Beyond Meat (BYND) Shifts Q3 Earnings to Nov 10 — The Surprising Power Players Behind This Meme Stock

Plant-based lightning strikes twice—Beyond Meat shuffles its earnings deck. Who’s really holding the cards?

The meme stock circus rolls on as BYND delays its numbers. Retail traders? Hedge funds? Or just algorithms high on soy protein?

Behind the curtain: A peek at the shareholders turning volatility into profit. Spoiler—it’s not your grandma’s retirement fund.

Bonus cynicism: If you can’t beat ’em, eat ’em—or at least trade their hype cycles.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wall Street expects Beyond Meat to post a nearly 16% year-over-year decline in revenue to $68.98 million. Meanwhile, analysts project a diluted loss of $0.40 per share, slightly lower than last year’s loss of $0.41. With earnings just around the corner, it’s worth taking a look at who holds the biggest stakes in BYND.

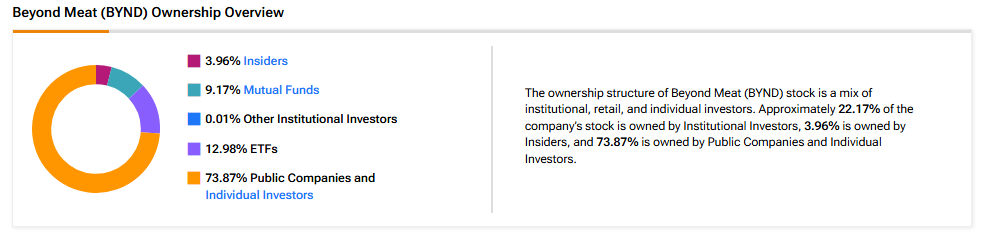

Now, according to TipRanks’ ownership page, public companies and individual investors own 73.87% of BYND. They are followed by ETFs, mutual funds, insiders, and other institutional investors, at 12.98%, 9.17%, 3.96%, and 0.01%, respectively.

Digging Deeper into BYND’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in BYND at 5.45%. Next up is Vanguard Index Funds, which holds a 4.49% stake in the company.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 2.96% stake in Beyond Meat stock, followed by the SPDR S&P Kensho New Economies Composite ETF (KOMP), with a 2.76% stake.

Moving to mutual funds, Vanguard Index Funds holds about 4.49% of BYND. Meanwhile, Fidelity Salem Street Trust owns 1.08% of the company.

Is BYND Stock a Buy, Hold, or Sell?

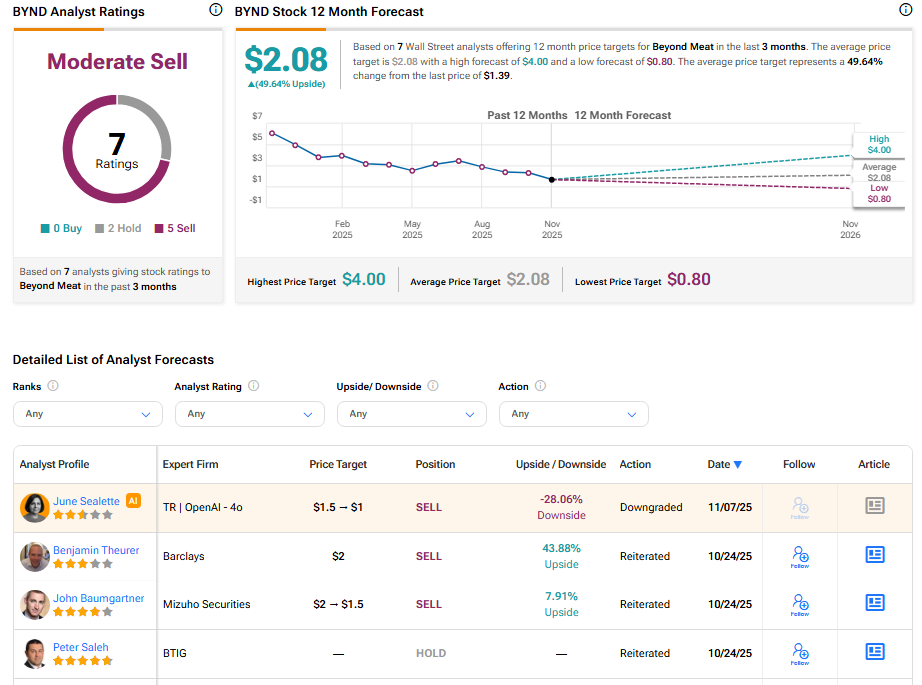

Currently, Wall Street has a Moderate Sell consensus rating on Beyond Meat stock based on five Sell and two Hold recommendations. The average BYND stock price target of $2.08 indicates about 49.64% upside potential from current levels.