Cathie Wood Dumps Tesla (TSLA) – Here’s the Stock She’s Betting Big On After Stellar Q3

Cathie Wood’s Ark Invest makes a bold pivot—dumping Tesla shares and doubling down on a dark horse contender. Is this the next trillion-dollar play?

The Tesla Exit: A Strategic Shift or Short-Term Play?

Wood’s move shocks markets as TSLA’s volatility clashes with Ark’s long-term disruptive tech thesis. But the real story? Her new bet surged post-earnings—while Wall Street wasn’t looking.

Q3’s Hidden Gem: The Stock That Stole Ark’s Spotlight

No spoilers—but let’s just say it’s not another EV or space stock. This pick combines AI adoption with old-school cash flows, a rarity in Wood’s typically moonshot-heavy portfolio.

One hedge fund manager quipped: ‘When Cathie zigzags, retail investors get whiplash—and brokers get richer.’

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wood Sells Tesla, GitLab, and Roku

The biggest sale came from Tesla (TSLA), as ARK offloaded 71,638 shares worth about $31.94 million. This marks another step in ARK’s ongoing reduction of its Tesla holdings. The sale came at the same time CEO Elon Musk’s record-breaking $1 trillion pay package won shareholder approval.

ARK also sold 236,749 shares of GitLab (GTLB) for around $10.79 million. The MOVE follows other recent sales as the fund reduces its exposure to software names. Another large sale came from Roku (ROKU), where ARK offloaded 84,988 shares worth roughly $8.91 million.

ARK Buys Trade Desk amid Strong Q3 Earnings Report

On the buying side, ARK made a big move into The Trade Desk (TTD), adding 316,072 shares worth about $14.51 million. The buy shows ARK’s interest in the digital ad market, which continues to grow as brands shift more spending online.

ARK’s move aligns with the company’s strong third-quarter results, which showed revenue of $739 million, up 18% year over year, and adjusted earnings of $0.45 per share, both above estimates.

ARK also added 1,046,699 shares of Intellia Therapeutics (NTLA), valued at about $12.90 million. The firm has been building its stake in the gene-editing company all week, signaling strong confidence in biotech innovation. In smaller buys, ARK purchased shares of BEAM Therapeutics (BEAM) worth about $4.28 million and Twist Bioscience (TWST) worth roughly $4.00 million.

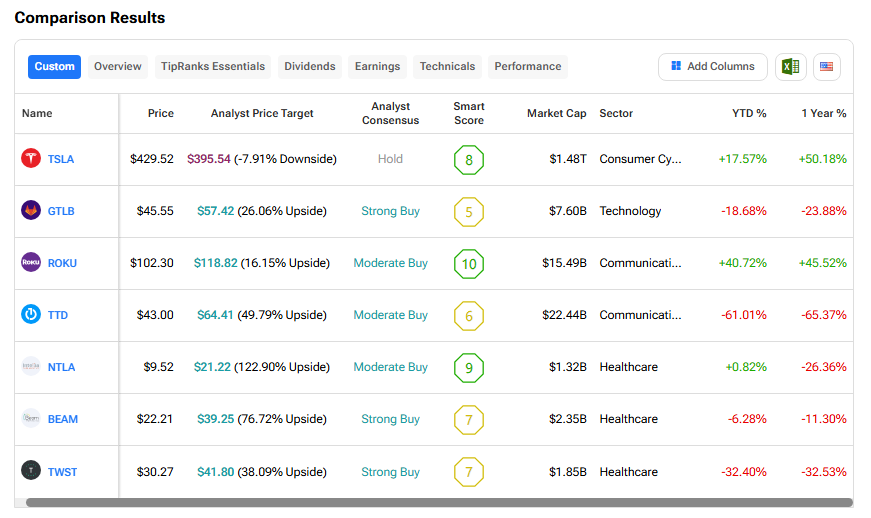

Let’s see how these stocks perform using the TipRanks Stock Comparison Tool: