Wedbush’s Dan Ives Crowns IBM Stock as the Undisputed AI Juggernaut – Here’s Why

Big Blue’s AI bets are finally paying off—and Wall Street’s taking notice. Wedbush analyst Dan Ives just slapped a bullish stamp on IBM, calling it a ‘must-own’ AI play as enterprise adoption skyrockets.

The sleeping giant woke up hungry. While crypto bros were memeing about ‘decentralized AI,’ IBM quietly built real-world solutions even your CFO could love. Now its stock’s climbing while speculators chase vaporware.

Legacy tech? Hardly. IBM’s hybrid cloud + AI stack is snatching contracts from hyperscalers—because sometimes enterprises want answers, not just GPU clusters burning cash. The irony? All that ‘boring’ enterprise revenue funds R&D while crypto-native AI projects beg for their next round.

One hedge fund manager muttered, ‘They monetize AI like it’s 1999—with actual contracts.’ Ouch. But when the hype fades, IBM’s the one holding the checks.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

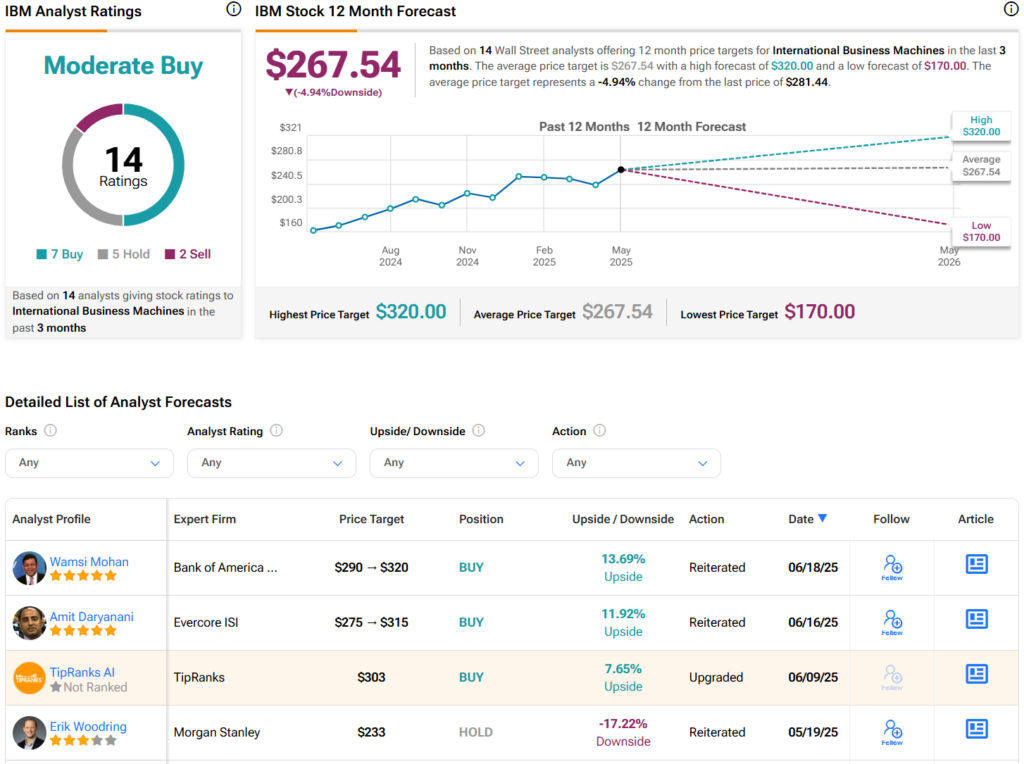

Adding to this optimism, Bank of America and Evercore ISI also recently raised their price targets on IBM due to the company’s ongoing transformation. BofA’s five-star analyst, Wamsi Mohan, boosted his target to $320 from $290, arguing that IBM is no longer the “value trap” some investors remember from its pre-2020 days. Instead, IBM has restructured its software segment by acquiring higher-growth businesses and shedding slower, cost-heavy operations, which are moves that should lead to stronger revenue growth going forward.

Similarly, Evercore ISI raised its price target from $275 to $315 and now expects mid-to-high single-digit revenue growth and double-digit earnings and free cash FLOW growth in the next few years. According to five-star analyst Amit Daryanani, IBM could generate $16–$18 per share in annual earnings within three years. With market sentiment and valuation multiples improving, all three firms agree that IBM is well-positioned to benefit from the next phase of enterprise AI and cloud expansion.

What Is the Target Price for IBM?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IBM stock based on seven Buys, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average IBM price target of $267.54 per share implies 5% downside risk.