BREAKING: London Court Slams Visa & Mastercard (MA) for Anti-Competitive Fee Structures

Financial giants Visa and Mastercard just got slapped by a London tribunal—their fee models ruled illegal under competition law. The verdict? A clear win for merchants and a blow to duopoly tactics.

Why this matters: These card networks have been accused of squeezing businesses with inflated interchange fees for years. Now regulators are calling their bluff.

The fallout? Expect merchant fees to drop—but don’t hold your breath for those "savings" to reach consumers. Banks never miss a chance to pocket the difference anyway.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The law firm Scott+Scott, which represents the claimants, called the ruling a major victory. David Scott, the firm’s global managing partner, said that the decision was “a significant win for all merchants who have been paying excessive interchange fees to Visa and Mastercard.” According to the firm, this is the first time a court has found that both commercial card fees and inter-regional (cross-border) multilateral interchange fees violate competition law. The ruling confirms that Visa and Mastercard’s fees unlawfully restricted competition by setting default rates that retailers had little choice but to accept.

Despite the setback, both Visa and Mastercard pushed back strongly against the ruling. A Visa spokesperson said that the company “continues to believe that interchange is a critical component to maintaining a secure digital payments ecosystem that benefits all parties, including consumers, merchants and banks.” Mastercard also criticized the decision by calling it “deeply flawed” and stating that it WOULD seek permission to appeal. A second phase of the litigation is still underway, which will determine whether merchants passed on the cost of these interchange fees to consumers through higher prices. That upcoming trial could influence the amount of any potential damages.

Which Payment Stock Is the Better Buy?

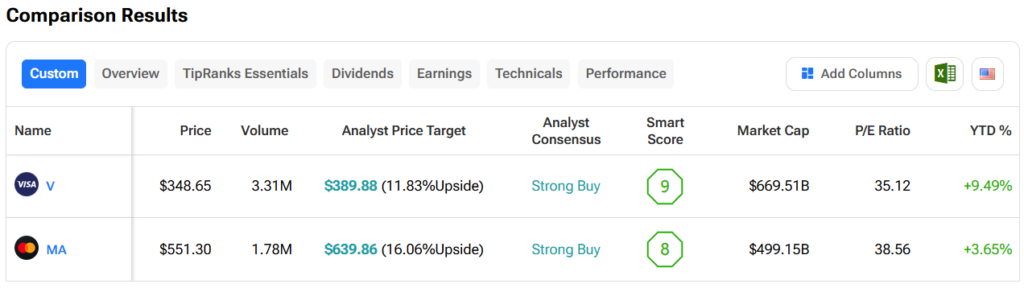

Turning to Wall Street, out of the two stocks mentioned above, analysts think that Mastercard stock has more room to run than Visa. In fact, Mastercard’s price target of $639.86 per share implies 16.1% upside versus Visa’s 11.8%.