Who Really Owns CoreWeave Stock (CRWV)? Key Insights Before Q3 Earnings Drop

As CoreWeave gears up for its Q3 earnings report, the spotlight turns to its shareholder roster. Who’s betting big on this high-stakes play?

The whales, the institutions, and the retail gamblers—we break down the power players behind CRWV.

Hint: It’s not just your average Wall Street suits. Tech VCs and crypto-adjacent funds are lurking in the shadows.

Will the numbers justify the hype? Or is this another ‘growth story’ propped up by cheap liquidity and lower standards? Stay tuned.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meanwhile, Wall Street expects CoreWeave to report a loss per share of $0.40 on revenue of $1.29 billion. In Q2 2025, revenue grew 207% year-over-year to $1.2 billion. However, CoreWeave reported a larger-than-anticipated loss of $0.27 per share. Nonetheless, CRWV ended the second quarter with a solid backlog of $30.1 billion.

Interestingly, ahead of the Q3 results, CoreWeave and AI startup Vast Data announced a $1.17 billion commercial agreement, extending their existing partnership amid growing demand for AI infrastructure.

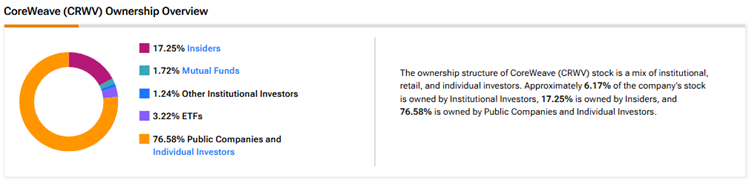

Now, according to TipRanks’ Ownership Tool, public companies and individual investors own 76.58% of CoreWeave. They are followed by insiders, ETFs, mutual funds, and other institutional investors, at 17.25%, 3.22%, 1.72%, and 1.24%, respectively.

Digging Deeper into CRWV’s Ownership Structure

Looking closely at the top shareholders, CW Opportunity LLC owns the highest stake in CoreWeave at 7.77%, followed by Philippe Laffont with a 4.68% holding.

Among the top ETF holders, the Vanguard Extended Market ETF (VXF) owns a 0.62% stake in CoreWeave, while the Vanguard Growth ETF (VUG) owns 0.44%.

Moving to mutual funds, Vanguard Index Funds holds about 0.92% of CRWV. Meanwhile, J.P. Morgan Mutual Fund Investment Trust owns 0.26% of the company.

Is CRWV Stock a Good Buy?

Currently, Wall Street has a Moderate Buy consensus rating on CoreWeave stock based on 13 Buys, 11 Holds, and one Sell recommendation. The average CRWV stock price target of $156.87 indicates 46% upside potential from current levels.