SoundHound AI Stock Tanks 15% Post-Q3 Beat—Wall Street Shrugs at ’Good’ Earnings

Another 'beat and drop' spectacle unfolds as SoundHound AI (SOUN) defies logic—posting solid Q3 numbers only to see its stock gutted. Voice-tech darling now trading at 'show me' multiples.

Earnings whiplash:

Revenue up, losses down—by all accounts a decent quarter. But the algos want blood, slicing 15% off SOUN's valuation by midday. Street punishing growth stocks for breathing lately.

The cynical take:

Another case of 'buy the rumor, sell the news'—or just hedge funds playing hot potato with retail bags? Either way, the AI hype train hits another speed bump. SoundHound's tech may recognize your voice—but can it recognize profitability?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company delivered Q3 revenue of $42 million, up 68% year-over-year, driven by rising enterprise adoption and new wins across automotive, healthcare, financial services, and consumer sectors. The top-line also easily surpassed the consensus estimate of $40.5 million.

While revenue soared, SoundHound reported an adjusted net loss of $0.03 per share. However, the reported figure compared favorably with the analysts’ expectations of a $0.09 loss and improved from the prior-year loss of $0.04.

Is SOUN a Good Stock to Buy?

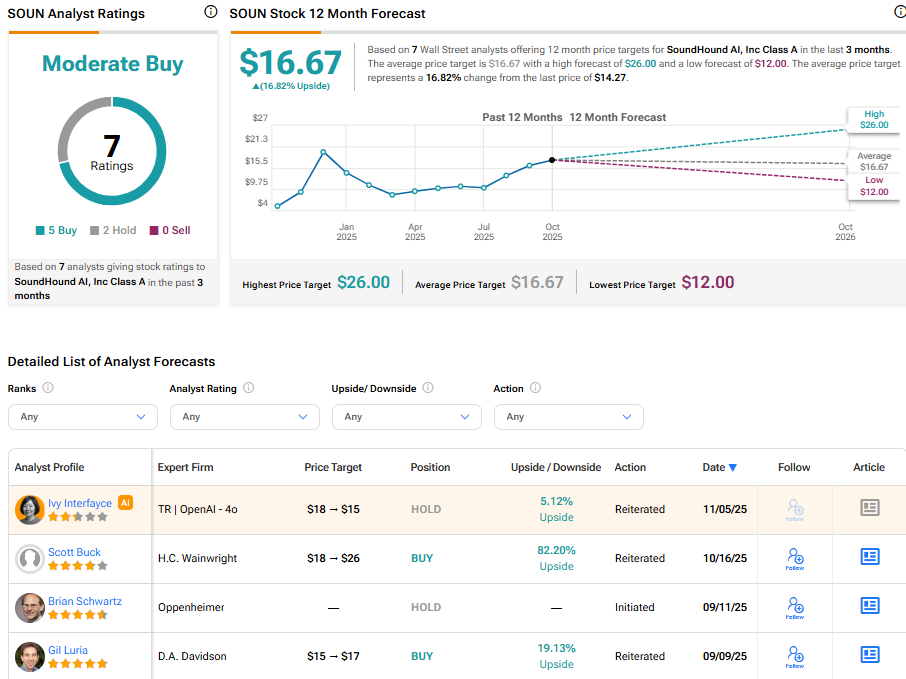

On TipRanks, SOUN stock has received a Moderate Buy consensus rating, with five Buys and two Holds assigned in the last three months. The average SoundHound stock price target is $16.67, suggesting a potential upside of 16.82% from the current level.

It must be noted that analysts may update their price targets for SOUN stock after this earnings report.