Huawei Declares War on Apple (AAPL): The iPhone Air Killer Is Here

Tech giants collide as Huawei drops its most aggressive Apple challenger yet.

Huawei's new flagship isn't just competing—it's gunning for iPhone Air's throne with specs that undercut Apple's pricing. The timing couldn't be worse for AAPL shareholders still nursing their metaverse hangovers.

Cutting-edge hardware meets brutal pricing strategy—Wall Street's favorite cash cow might finally get some real competition. Meanwhile, analysts scramble to downgrade AAPL's 'eternal growth' projections.

One question remains: Can Tim Cook's reality distortion field survive this onslaught? (Spoiler: Those Q4 buybacks won't save you now.)

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Other Chinese phone brands are also stepping up to challenge Apple this year. For example, Xiaomi (XIACF) released its new Xiaomi 17 and 17 Pro models earlier than planned, while giving them names and features meant to match Apple’s, but for less money. Still, Apple’s latest iPhones are selling better in China this year than they did last year, which might be why more competitors are now launching new options.

Interestingly, it is worth noting that, rather than taking on Apple’s top-end iPhone, the Mate 70 Air is designed for people who care more about style and design, just like the iPhone Air’s target audience. And despite being thin, Huawei’s phone still includes a 7-inch screen, stereo speakers, and a big 6,500mAh battery. It also runs on Huawei’s own software and is now available for pre-order in China, with deliveries starting on November 11.

Is Apple a Buy or Sell Right Now?

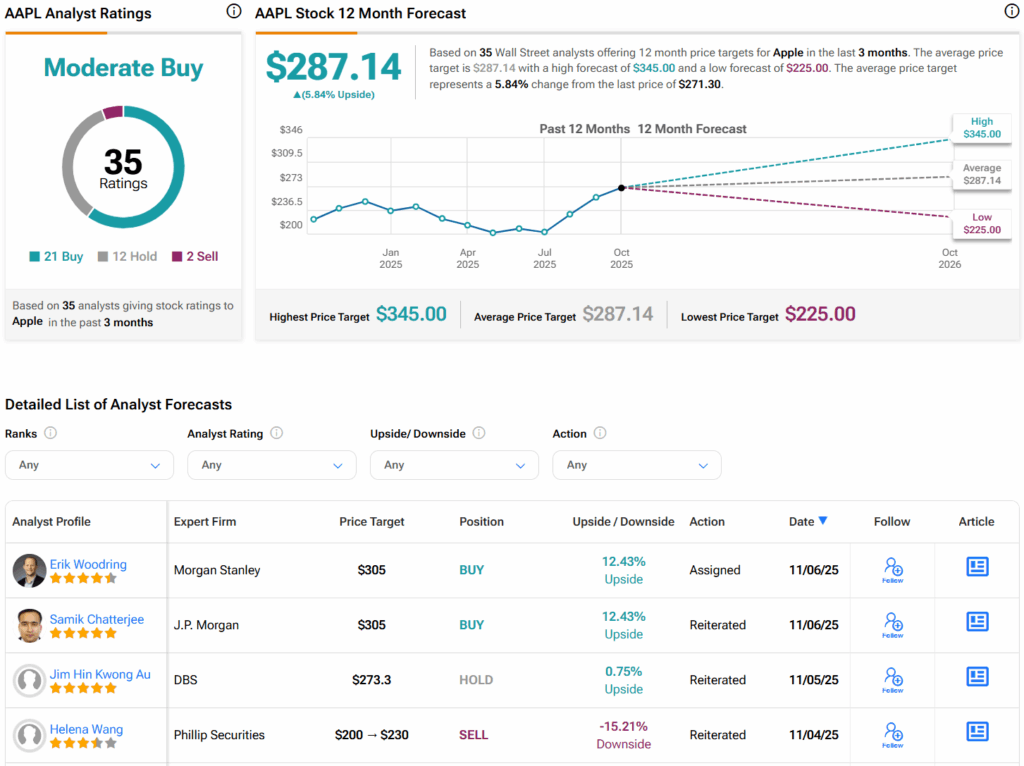

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 21 Buys, 12 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $287.14 per share implies 5.8% upside potential.