Amazon (AMZN) Hits a ’Perfect 10’—Here’s Why Wall Street Can’t Stop Cheering

Amazon just aced the scorecard—again. What’s fueling the hype this time? Let’s break it down.

The Bull Case: Cloud, AI, and Retail Domination

AMZN’s trifecta of AWS growth, AI integrations, and relentless retail expansion has analysts swooning. No surprises—just execution.

The Skeptic’s Corner: ‘Perfect’ Doesn’t Exist

Sure, a ‘10’ looks shiny—until you remember Wall Street grades on a curve. Remember when ‘disruptive’ meant more than stock buybacks?

Bottom line: Amazon’s machine keeps humming. Whether that justifies the frothy multiples? That’s the real test.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The top rating reflects strong analyst support, hedge fund buying, upbeat news sentiment, and positive trading signals for Amazon stock.

Strong Q3 Results Drive Growth

Amazon recently reported strong third-quarter earnings, showing that demand across its key businesses remains solid. The company posted earnings per share of $1.95, beating analyst estimates of $1.57, while revenue ROSE 13.4% year over year to $180.2 billion, above expectations of $177.9 billion.

The growth was led by Amazon Web Services (AWS), the company’s most profitable division. CEO Andy Jassy said AWS is “growing at a pace we haven’t seen since 2022,” driven by rising demand for artificial intelligence (AI) services.

The results show that AI demand is lifting Amazon’s cloud business and supporting steady growth across the company.

New OpenAI Partnership Strengthens Amazon’s Market Position

Earlier this month, Amazon signed a multi-year, $38 billion partnership with OpenAI, marking one of its largest cloud and AI infrastructure deals to date. Under the agreement, OpenAI will use Amazon’s cloud services to run its AI models and data operations.

The deal has lifted investor and analyst confidence in Amazon’s strength in the AI race. It also showed that big players see AWS as a key partner for large-scale AI projects, helping Amazon compete more directly with Microsoft (MSFT) and Google (GOOGL) in cloud computing.

Institutional Support and Technical Signals Boost Confidence

The Perfect 10 score is also supported by strong institutional interest. Hedge funds added nearly 14.2 million Amazon shares last quarter, reflecting growing conviction from large investors.

On the technical side, momentum remains positive. The Williams %R indicator, which measures whether a stock is overbought or oversold, currently shows a Buy signal for AMZN, suggesting the stock still has room to climb.

Analysts Stay Bullish on the Stock

Analysts remain positive about Amazon’s growth outlook as AWS continues to show signs of strength.

Recently, Mizuho analyst Lloyd Walmsley raised his price target on Amazon stock to $315 from $300 and kept a Buy rating. The 5-star analyst said his higher target reflects stronger confidence after Amazon’s solid Q3 results, upbeat management comments, and the new OpenAI partnership.

Walmsley added that Amazon’s “strong Trainium outlook” and expanding AI deals give him more confidence in AWS’s long-term growth. He expects AWS revenue to rise about 21.4% in Q4 2025, showing steady improvement ahead.

Is Amazon a Good Long-Term Investment?

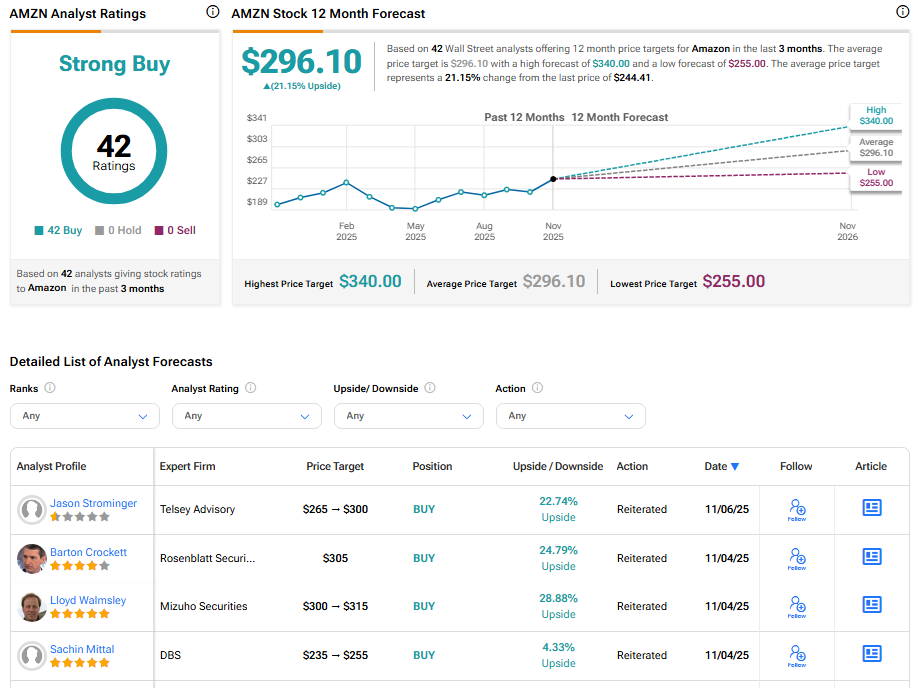

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 42 Buys assigned in the past three months, as indicated by the graphic below. After a 18% rally in its share price over the past year, the average AMZN price target of $296.10 per share implies 21.15% upside potential.