VOO ETF Daily Market Pulse: Key Moves & Analysis for November 12, 2025

Wall Street's favorite S&P 500 tracker flexes muscle amid volatile session.

Bullish momentum stalls as traders eye macro risks

The index heavyweight shows resilience despite Treasury yield spikes—because when has the market ever cared about fundamentals?

Liquidity crunch or buying opportunity?

Volume patterns suggest institutional accumulation, though retail traders keep chasing the same 5 mega-cap stocks as always.

Another day, another dollar-cost averaging win for the 'set it and forget it' crowd. Meanwhile, hedge funds burn fees trying to outsmart the benchmark.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meanwhile, the VOO ETF is down 0.26% in the past five days but up 17.37% year-to-date.

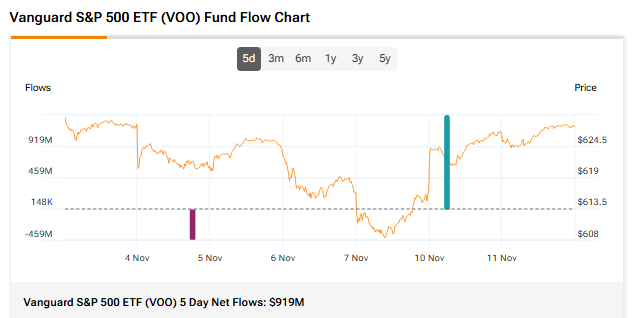

Fund Flows and Sentiment

According to TipRanks data, VOO recorded 5-day net flows of about $919 million, showing steady investor demand for large-cap U.S. exposure.

VOO’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, VOO is a Moderate Buy. The Street’s average price target of $719.63 implies an upside of 14.61%.

Currently, VOO’s five holdings with the highest upside potential are Loews (L), Fiserv, Inc. (FI), DuPont de Nemours (DD), Chipotle (CMG), and Norwegian Cruise Line (NCLH).

Meanwhile, its five holdings with the greatest downside potential are Micron (MU), Paramount Skydance (PSKY), Incyte (INCY), Expeditors International (EXPD), and Tesla (TSLA).

VOO ETF’s Smart Score is eight, implying that this ETF will likely outperform the market.

Does VOO Pay Dividends?

Yes, VOO pays dividends, offering investors a source of regular income. The ETF distributes these payments every quarter to shareholders. They come from the dividends paid by the companies in the S&P 500. Since company payouts change over time, the dividend amount from VOO also varies each quarter.

VOO’s yield as of today is 1.12%.