AMZN, WMT, COST Smash Records: Holiday Sales to Crack $1 Trillion for First Time in History

Retail giants Amazon, Walmart, and Costco are poised to rewrite economic history—holiday sales will blast past the $1 trillion mark for the first time ever.

The trillion-dollar sleigh ride

Consumers are funneling cash into these retail behemoths faster than Bitcoin maximalists dump altcoins. AMZN’s logistics machine, WMT’s price-slashing dominance, and COST’s bulk-buying cult are vacuuming up discretionary spending.

Peak consumerism or peak insanity?

Wall Street analysts high-fived over the numbers while quietly ignoring the credit card debt time bomb. ‘Tis the season for leveraged cheer—after all, those 29% APR balances won’t pay themselves.

One thing’s certain: when the hangover hits in Q1, these stocks will still be standing—unlike your average crypto trader’s portfolio.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The leading voice of America’s nearly four million retailers says that despite everything that’s currently going on in the U.S. and wider world, consumers will remain resilient and continue spending money on gifts and other festive items during the year-end holidays.

The National Retail Federation forecasts that retail sales will increase at an annual pace of 3.7% to 4.2% between Nov. 1 and Dec. 31, translating into $1.01 trillion to $1.02 trillion in sales. That outlook is positive for leading retailers and e-commerce companies such as Amazon (AMZN), Walmart (WMT), and Costco Wholesale (COST).

Tariff Impacts

The National Retail Federation’s holiday 2025 forecast is bullish and aggressive compared to other predictions for consumer spending in the final two months of the year. Consulting firm Deloitte is forecasting slower holiday sales growth in a range of 2.9% to 3.4%. In 2024, holiday spending in the U.S. increased 4.3%.

Many forecasters are also warning of tariff impacts this Christmas season. Online lending marketplace LendingTree (TREE) just released a report estimating that import tariffs will increase holiday costs for Americans by $40.6 billion this November and December.

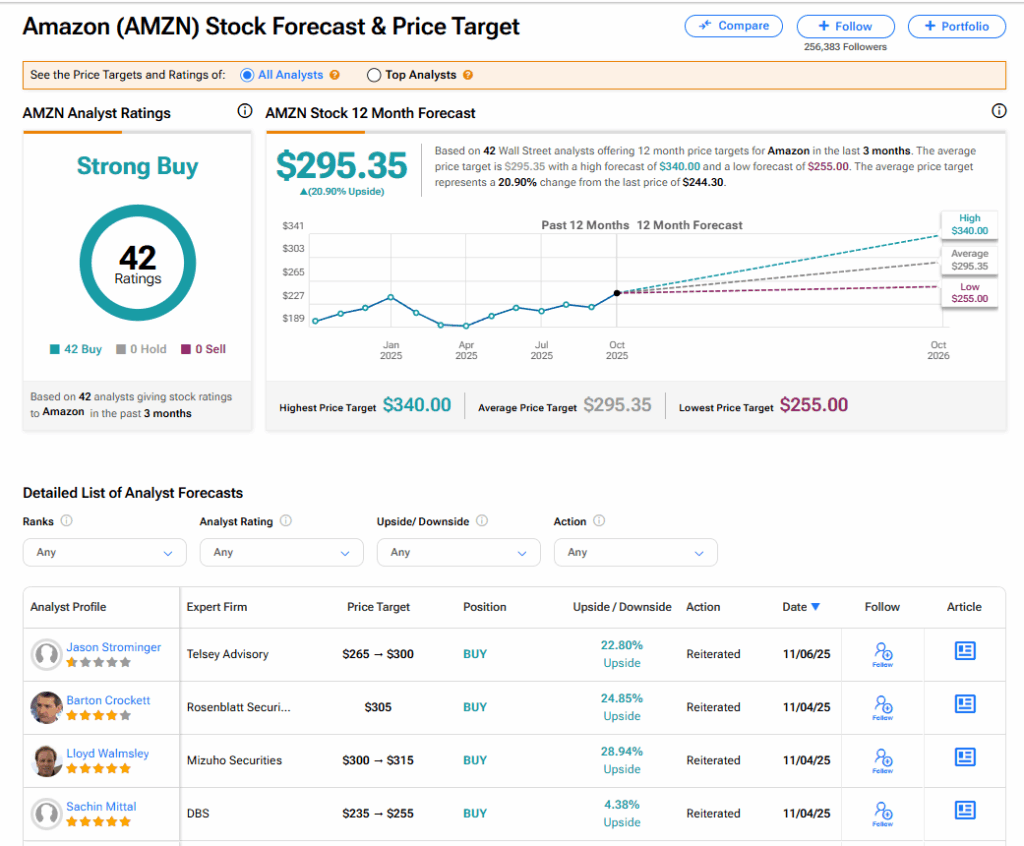

Is AMZN Stock a Buy?

AMZN stock has a consensus Strong Buy rating among 42 Wall Street analysts. That rating is based on 42 Buy recommendations assigned in the last three months. The average AMZN price target of $295.35 implies 20.90% upside from current levels.