Who’s Betting Big on Vertiv (VRT)? The Power Players Dominating This AI Infrastructure Stock

Vertiv Holdings (VRT) isn’t just another ticker—it’s become the backroom darling of AI’s infrastructure boom. Here’s who’s stacking shares like data centers stack servers.

The Whale Watch: Institutional investors are gobbling up VRT, betting the company’s cooling and power solutions will be as essential as oxygen for AI’s hyperscale growth. No surprise—when tech giants throw billions at GPUs, someone’s gotta keep them from melting down.

Retail’s Late Arrival: Main Street’s finally noticing, but let’s be real: by the time your cousin’s Discord group pumps it, the smart money’s already eyeing exits. Classic.

Bottom line? Vertiv’s become a proxy for AI’s unglamorous backbone—where the real money flows when hype meets thermodynamics. Just don’t expect Wall Street to admit they’re basically investing in glorified air conditioners.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

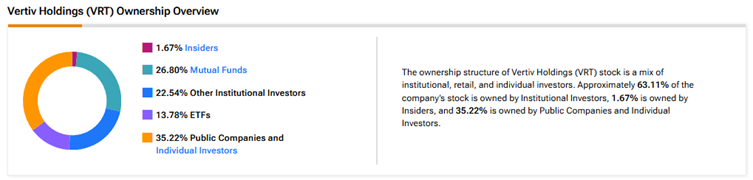

Interestingly, according to TipRanks’ ownership page, institutional investors (mutual funds, ETFs, and other institutional investors) hold the largest share of Vertiv Holdings at 63.1%. They are followed by public companies and individual investors, owning 35.2%. Meanwhile, insiders hold about 1.7% of VRT stock.

Digging Deeper into Vertiv’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in Vertiv Holdings at 9.4%. Vanguard Index Funds comes second, with an 8.92% stake.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 3.2% stake in VRT stock, followed by the Vanguard Mid-Cap ETF (VO), with a 2.17% stake.

Moving to mutual funds, Vanguard Index Funds holds about 8.92% of VRT. Meanwhile, Fidelity Concord Street Trust owns 1.06% of the AI infrastructure company.

Is Vertiv a Good Stock to Buy?

Turning to Wall Street, Vertiv Holdings stock scores a Strong Buy consensus rating based on 12 Buys and two Holds. The average VRT stock price target of $116.93 indicates 1.4% downside risk from current levels.