Micron (MU) Stock: Top Analyst Predicts ’Explosive Gains’ Ahead

Wall Street's brightest minds are doubling down on Micron—and the charts agree.

Here's why MU could be the semiconductor play of the decade.

Memory chip demand is surging past projections as AI and data centers hit hypergrowth. Micron's latest earnings smashed estimates, yet the stock still trades at a 20% discount to peers. One Goldman Sachs analyst calls it 'the most asymmetric upside in semis.'

Short sellers got burned last quarter as MU rallied 35% in three weeks. Now institutions are piling in—options volume just hit a 12-month high.

Technical breakout above $120 could trigger a gamma squeeze. The stock's RSI hasn't been this bullish since the 2021 crypto mining boom (back when your portfolio actually made money).

Risks? Sure. The CFO still owns a yacht named 'Shareholder Value.' But with DRAM prices spiking and short interest at 5.2%, this trade writes itself.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

AI Memory Demand Remains Strong

Rakesh said demand for High Bandwidth Memory (HBM) should stay strong into 2026 and 2027, helped by rising use in AI servers. He believes about 40% of Micron’s DRAM products could see higher sales and better margins as prices improve early next year.

Micron’s next HBM4 chips, built with its own design and advanced process tech, are ramping up well. The analyst expects HBM sales to more than double year over year, giving Micron a larger role in the fast-growing AI chip market.

Tight Supply and Rising SSD Demand

The analyst said limited capacity in China could support memory prices over the next few years. Around 30–35% of Samsung and Hynix’s memory output is facing delays due to chipmaking rules, which could keep supply tight and help Micron benefit from firmer prices into 2027 and 2028.

He also noted that Micron’s new U.S. plants in Idaho and New York, expected to start production between 2027 and 2029, could raise its U.S. DRAM share from mid-single digits to around 20% over the next decade.

Rakesh added that demand for solid-state drives (SSDs) is climbing as AI servers need faster storage. Micron’s QLC-based eSSDs are seeing greater adoption in AI systems that require high speed and capacity. With hard drives still in short supply, SSDs are gaining more share in large data centers.

Rakesh believes Micron is “well positioned in the AI data center market,” with solid pricing trends and a strong roadmap for future products.

Is Micron a Good Stock to Buy?

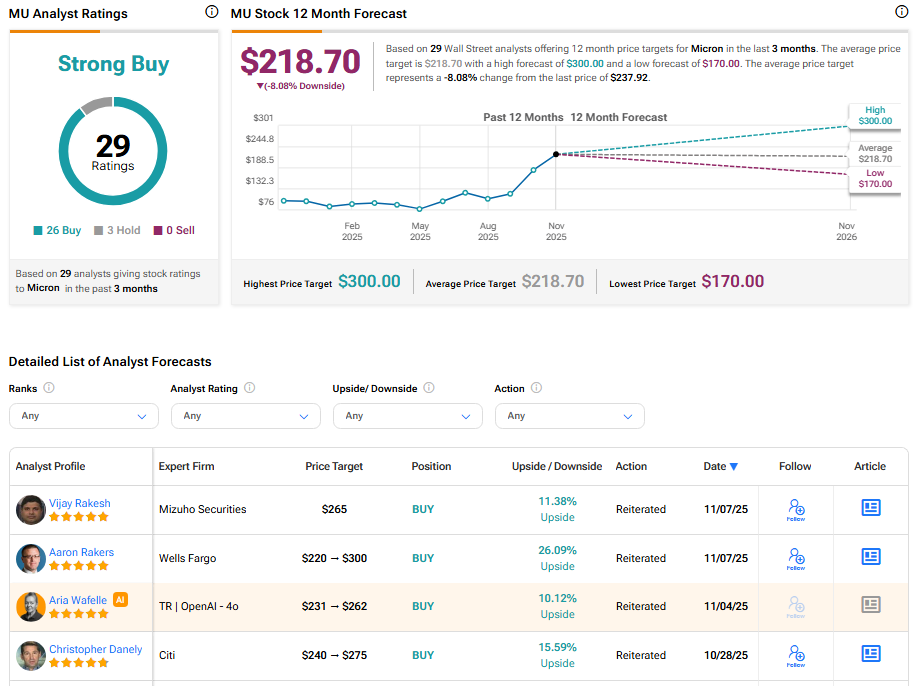

Micron stock has a consensus Strong Buy rating among 29 Wall Street analysts. That rating is based on 26 Buy and three Hold recommendations assigned in the last three months. The average MU price target of $218.70 implies 8.08% downside from current levels.