General Mills (GIS) Revenue Forecast Slashed—Trump Tariffs Crush Margins

Another corporate casualty in the trade war crossfire.

General Mills just gutted its revenue guidance—and Wall Street's already reaching for the antacids. The packaged food giant's margins are getting squeezed like a Cap'n Crunch box in a toddler's fist, thanks to the lingering ghost of Trump-era tariffs.

Here's the damage:

• No specific numbers disclosed—just the fiscal equivalent of a profit warning flare

• Supply chain costs biting harder than a stale Wheaties biscuit

• Pricing power? More like pricing suggestion in this inflationary environment

Funny how these 'temporary' trade policies keep haunting earnings calls years later. But hey—at least shareholders can drown their sorrows in Yoplait. (Pro tip: The strawberry flavor pairs well with margin compression.)

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

I believe that investors have every right to feel uneasy due to a combination of internal (volume loss in its key market) and external (Trump’s tariffs) threats, making me cautiously Neutral on GIS stock.

General Mills’ Latest Financials

In its fiscal fourth quarter, General Mills reported earnings per share of $0.74, surpassing analyst expectations of $0.71, while revenue met forecasts at $4.6 billion, a 3% year-over-year decline. Despite the earnings beat, shares of General Mills have declined and are now trading NEAR 52-week lows. This reaction reflects a broader market trend: investor attention is typically more focused on forward-looking guidance than on backward-looking results, which is reasonable given that future performance carries more weight in valuation models.

In that context, General Mills’ cautious outlook for fiscal year 2026 has unsettled investors. The company expects organic sales growth to remain flat, with a range of -1% to 1%. However, the more significant concern was its guidance for adjusted operating profit, which is projected to decline by 10% to 15% in constant currency from the fiscal 2025 baseline of $3.4 billion. This anticipated drop is a result of a combination of internal and external challenges.

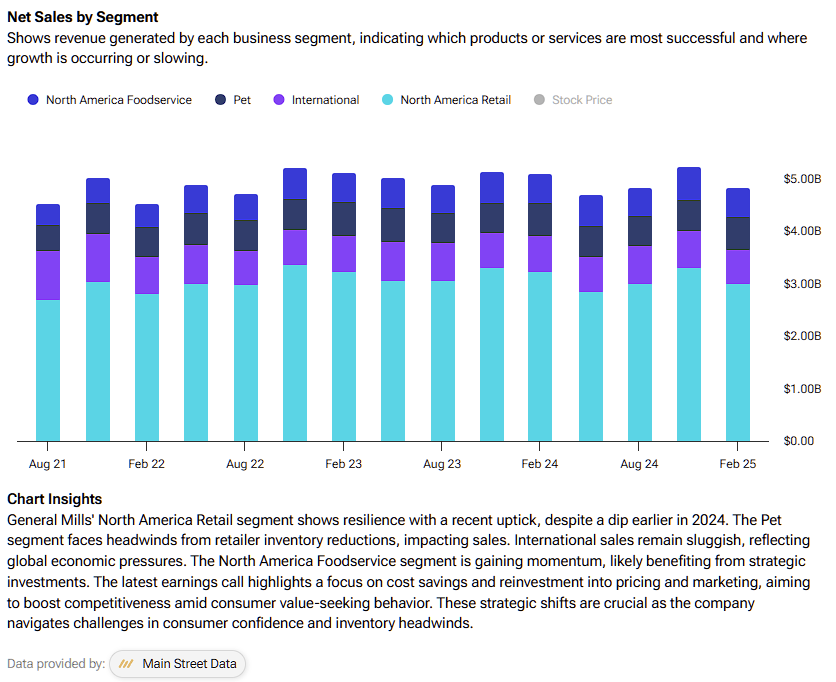

Some of these pressures were already evident in the latest quarter. As TipRanks data shows, in its largest segment—North American Retail—net sales declined by 3%, despite volume remaining flat, indicating underlying pricing or mix issues that may persist.

