CRWD, PANW, and SentinelOne: The Cybersecurity Trio Dominating 2025’s Digital Battlefield

The cybersecurity arms race heats up as CrowdStrike, Palo Alto Networks, and SentinelOne lock horns—while Wall Street bets on who'll profit from our paranoia.

Zero-day threats meet zero-sum markets in this high-stakes security showdown.

These players aren't just selling firewalls—they're cashing in on the digital fear economy. Because nothing grows portfolios like catastrophic breaches.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

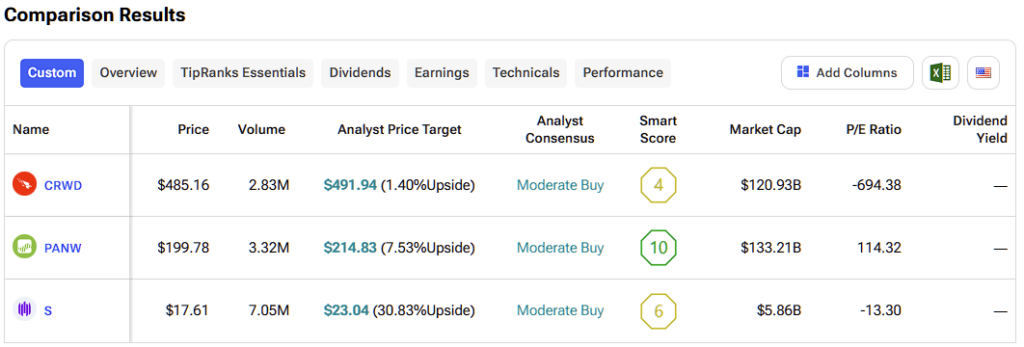

So, where should investors focus? CrowdStrike (CRWD), Palo Alto Networks (PANW), and SentinelOne (S) stand out as leading players, each offering compelling reasons to be on your radar for 2025 and beyond.

CrowdStrike (NASDAQ:CRWD) | The AI Vanguard

CrowdStrike’s Falcon platform is a powerhouse, combining AI-driven precision with real-time threat detection. In its latest update, the company reported $4.4 billion in annual recurring revenue (ARR)—a 22% year-over-year increase. Its generative AI tool, Charlotte AI, is proving to be a game-changer, slashing incident response times and driving DEEP customer engagement—22% of clients now use eight or more Falcon modules, signaling strong retention and upselling.

CrowdStrike’s recent partnership with Nvidia to secure AI pipelines—from data ingestion to model deployment—further reinforces its strategic edge in an AI-centric security landscape. While the stock trades at a lofty 44x sales, this premium reflects its leadership in a high-growth industry. With 20%+ revenue growth and expanding relevance, CrowdStrike isn’t likely to come cheap—but for long-term investors, the valuation may be justified.

Is CRWD a Buy, Hold, or Sell?

Currently, most analysts are bullish on CRWD stock. The stock features a Moderate Buy consensus rating based on 27 Buy, eight Hold, and one Sell ratings assigned in the past three months. CRWD’s average stock price target of $491.94 implies less than 2% upside over the next twelve months, suggesting Wall Street believes the stock is already priced for perfection.

