CoreWeave Stock (CRWV) Downgraded & Slashed Despite Q3 Beat—What Wall Street Missed

Wall Street analysts just can't handle a good thing. CoreWeave (CRWV) smashed Q3 expectations—only to get hit with downgrades and price target cuts. Here's why the suits got it wrong.

The Beat That Backfired

CRWV delivered a textbook earnings beat. Revenue up, margins expanding, guidance raised. Classic bullish setup—until the analyst chorus started singing the downgrade blues.

Short-Term Myopia Strikes Again

Institutional 'wisdom' focused on nitpicked 'forward risks' rather than the company's GPU-cloud dominance. Typical sell-side behavior—punishing winners for not being perfect.

The Real Play

Smart money's accumulating this dip. When Wall Street downgrades a fundamentally strong tech stock, it's usually a buy signal in disguise. Remember: analysts are still catching up to the AI infrastructure boom.

Another quarter, another case of Wall Street fighting the tape. Their loss—your opportunity.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

CoreWeave lowered its fourth quarter guidance, citing infrastructure timing issues at one data center and challenges in securing sufficient compute power. A delay from an external builder led the company to lower its 2025 revenue forecast to $5.1 billion from $5.25 billion and reduce planned capital spending by $8.5 billion. CRWV shares were down 8.5% in pre-market trading following the results.

Top Analyst Downgrades CRWV to Hold

J.P. Morgan’s top analyst Mark Murphy downgraded CRWV stock from a “Buy” rating to “Hold,” while keeping his $110 price target, which implies 4.2% upside potential.

Murphy highlighted that some CoreWeave projects were delayed because of supply-chain problems, which moved some revenue to a later quarter. He added that while these delays caused short-term pressure, CoreWeave is still securing major AI contracts and gaining new clients such as CrowdStrike (CRWD), Rakuten, Poolside, and Jasper.

Here’s Why Analysts Are Cutting Price Targets

Several analysts reduced their price targets for CRWV following the Q3 update. Let’s briefly look at some of them.

Bank of America Securities analyst Bradley Sills kept his “Hold” rating but cut his price target from $168 to $140, implying 32.6% upside potential. Sills pointed to a $150 million reduction in CoreWeave’s FY25 outlook, attributing it to a supply issue, which he views as “fixable” by the first quarter.

Similarly, Mizuho Securities analyst Gregg Moskowitz lowered his price target from $150 to $120, representing 13.6% upside, while keeping his “Hold” rating. He noted that quarterly sales growth this quarter was smaller than in its previous two public quarters and the firm cut its Q4 guidance. Moskowitz is now “incrementally less optimistic” about CRWV’s revenue upside over the NEAR term.

Meanwhile, Jefferies analyst Brent Thill slashed his price target from $180 to $155, implying 46.8% upside potential, and maintained his “Buy” rating. Thill stated that CoreWeave’s backlog grew strongly, but cited capacity limits and deployment delays for the target cut. He expects the lost revenue and profit to return in early 2026 and noted that the stock offers a good risk/reward balance given its growth potential.

Is CoreWeave Stock a Good Buy?

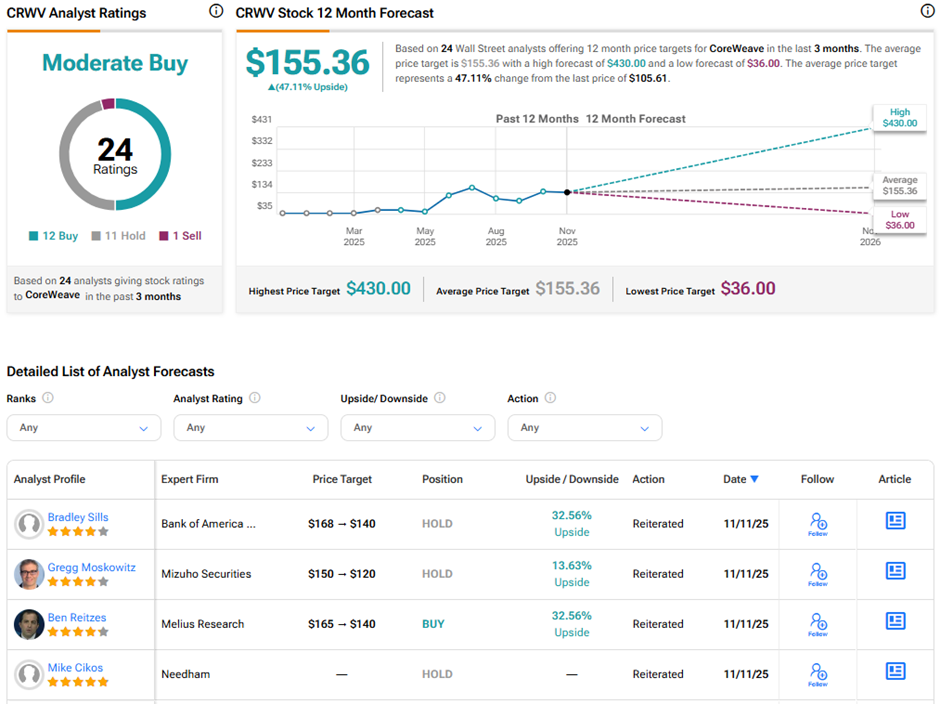

On TipRanks, CRWV has a Moderate Buy consensus rating based on 12 Buys, 11 Holds, and one Sell rating. The average CoreWeave price target of $155.36 implies 47.1% upside potential from current levels. Year-to-date, CRWV stock has surged over 184%.