Novo Nordisk (NVO) Stock Surges as Pharma Giant Doubles Down on Obesity Deals After Metsera Setback

Novo Nordisk pivots hard—investors cheer the rebound play.

When Metsera flopped, NVO didn’t flinch. Instead, the Danish pharma titan slammed the accelerator on new obesity-treatment partnerships. Shares jumped 5% pre-market as analysts praised the aggressive repositioning.

Wall Street’s take? ‘Fail fast, deal faster’—another masterclass in Big Pharma’s ‘throw-spaghetti-at-the-wall’ R&D strategy.

One hedge fund manager quipped: ‘At this rate, they’ll monetize obesity before curing it.’

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Pfizer won the takeover bid after the startup accepted its performance-contingent $10 billion offer, ending a bitter battle with Novo Nordisk. Metsera’s products are yet to hit the market but are considered to hold high potential.

Novo Nordisk to Pursue Other Deals

According to Bloomberg, which spoke to insider sources, Novo Nordisk considered Metsera a complementary acquisition rather than a major deal that WOULD have transformed Novo’s business. As a result, CEO Mike Doustdar plans to seek out other opportunities in the obesity, diabetes, and other associated areas.

Novo Nordisk, which is the Maker of blockbuster weight-loss drug Wegovy and its diabetes counterpart Ozempic, dropped out of the Metsera acquisition race on Saturday after upping its offer to $10 billion in efforts to outbid Pfizer. However, Metsera went with the Pfizer deal, citing antitrust and legal risks tied to the choice of going with Novo Nordisk.

Competition in the Obesity Market Heats Up

Novo Nordisk’s loss to Pfizer came at a time when the Danish drugmaker is making efforts to regain its share of the $70 billion obesity market, contending with key rivals such as Eli Lilly (LLY). In its recent third-quarter 2025 earnings results, Novo Nordisk downgraded its full-year revenue forecast for the fourth time this year after the results failed to match Wall Street’s expectations.

On the other hand, the Metsera deal represents an opportunity for Pfizer to expand its presence in the lucrative weight-loss market.

Is Novo Nordisk a Buy or Sell?

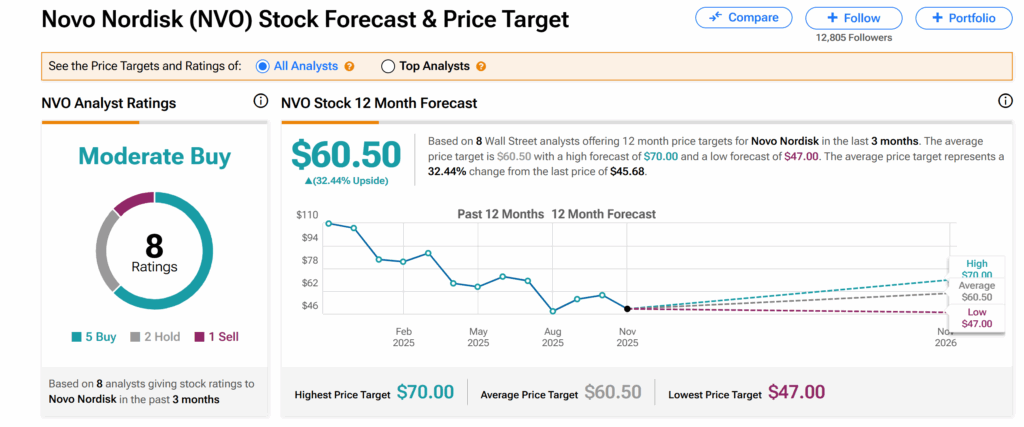

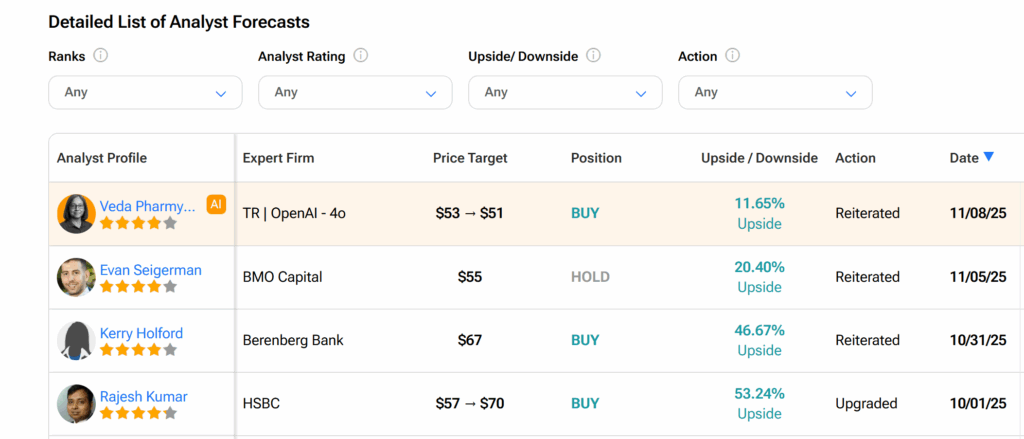

Across Wall Street, Novo Nordisk’s shares currently have a Moderate Buy consensus rating based on five Buys, two Holds, and one Sell issued by eight analysts over the past three months.

According to TipRanks, the average NVO price target of $60.50 indicates more than 32% upside potential from the current trading level.