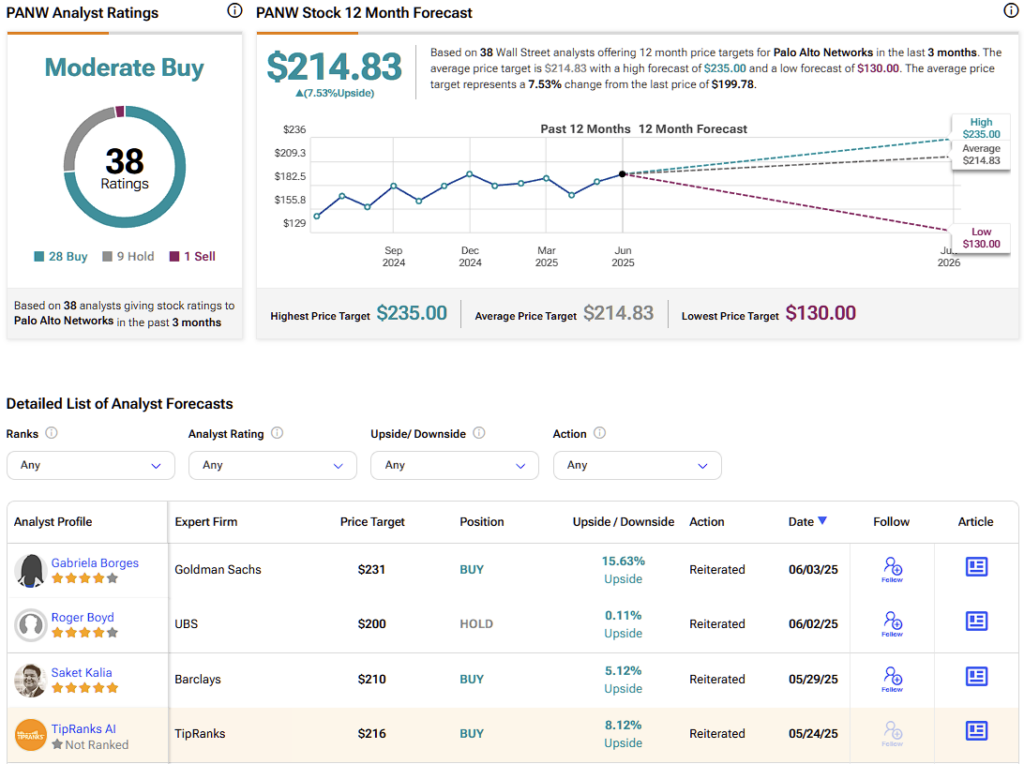

Palo Alto Networks (NASDAQ:PANW) | The Value Powerhouse

Palo Alto Networks is a veteran in the cybersecurity space, known for its ability to evolve. Its ongoing platformization strategy—which unifies endpoint, cloud, and network security—continues to gain traction, landing 90 net new platform deals in Q3 FY2025 and delivering a 15% year-over-year revenue increase to $2.29 billion. Meanwhile, its AI-powered XSIAM platform is scaling rapidly, with ARR up over 200%, cementing Palo Alto’s leadership in key cybersecurity segments.

What really makes PANW stand out now is its relatively reasonable valuation. The stock trades at 26x revenue—still high, but modest compared to peers given its consistent mid-teens growth outlook through 2030. With the company targeting $15 billion in ARR by the end of the decade—and likely to surpass it given soaring demand for cybersecurity—PANW may be undervalued relative to its long-term potential.

Is PANW a Buy, Sell, or Hold?

On Wall Street, Rigetti stock carries a Moderate Buy consensus rating based on 28 Buy, nine Hold, and one Sell ratings. PANW’s average stock price target of $214.83 implies almost 8% upside potential over the next twelve months.

