SPY ETF Daily Market Pulse: November 12, 2025 – Tracking the Bull’s Next Move

Wall Street's favorite tracker flexes muscle as traders eye macro winds.

Market Snapshot: The SPDR S&P 500 ETF (SPY) continues its tightrope walk between institutional flows and retail FOMO.

Under the Hood: Volume patterns suggest algo traders are running the show—human investors left playing catch-up.

Forward Look: All eyes on Fed whispers and the quarterly corporate earnings circus. Because nothing says 'healthy market' like spreadsheet jockeys guessing growth rates.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Within SPY’s holdings, the Healthcare, Financials, Utilities, and Materials sectors posted gains today, while only the Consumer Staples, Energy, and Communication Services sectors declined.

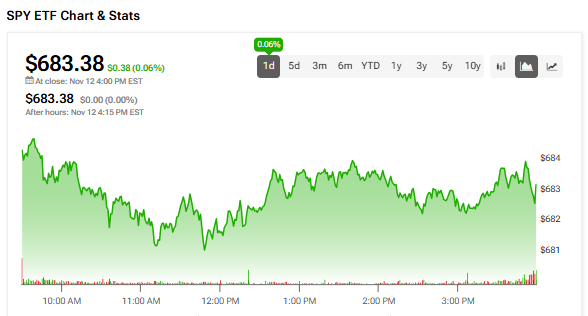

Importantly, SPY closely tracks the S&P 500 Index (SPX), which ROSE 0.06%, while the tech-heavy Nasdaq 100 (NDX) declined 0.06%.

Key Catalysts That Can Move SPY

Looking ahead, potential catalysts for volatility in the SPY ETF are a lineup of Federal Reserve official speeches this week, updates on the ongoing U.S. government shutdown, and key corporate earnings reports from companies such as The Walt Disney Company (DIS).

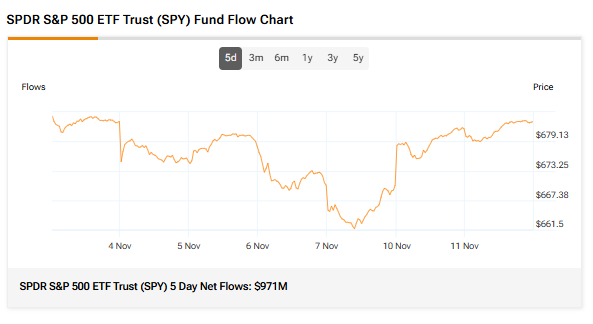

Fund Flows and Sentiment

SPY’s 5-day net inflows totaled $971 million, showing that investors put capital in SPY over the past five trading days. Meanwhile, its three-month average trading volume is 74.07 million shares.

It must be noted that retail sentiment remains neutral, while hedge fund managers have increased their holdings of the SPY ETF in the last quarter.

SPY’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, which is based on a weighted average of analyst ratings on its holdings, SPY is a Moderate Buy. The Street’s average price target of $779.09 for the SPY ETF implies an upside potential of 14.01%.

Currently, SPY’s five holdings with the highest upside potential are Loews (L), Fiserv (FI), DuPont de Nemours (DD), Chipotle Mexican Grill (CMG), and Norwegian Cruise Line (NCLH).

Meanwhile, its five holdings with the greatest downside potential are Paramount Skydance (PSKY), Incyte (INCY), Tesla (TSLA), Expeditors (EXPD), and Micron Technology (MU).

Revealingly, SPY’s ETF Smart Score is eight, implying that this ETF is likely to outperform the broader market.