Why Adobe’s (ADBE) Steady Growth Still Has the Bears Growling in 2025

Adobe’s relentless growth engine keeps churning—so why won’t Wall Street’s skeptics shut up?

Subheader: The Bull Case Crumbles Under Bear Claws

Another quarter, another beat. ADBE’s creative suite dominance prints cash like a Fed-backed stablecoin. But analysts still whisper ‘overvalued’ between sips of their $8 oat milk lattes.

Subheader: When ‘Good Enough’ Isn’t Enough

Cloud adoption? Up. Recurring revenue? Locked. Stock price? Meh. The market yawns at 15% YoY growth while chasing AI vaporware and meme stocks. Classic.

Closing jab: Maybe if Adobe launched a useless NFT division, the bulls would finally pay attention. Until then—enjoy your ‘boring’ compounder while the hedgies chase the next zero-revenue ‘disruptor.’

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

One of the main issues driving skepticism about Adobe’s stock performance is that it is increasingly viewed as a slow-growth software company, despite its strong cash flows and dominant position in the creative software space. The AI boom has brought a wave of generative innovation that Adobe seems to be struggling to fully capitalize on.

As a result, even though valuations are historically depressed, it seems unlikely that the massive premium investors were once willing to pay for Adobe will return anytime soon. With the market recognizing that, I believe there’s limited upside from here, and the stock remains at high risk of trading sideways, at best. That’s why I’m maintaining a Hold rating on ADBE for the time being.

Adobe’s Path Forward as New Creative Tools Gain Traction

To begin with, Adobe has been the Gold standard in the creative software industry for decades. Even though its stock price hasn’t moved much in recent years, the company still holds that status today. Adobe’s Creative Cloud suite, which includes its flagship products, remains an essential toolkit for any professional in the creative world.

For example, in the most recent quarter (Q2), the Digital Media segment saw a 13% year-over-year growth in annual recurring revenue—practically in line with the previous quarter—with no signs of slowing down.

However, while past performance has been consistent, the concern lies in what’s ahead for Adobe. Competition in the creative space has intensified, particularly with the rise of AI. Many players are leveraging generative AI to offer simpler, more accessible, and often more affordable tools.

For example, major tech platforms like Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOGL) have started integrating creative functionalities directly into their operating systems, reducing the need for third-party software like Adobe’s.

That said, Adobe isn’t standing still. The company is heavily leaning into generative AI, integrating its Firefly AI models across its product ecosystem to enhance user capabilities and maintain its competitive edge. Adobe has its Firefly app for iOS and Android, which blends its own AI model with partners, and will also be available as a standalone app for $10 per month.

A significant point is that the market hasn’t fully convinced itself that Adobe is immune to these threats, which could limit expectations for a stronger growth path ahead. While Adobe’s products remain feature-rich and the industry benchmark, many new creators are opting for simpler tools like Canva, which already holds 16 million paid users compared to Adobe Creative Cloud’s 30 million.

Adobe’s Growth Goals and Capital Missteps

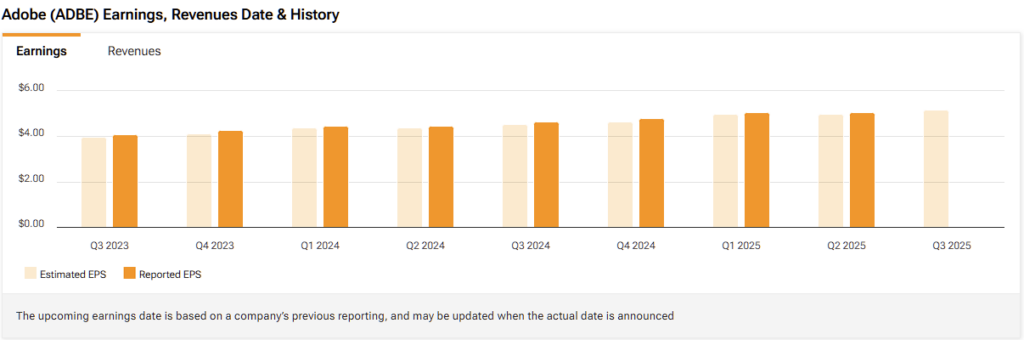

Adobe’s management team recently raised its early targets for FY 2025, now expecting EPS to land in the mid-$20s at around $20.6—which WOULD represent about 11% yearly growth—and total revenues to hit $23.5 billion, an annual increase of 9.5%. These numbers align perfectly with market expectations, as the consensus has already factored in these levels. In that sense, it suggests Adobe isn’t guiding its top or bottom line very conservatively.

