AMD Stock Soars Post-Analyst Day: Cowen Unveils Bullish Next-Gen Outlook

AMD's shares rocket as Cowen drops bullish signals—here's what Wall Street's buzzing about.

Semiconductor giant AMD just gave analysts reason to cheer. After a blockbuster Analyst Day presentation, the stock surged as Cowen outlined a roadmap that could reshape the chip wars.

Why the Street's excited:

- Next-gen architecture beats rivals at power efficiency

- Data center gains accelerating faster than expected

- AI chip pipeline looking 'materially stronger' than projections

Of course, no tech rally is complete without Wall Street's favorite game: 'Let's pretend we knew this all along.' The same analysts who were cautious last quarter are now tripping over themselves to raise targets—classic buy-high, sell-higher logic.

Bottom line? AMD's playing chess while others play checkers. Whether the market's ready for their next move remains to be seen.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Although no new customers were announced, this was largely expected given that most prefer to unveil new products and investments at their own events rather than AMD’s. However, Su did note that the company expects to have multiple gigawatt-scale customers (beyond OpenAI) in the MI450 time frame.

While the company highlighted the breadth of its technology portfolio across Client & Gaming and Embedded, most of its long-term growth – and consequently earnings potential – is expected to come from the Data Center platform, particularly with the ramp of the MI450 in the second half of 2026 and the MI500 following in 2027.

Cowen’s Joshua Buchalter sees this focus on MI450 and MI500 as the natural next phase of AMD’s data-center rise. The analyst argues that the company is “beginning to hit the knee” of adoption with its third-generation Instinct platform, drawing a direct parallel to how EPYC CPUs gained traction.

“As Naples and then Rome re-established AMD in server CPU and laid the foundation for the inflection during the Milan and Genoa generations, so too have MI300 and MI355 laid the foundations for a potential inflection on MI450 and MI500,” the 5-star analyst explained.

Investors are likely to be closely monitoring AMD’s progress with these product ramps, and Buchalter acknowledges the “execution risk” tied to these launches, along with broader industry risks on account of the massive scale of AI infrastructure buildouts. It’s also worth noting that, in this case, AMD is competing directly with Nvidia rather than a weaker Intel. Even so, Buchalter points out that the company’s market share goal is a relatively modest mid-teens percentage, compared to the roughly 40% share it currently holds in server CPUs.

The analyst believes AMD did an “admirable job” at the event in outlining its case for success with the new products, though he remains mindful of ongoing skepticism among investors.

“That said,” Buchalter summed up, “set against a stock that trades at ~10x its potential 2030E earnings power, we see an attractive risk/ reward skew for a company and management team with a track record of hitting targets.”

Accordingly, Buchalter assigns AMD shares a Buy rating, along with a $290 price target. This suggests the shares will gain 12% in the months ahead. (To watch Buchalter’s track record, click here)

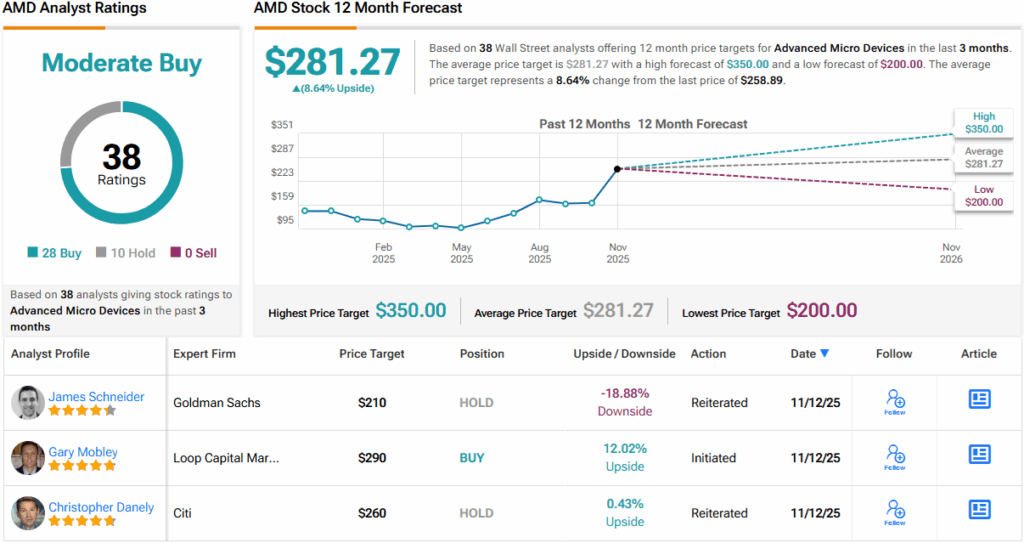

27 other analysts are also AMD bulls and with an additional 10 Holds, the stock claims a Moderate Buy consensus rating. The forecast calls for 12-month returns of just below 9%, considering the average price target clocks in at $281.27. (See)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.