Apple Stock (AAPL) at a Crossroads: Analysts Split on Recovery Prospects

Wall Street can't decide if AAPL is a rebound play or dead money. Again.

Bull Case: The usual suspects point to services growth and Vision Pro adoption—because nothing says 'recovery' like betting on $3,500 ski goggles.

Bear Trap: Supply chain whispers and China sales slump have shorts licking their chops. Tim Cook's reality distortion field looking a little... thin.

Bottom Line: When analysts agree, get nervous. When they disagree? Grab popcorn. Either way, the stock's stuck in iPhone upgrade cycle purgatory—just like your portfolio.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Apple investors are patiently awaiting a rebound in the stock and are concerned about the company missing huge opportunities presented by the ongoing AI boom. Moreover, the recently held and much-awaited Worldwide Developers Conference (WWDC) failed to meet investor expectations from Apple’s AI innovations.

Wall Street Is Divided on a Rebound in Apple Stock

Following the WWDC event, Goldman Sachs analyst Michael Ng reaffirmed a Buy rating on AAPL stock with a price target of $253. The 5-star analyst pointed out the decline in Apple stock after the event, noting that while the company announced design improvements and new features across its operating systems and first-party apps, it failed to reveal any substantial progress in Apple Intelligence. In fact, Apple confirmed that the features that make Siri more personal will be delayed to 2026.

Nevertheless, Ng believes that Apple continues to demonstrate that it has the best-in-class suite of devices with new offerings, including liquid glass displays and AI-powered features like live translation, designed to enhance user experience. The analyst continues to expect an improvement in the iPhone replacement cycle, coinciding with new iPhones planned in 2025/2026/2027.

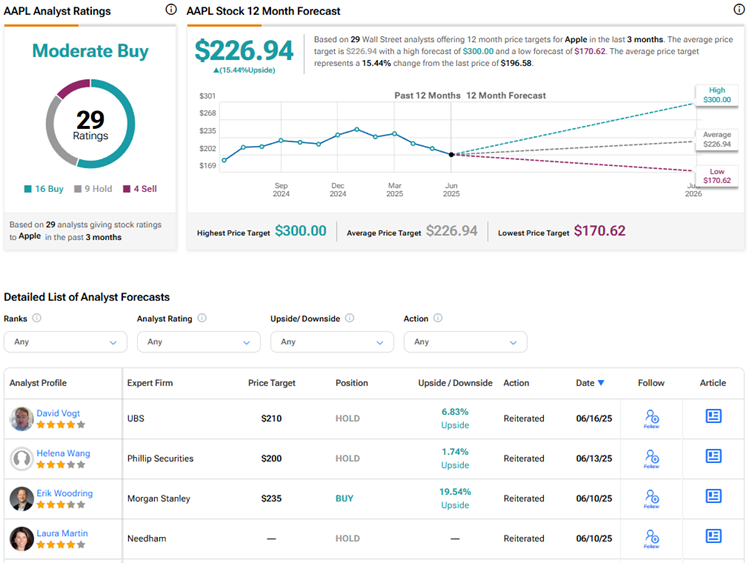

Meanwhile, UBS analyst David Vogt reiterated a Hold rating on AAPL stock with a price target of $210. The 4-star analyst noted that based on supply chain checks and preliminary sell-through data from Counterpoint, global iPhone sell-through data in April and May is tracking up by mid-teens year-over-year. This indicates that the nearly 14% year-over-year sell-through growth in April that Vogt attributed to a pull-forward of demand continued into May amid fears of a tariff-led rise in iPhone prices.

Vogt estimates that iPhone sell-through is tracking about 4 million units higher so far (through May) in the June quarter compared to the prior-year period and his own estimate. While this upside is encouraging, the analyst doesn’t expect the momentum to sustain, given “relatively uneventful” offerings announced at WWDC and muted purchase intent reflecting in the most recent UBS Evidence Lab survey. Consequently, Vogt expects near-term demand trends for iPhone to moderate in the coming months and quarters.

Is Apple Stock a Good Buy?

Overall, Wall Street is cautiously optimistic on Apple stock, with a Moderate Buy consensus rating based on 16 Buys, nine Holds, and four Sell recommendations. The average AAPL stock price target of $226.94 indicates 15.4% upside potential from current levels.