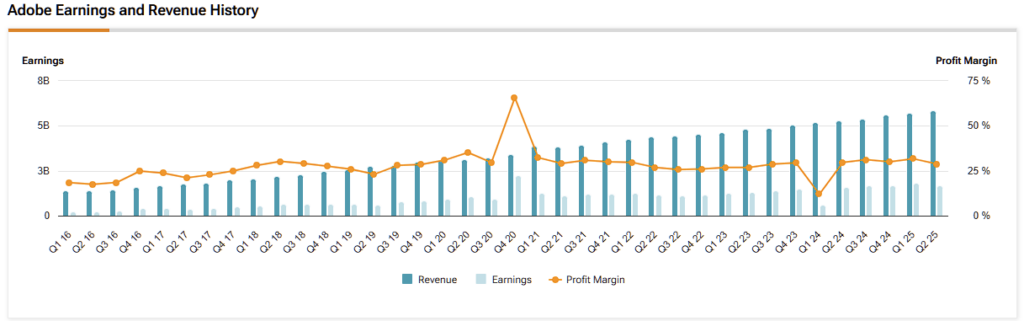

Now, looking at the Rule of 40—a benchmark for subscription-based software companies where revenue growth plus operating margin should exceed 40%—Adobe’s guidance of 9.5% revenue growth combined with a 36.7% operating margin (over the last twelve months) gives it a Rule of 40 score of 46.2. This means that even in a moderate growth phase, the company’s operational strength more than makes up for slower top-line expansion.

But putting revenue and earnings aside, I think Adobe still needs to shake off some negative reputation it’s built over the last few years by aggressively buying back its own shares using debt, rather than allocating that capital to other uses—like paying down debt, building cash reserves, or investing in organic and inorganic growth. Over the past five years, Adobe has spent more than $30 billion on buybacks as TipRanks data shows, primarily when its shares were trading at an average of 35x earnings—all while its stock has declined by about 11% since then.

So, although Adobe’s balance sheet remains fundamentally solid and it has historically operated as a net cash company, the shift to a modest net debt position, in my view, signals a misstep in capital allocation. This introduces a valid counterpoint to the otherwise bullish investment thesis.

A Closer Look at Adobe’s Valuation Metrics

Trading at 18.4x its forward earnings, Adobe’s multiple is now just 6% below the sector median and 46% below its historical average over the past five years. While Adobe’s nearly 7x sales multiple might seem high at first glance, it tends to be structurally elevated. This reflects the premium the SaaS model commands due to customer stickiness, subscription visibility, and scalability.

However, one valuation metric I find potentially more helpful than the P/E for Adobe is the earnings yield, calculated as operating profit divided by enterprise value. This is because EV/EBIT strips away distortions from buybacks, tax strategies, and varying debt levels, focusing purely on the company’s Core operating performance relative to its total enterprise value. TipRanks data indicates profit margins are stable at ~25%.

Using an operating profit of $8.3 billion over the last twelve months and a current enterprise value of $162.8 billion, Adobe’s earnings yield comes to about 5%. Comparing this to a weighted average cost of capital (WACC) of roughly 7% and a risk-free rate (based on 10-year Treasury bonds) of 4.5% suggests that, on an operating profit basis, Adobe may not be generating returns above its cost of capital. This could imply that the stock is fairly valued or perhaps even slightly expensive.

Is Adobe Stock Worth Buying?

Wall Street analysts are generally more optimistic than skeptical about Adobe. Over the past three months, 20 out of 27 analysts covering the stock have given it a Buy rating, while the remaining seven have assigned a Hold rating. ADBE’s average stock price target stands at $503.83, implying a potential upside of ~31% over the coming twelve months.

Holding Tight as Adobe Figures it Out

The market clearly isn’t as confident about Adobe’s fundamentals going forward as it has been in past years. The surge in competition driven by generative AI in the creative space has put some limits on Adobe’s growth story. Analysts’ top and bottom-line forecasts also reflect a cautious stance, expecting Adobe to deliver results broadly in line with its own conservative guidance rather than any big upside surprise.

While valuation multiples look lower compared to Adobe’s historical levels, the stock remains reasonably priced based on its underlying operations and performance metrics. For this reason, I would advise against a super bullish “buy-the-dip” approach at this time. A Hold rating seems the most sensible move, as the stock may experience some further sideways trading or mild corrections before a clearer uptrend emerges.