Why Your Crypto Wallet Needs an Upgrade in 2025 – Don’t Get Left Behind

Crypto wallets aren’t what they used to be—and that’s a good thing. The 2025 landscape demands faster, smarter, and more secure storage solutions. Here’s why your old wallet might be a liability.

The Security Gap Widens

Legacy wallets are struggling to keep up with novel attack vectors. If you’re still using a 2022-era solution, you’re basically broadcasting your private keys to hackers.

DeFi Integration or Bust

Modern wallets now natively support cross-chain swaps and yield aggregators. Still manually bridging assets? Enjoy paying triple gas fees for the privilege.

The Institutional Test

Even Wall Street’s adopting self-custody—with compliance features that would make your current setup look like a paper ledger. (Bonus jab: Your bank’s ‘crypto division’ still uses Excel.)

Upgrade or risk becoming a cautionary tweet.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Arya said investors are worrying too much about a slowdown in AI spending. In his view, this skepticism is actually a good thing. It shows that the market is cautious, not overly excited, and that leaves room for steady gains. He explained that recent weakness in AI chip stocks, including Nvidia, was driven by broader market issues, not by anything wrong with the AI story itself.

Why NVDA Stock Remains a ‘Top Pick’ for This Top Analyst

At Nvidia’s recent GPU Technology Conference, the company revealed about $500 billion in data center orders expected for 2025 and 2026. To Arya, this is a clear sign that AI infrastructure spending is still robust. He said Nvidia’s position at the center of that buildout makes it hard to match.

Arya believes Nvidia can grow its sales by 50% and earnings by 70% in 2026, driven by demand for its AI chips used in data centers and cloud systems. Despite that, he noted, the stock trades at only 24 times forward earnings, which he called a reasonable valuation for such growth.

Looking further out, Arya estimated that if global AI spending by 2030 reaches even half of Nvidia’s forecast — around $3–$4 trillion — the company could earn more than $40 a share. In that case, he said, the stock WOULD be trading at less than 5x earnings, showing how conservatively it’s priced today.

China Risks Seen as Overstated

Some investors remain focused on risks tied to U.S. export restrictions on China. But Arya called that concern “unhelpful but irrelevant” to Nvidia’s near- and mid-term results. He said the company’s main growth engines, AI data centers, networking, and accelerated computing, remain on track.

While Arya acknowledged short-term challenges, such as uneven gaming sales or project delays in new data centers, he believes Nvidia’s long-term outlook is intact.

With a dominant market position and a growing order book, Nvidia remains, in his words, “one of the most compelling ways to invest in the AI revolution.”

Is NVDA Stock a Buy, Sell, or Hold?

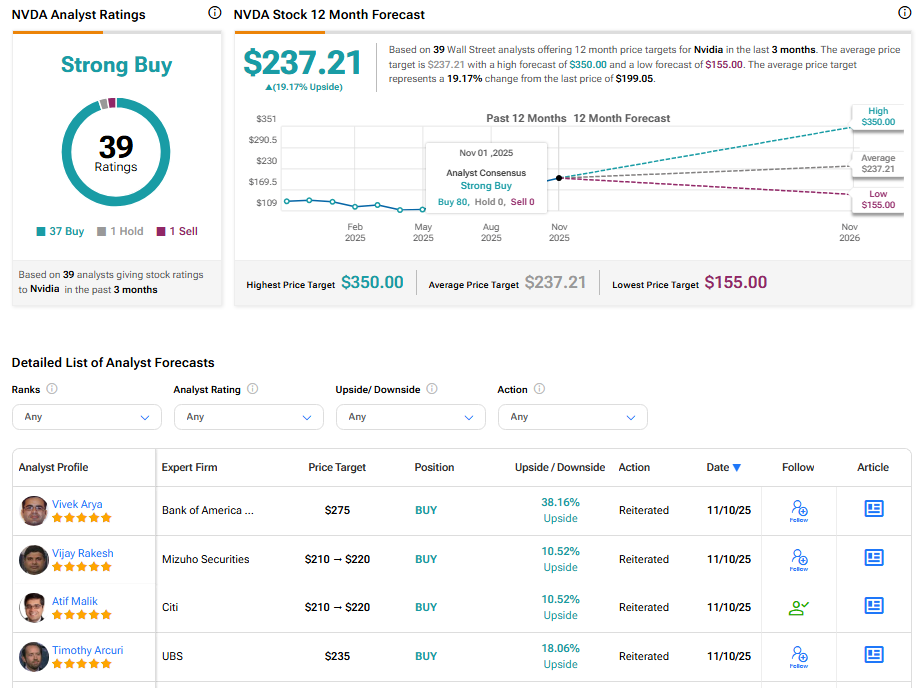

Currently, Wall Street has a Strong Buy consensus rating on Nvidia stock based on 37 Buys, one Hold, and one Sell recommendation. The average NVDA stock price target of $237.21 indicates 19.17% upside potential.