VTI ETF Daily Pulse: Key Investor Insights for November 11, 2025

Wall Street's favorite index fund just flexed its muscles again—here's what you missed.

Market Moves: VTI continues its relentless grind upward, shrugging off volatility like a bored bull.

Behind the Numbers: Liquidity flows suggest institutions are quietly accumulating—retail investors still chasing last week's meme stocks.

Bottom Line: While hedge funds overcomplicate their strategies, VTI keeps printing money the boring way. (Fun fact: It's outperformed 92% of active managers this decade—but who's counting?)

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

VTI ETF’s Latest Performance

The VTI ETF gained 1.46% on Monday. Likewise, the Nasdaq Composite gained by 2.27%, and the S&P 500 was up by 1.54%. The markets bounced back after Senate Democrats joined Republicans to MOVE forward with a bill to end the government shutdown.

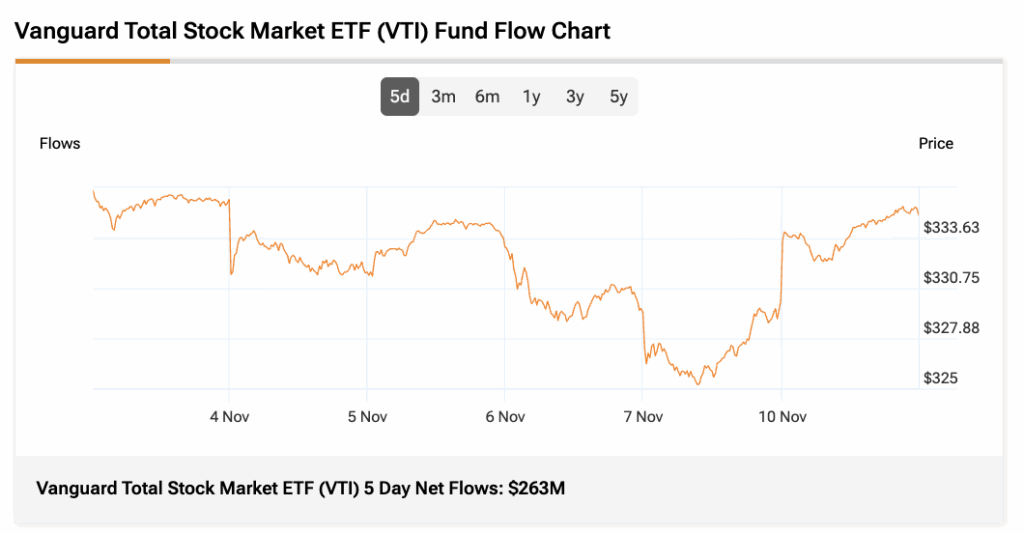

VTI’s three-month average trading volume is 4.04 million shares. Meanwhile, its 5-day net flows totaled $263 million, showing that investors added capital to VTI over the past five trading days.

Technical Snapshot

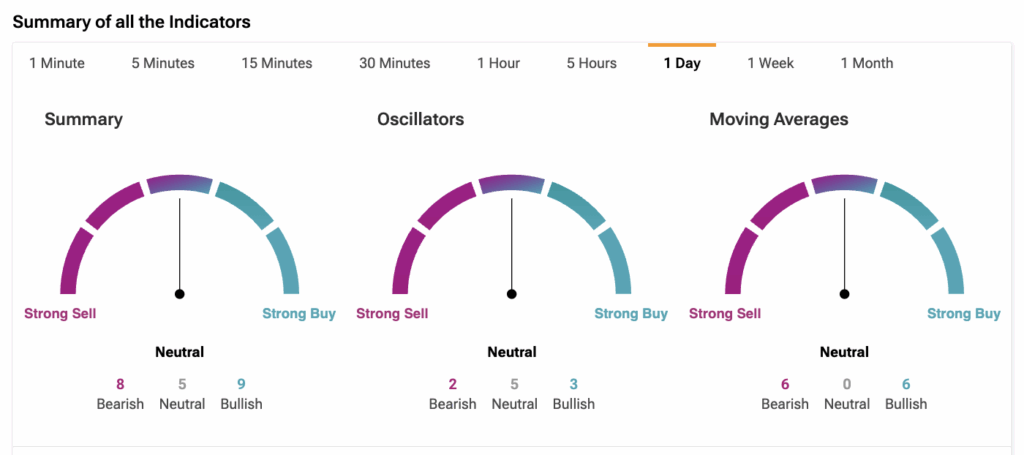

From a technical standpoint, VTI remains above its 50-day moving average. Notably, VTI is trading at $334.92, compared to its 50-day exponential moving average of $326.93, indicating a bullish trend and a potential Buy signal.

According to TipRanks Technical Analysis, VTI has a Neutral rating based on the overall summary and the moving average consensus.

VTI’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, VTI is a Moderate Buy. The Street’s average price target of $382.54 implies an upside of 14.2%.

VTI’s top three holdings are chipmaker Nvidia (NVDA) at 6.69%, followed by tech giants Microsoft (MSFT) at 5.98% and Apple (AAPL) at 5.87% of the fund’s total weight.

Currently, VTI’s five holdings with the highest upside potential are BioAtla (BCAB), Cibus (CBUS), MetaVia (MTVA), NRX Pharmaceuticals (NRXP), and FibroBiologics (FBLG).

Meanwhile, its holdings with the greatest downside potential are LiveOne (LVO), iHeartMedia (IHRT), Fluence Energy (FLNC), and eGain Communications (EGAN).

Notably, VTI ETF’s Smart Score is seven, implying that this ETF is likely to perform in line with the broader market.