OpenAI’s Stealth Assault: The Silent Disruption of Microsoft Office & Google Workspace (GOOGL)

OpenAI isn’t just playing the AI game—it’s rewriting the rules. While Microsoft and Google bicker over market share, Sam Altman’s crew is quietly building tools to gut their cash cows. Office suites? Yesterday’s news.

The new battleground: productivity. OpenAI’s rumored suite—leaked as 'Project Canvas'—promises seamless AI integration where Word and Docs feel like typewriters in a ChatGPT world. No more clunky plugins. No more subscription fatigue. Just code that works.

Wall Street’s take? 'But muh recurring revenue!' Meanwhile, startups are already dumping Workspace licenses. The pivot? Inevitable. The casualties? Probably your IT department’s budget.

One question remains: When OpenAI flips the switch, will Office 365 become the next Netscape Navigator?

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

If the collaboration tools move forward, they could shift ChatGPT from mainly a consumer app to one that also competes directly in the workplace. This move lines up with CEO Sam Altman’s goal to make ChatGPT a “supersmart personal assistant for work.” Adding tools like document collaboration and file storage could challenge the core products in Microsoft Office and Google Workspace, both of which now include built-in AI features.

Although Microsoft is OpenAI’s biggest investor and business partner, launching these tools could put pressure on their already complex relationship, especially as OpenAI is asking Microsoft to approve a restructuring of its for-profit division that oversees ChatGPT. Indeed, OpenAI has been growing its business subscriptions by selling teamwide access to companies like Moderna (MRNA) and T-Mobile (TMUS). It also recently offered discounts on these plans, which frustrated Microsoft staff who sell similar tools. OpenAI now expects ChatGPT to bring in $15 billion from business subscriptions by 2030, up from $600 million in 2024.

Which Tech Stock Is the Better Buy?

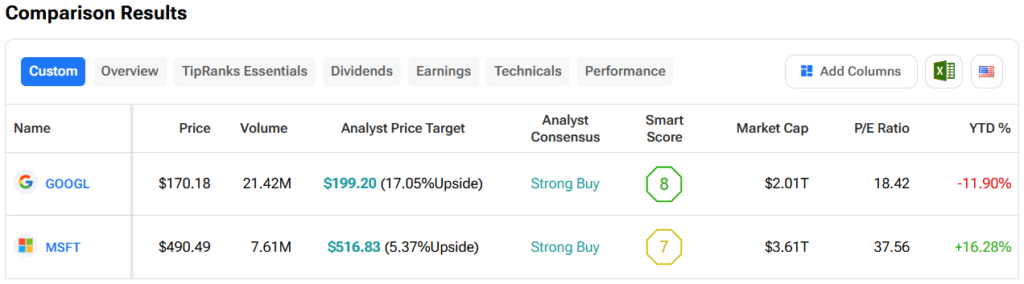

Turning to Wall Street, out of the two stocks mentioned above, analysts think that GOOGL stock has more room to run than MSFT. In fact, GOOGL’s price target of $199.20 per share implies 17% upside versus MSFT’s 5.4%.