Goldman Sachs (GS) Set to Rake in Record $55B Fee from Electronic Arts Mega-Deal

Wall Street's fee feast continues as Goldman Sachs cashes in on gaming's biggest buyout.

The $55 billion EA deal isn't just changing the game—it's printing money for bankers.

While developers crunch 80-hour weeks, GS collects what amounts to 3,500 years of average programmer salaries... for paperwork.

Another day, another 10-figure justification for those investment banking premiums.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Goldman Sachs Gains Record Fee from Electronic Arts Deal

A Securities and Exchange Commission (SEC) filing on Monday revealed that Goldman Sachs was paid $10 million when the Electronic Arts take-private transaction was announced. The remaining $100 million fee will be paid upon completion of the buyout, subject to shareholder and regulatory approval.

Additionally, the SEC filing disclosed that the videogame company had not paid Goldman Sachs any kind of fees in the last two years. However, the investment bank secured $24 million and $154 million in fees for its work for PIF and Silver Lake, respectively, over the past two years.

Interestingly, prior to the EA deal, Goldman Sachs’ largest publicly disclosed fee was $93 million from the sale of food company Kellanova to candy giant Mars for $36 billion.

Meanwhile, the buyout of Electronic Arts includes $20 billion of debt financing fully and solely committed by JPMorgan Chase (JPM). This arrangement is expected to generate “hundreds of millions” of dollars in separate fees for a large consortium of banks, noted the Financial Times.

Goldman Sachs Gains from Robust Investment Banking Business

Last month, Goldman Sachs reported better-than-expected Q3 results, driven by the impressive performance of its investment banking and fixed income trading businesses.

Notably, Goldman Sachs’ investment banking fees surged 42% year over year to $2.66 billion in Q3 2025, thanks to improving deal activity, including mergers and IPOs (initial public offerings).

Advisers like Goldman Sachs have been earning significant fees amid a series of massive deals, backed by stable debt markets and less stringent regulations. Interestingly, Bank of America (BAC) is set to earn a $130 million fee from the $85 billion takeover of Norfolk Southern (NSC) by railway giant Union Pacific (UNP).

In fact, Goldman Sachs CEO David Solomon recently stated that the current backdrop looks quite “constructive” for large mergers and acquisitions in 2026 and 2027, especially in the U.S.

What Is the Price Target for Goldman Sachs Stock?

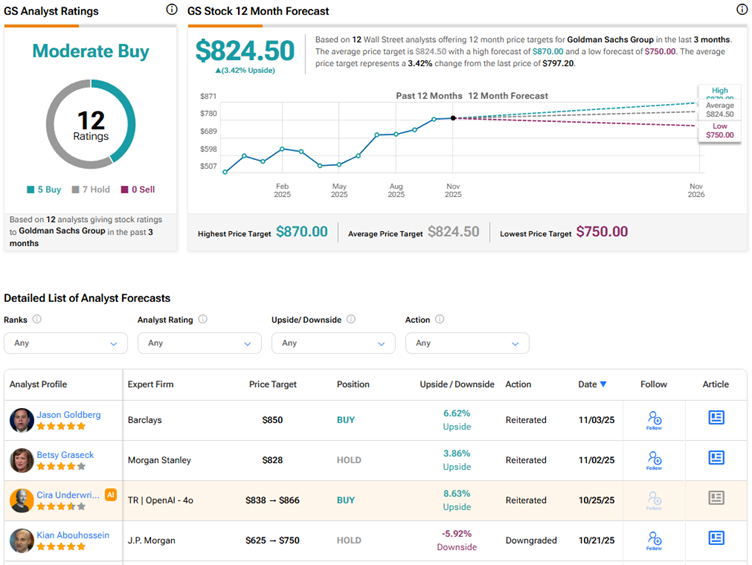

Currently, Wall Street has a Moderate Buy consensus rating on Goldman Sachs stock based on five Buys and seven Holds. The average GS stock price target of $824.50 indicates 3.4% upside potential from current levels.