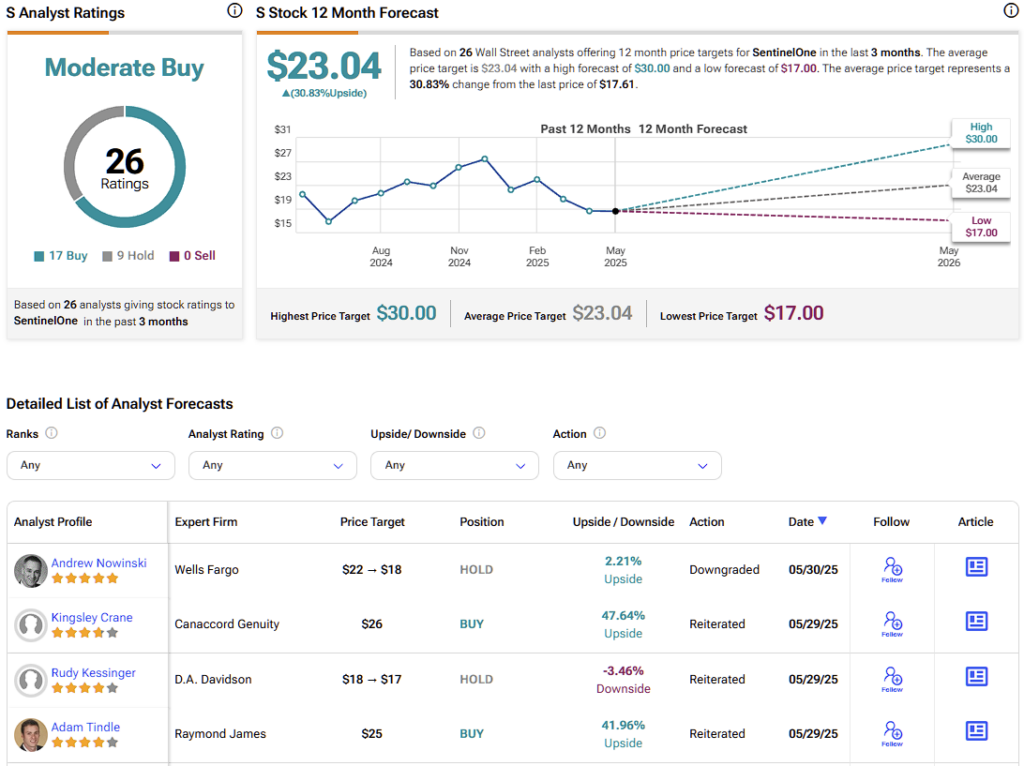

SentinelOne (NYSE:S) | The Nimble Disruptor

SentinelOne may be smaller than its big-name peers, but it’s certainly punching above its weight. Its Singularity platform, powered by Purple AI, delivered 24% ARR growth last quarter, and a newly inked partnership with Lenovo is expected to drive additional revenue in late 2025 by expanding market access.

While the recent six-hour outage in May raised concerns about cloud dependency and weighed on the stock, the company’s quick recovery demonstrated operational resilience. Despite that setback, SentinelOne’s AI-first approach continues to deliver. Recently, the company successfully thwarted a Chinese APT41 supply chain attack, further reinforcing the strength of its technology.

With a market cap well below CrowdStrike’s $122.6 billion, SentinelOne offers agility and innovation, but also higher risk. Still, trading at just 11x forward revenue and maintaining ~20% top-line growth, the stock presents a compelling high-risk, high-reward opportunity in a fast-growing sector.

Is SentinelOne a Good Stock to Buy?

SentinelOne is currently covered by 26 Wall Street analysts, most of whom hold a bullish outlook. The stock carries a Moderate Buy consensus rating with 17 analysts assigning a Buy and nine a Hold rating over the past three months. Notably, SentinelOne’s average price target of $23.04 suggests over 30% upside potential over the next twelve months.

The Cyber Stakes Are High

With Gartner forecasting 15% growth in the cybersecurity market for 2025, driven by rising AI-powered threats and high-profile breaches, such as the Washington Post hack and APT41 attacks, the sector is poised for continued expansion.

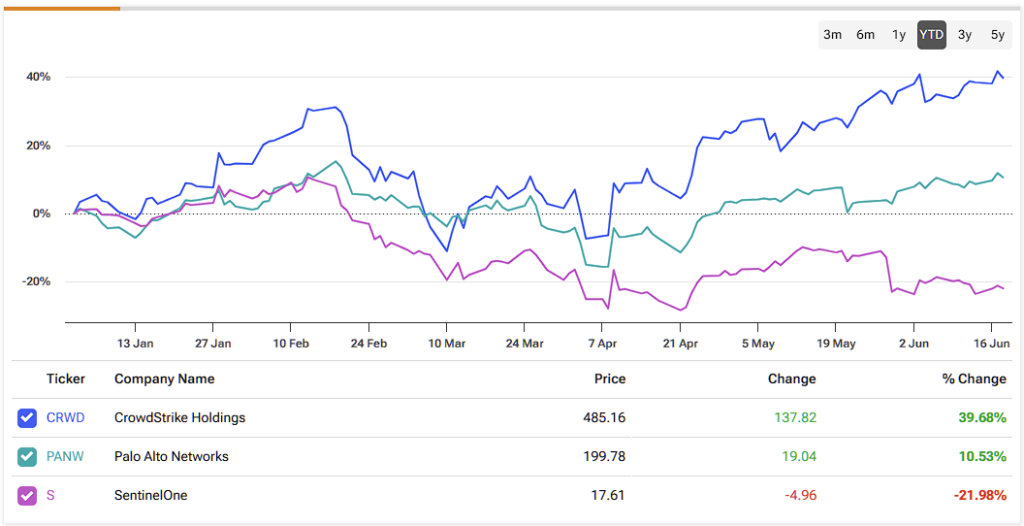

CrowdStrike stands out with its AI edge and loyal customer base, making it a top-tier pick. Palo Alto Networks offers a compelling balance of growth and value, backed by a strong platform and solid execution. SentinelOne, while riskier, represents a bold bet on innovation and agility.

All three are gaining market share in a red-hot industry. Whether you’re drawn to the leader, the value play, or the nimble disruptor, each one offers a strong case for inclusion in a future-focused portfolio.