Palantir Stock (PLTR) Forecast: AI Analyst Defies Wall Street Skepticism with Bullish Outlook

AI versus Wall Street: Palantir's algorithms battle traditional analysts in high-stakes forecasting clash.

The Data Divide

While human analysts hedge their bets, machine learning models crunch terabytes of operational data—spotting patterns invisible to conventional financial models. Palantir's proprietary AI doesn't just analyze markets; it eats quarterly reports for breakfast and digests economic indicators before lunch.

Defiance in Digits

The bullish stance isn't based on sentiment. It's pure computational conviction—algorithms identifying undervalued potential while Wall Street remains trapped in spreadsheets from last decade. One might say traditional analysts are still using candles while Palantir's running quantum prediction engines.

Finance's Funny Math

Wall Street skepticism? More like institutional inertia—the same crowd that once dismissed Bitcoin now questions AI-driven valuation models. Because nothing says 'forward-thinking' like doubting technology that outperforms human analysts 83% of the time.

Final analysis: When machines outthink masters of the universe, maybe it's time to question who really understands value in the digital age.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, TipRanks’ A.I. Stock Analysis delivers automated, data-driven evaluations of stocks based on key performance metrics, giving investors a clear and concise snapshot of a stock’s potential.

Palantir Q2 Earnings Impress AI-Analyst

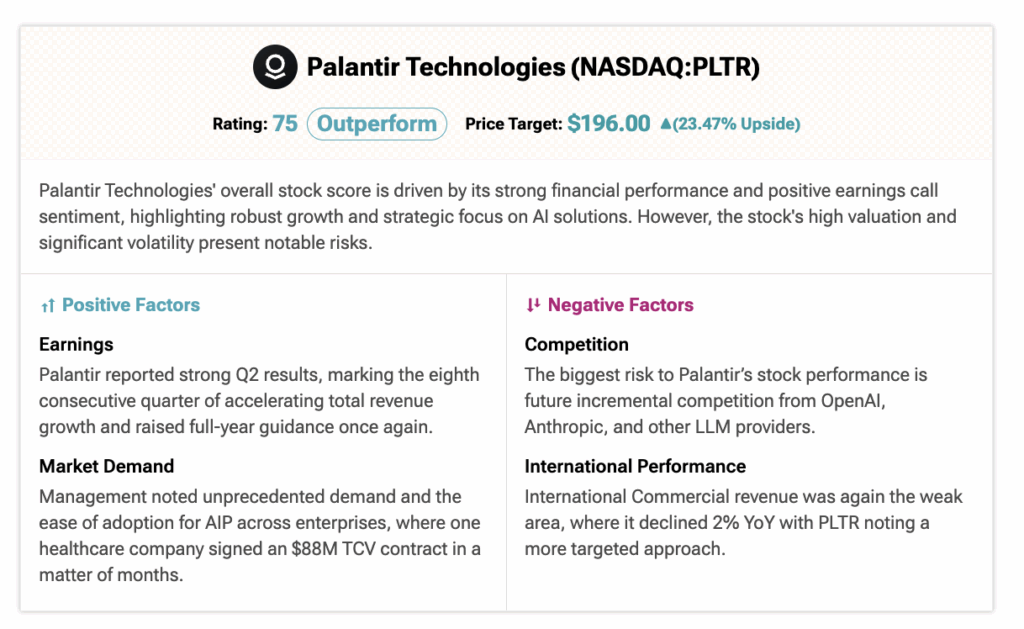

According to TipRanks A.I. Stock Analysis, Palantir earns a solid score of 75 out of 100 with an Outperform rating. The tool also highlights both the positive and negative factors influencing the company’s stock performance. Overall, PLTR’s stock score reflects strong financial performance and positive earnings call sentiment. However, its high valuation and significant volatility pose notable risks for investors.

The tool also summarizes the latest earnings call, highlighting both positive and negative updates for users. Palantir’s Q2 earnings call emphasized strong revenue growth, along with expanding customer accounts and solid profitability. Notably, revenue for the period reached $1 billion, surpassing analyst expectations of $940 million, and marked a 48% year-over-year increase.

On the other hand, challenges were noted in international commercial revenue and strategic contract declines, along with expected seasonal expense increases. Overall, the positive developments far outweigh the negatives.

Wall Street Stays Cautious on PLTR

Despite positive earnings momentum, Wall Street remains cautious on PLTR stock. Analysts point to the stock’s high valuation and volatile trading as key risks, keeping most ratings at Hold. While the company’s focus on AI and government contracts offers long-term potential, short-term uncertainties are limiting enthusiasm.

Is PLTR a Good Stock to Buy Now?

According to TipRanks consensus, PLTR stock has a Hold rating, based on five Buys, 13 Holds, and two Sells assigned in the last three months. The average Palantir share price target is $156.8, which implies a downside of 1.23% from current levels.