22%.

Is Kroger Stock a Buy, Sell, or Hold?

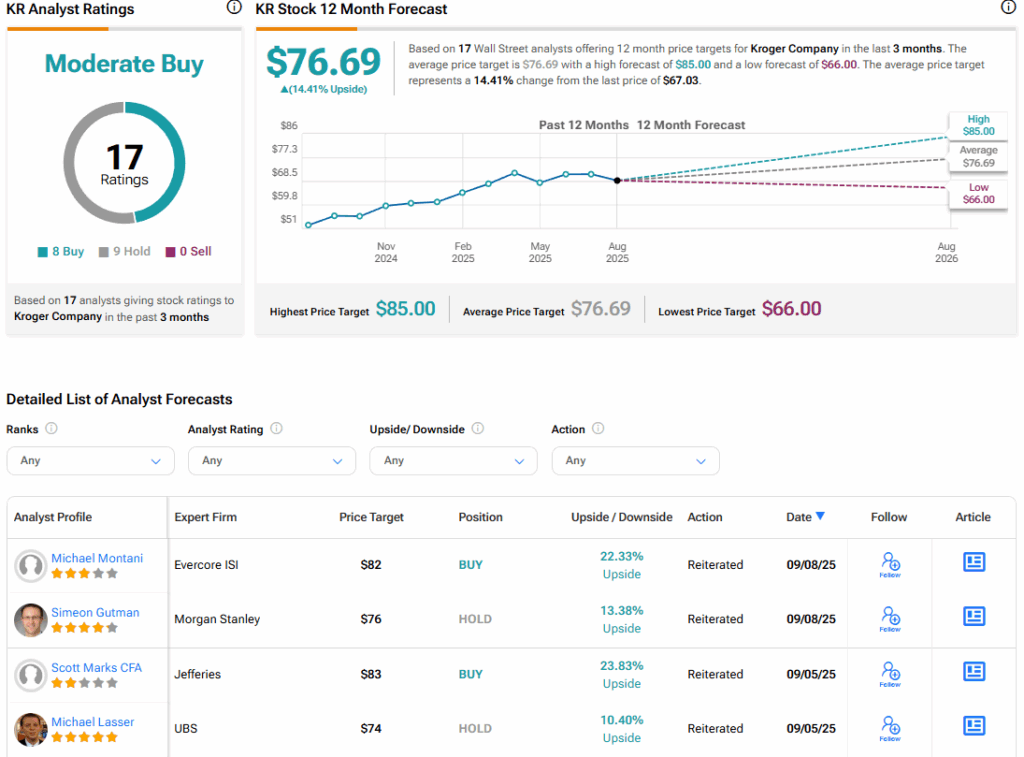

Turning to Wall Street, the analysts’ consensus rating for Kroger is Moderate Buy, based on eight Buy and nine Hold ratings over the past three months. With that comes an average KR stock price target of $76.69, representing a potential 14.41% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.