This dynamic signals a deliberate reduction in the average price per unit and aligns with the company’s strategic focus on “returning to volume growth.”

However, slashing prices doesn’t always translate into higher sales volumes, particularly when underlying brand challenges remain. To address this, General Mills is ramping up its advertising investments, a strategy that will likely support the company’s upcoming expansion into the fresh pet food category under its Blue Buffalo brand.

Trump Tariffs Stir Trouble for General Mills

Increased Selling, General, & Administrative (SG&A) costs aren’t alone to blame for General Mills’ profitability woes. Donald Trump’s infamous tariffs continue to be a significant external operating headwind for General Mills. In fact, much of the 10% to 15% operating profit can be associated with tariffs, given that many ingredients and packaging materials are imported from China, Canada, and Mexico.

General Mills’ Mitigation Strategy

Founded in 1928, General Mills is well-equipped to navigate challenging environments and has several strategies in place to help manage current headwinds. One key initiative is its “Holistic Margin Management” program, which targets cost savings of 4%–5% as a percentage of cost of goods sold (COGS). This effort could yield up to $100 million in savings by fiscal year 2026, helping to offset inflationary pressures on input costs.

The company is also shifting focus toward higher-margin, higher-growth categories. A notable MOVE in this direction is the recent divestiture of its yogurt brands, including Yoplait and Go-Gurt, to Lactalis and Sodiaal for $2.1 billion—a clear example of strategic portfolio realignment. This transaction not only simplifies operations but also provides additional capital to reinvest in innovation and brand development. As a result, the coming year is expected to emphasize product innovation and brand building, although these efforts may weigh on short-term profit margins. According to TipRanks data, GIS maintains a profit margin of ~13%.

From a valuation perspective, General Mills’ stock appears reasonably priced, trading at a forward P/E of 12.74—approximately 32% below the Consumer Staples sector average. For comparison, The Hershey Company (HSY) trades at a P/E of 30.27, supported by more substantial EBITDA margins of 25.84% versus General Mills’ 19.91%.

Is GIS Stock Worth Buying?

On Wall Street, General Mills carries a Hold consensus rating based on two Buy, nine Hold, and two Sell ratings over the past three months. GIS’ average price target of $56 implies an 11% upside potential over the next twelve months.

Earlier this month, Morgan Stanley analyst Megan Alexander assigned a Sell rating to GIS stock with a price target of $51. The analyst expressed caution due to the company’s “decelerating scanner data trends” and a “decline in retail takeaway.”

She also expects a “high single-digit percentage decline in earnings per share (…), driven by several headwinds, including profit dilution from the yogurt divestiture, operating profit headwinds from resetting incentive compensation, and potential cost inflation impacts.”

On the other side of the aisle, Bank of America Securities analyst Peter Galbo is more bullish on General Mills, issuing a Buy rating on its stock with a price target of $63. He highlighted operational improvements, including improved gross margins, and believes the company’s guidance for FY26, which calls for a decline in operating profit and EPS, is “manageable.”

General Mills Faces Tough Choices with Strong Brands

In conclusion, General Mills’ strategy of prioritizing volume growth over near-term profitability has drawn mixed reactions, and with good reason. The company operates in a mature, highly competitive market, faces flat growth, and has limited flexibility in terms of margins. While its planned entry into the fresh pet food category is an encouraging step toward diversification, it’s still unclear when—or if—the necessary investments to build and scale that brand will yield meaningful returns.

Ultimately, this situation underscores a broader reality: even a legacy player like General Mills cannot rely solely on established brands. Continued relevance in the food industry requires ongoing innovation and investment.

For income-focused investors, the stock does offer a compelling 4.49% dividend yield. However, this alone may not justify the risk, particularly given that 10-Year Treasury Notes are offering comparable yields with far less volatility. At this point, General Mills’ products may be more appealing on store shelves than its shares are in a portfolio.