Robinhood (HOOD) Q3 Earnings Drop Tomorrow: Here’s What Wall Street’s Watching

Robinhood faces its moment of truth as Q3 earnings hit the tape tomorrow.

The Trading App's Critical Test

All eyes on user growth metrics and crypto trading volumes—the twin engines that either propel this platform or reveal its limitations. Analysts want to see if the retail trading frenzy has legs or if we're watching another fintech fairy tale unravel.

Revenue streams under microscope as commission-free models face reality checks. Options trading, margin lending, and those sweet crypto spreads—every basis point matters when you're competing in a zero-fee world.

Market makers and payment for order flow scrutiny continues—because what's a modern trading platform without some regulatory side-eye?

The real question: Can HOOD deliver profits that justify its valuation, or will this be another 'growth story' that conveniently ignores the bottom line? Wall Street's waiting with the kind of patience usually reserved for a meme stock's next pump.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, revenues are expected to increase by 88% from the year-ago quarter to $1.21 billion, according to data from the TipRanks Forecast page. Notably, Robinhood has an encouraging earnings surprise history. The company missed earnings estimates once out of the previous nine quarters.

Analysts’ Views Ahead of HOOD’s Q3 Earnings

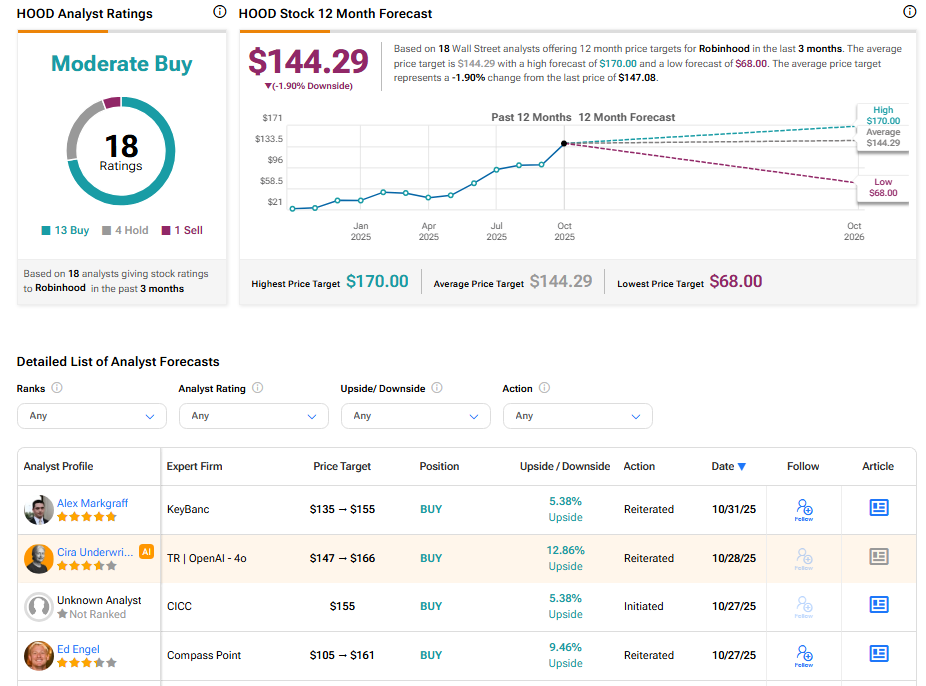

KeyBanc analyst Alex Markgraff raised the price target on HOOD to $155 from $135, while keeping a Buy rating. The analyst said he remains positive heading into the company’s Q3 earnings, citing stronger product updates, better monetization trends, and improving data for FY26.

Meanwhile, TipRanks’ AI Analyst Cira Underwritta (under the GPT-4o model) also raised the price target to $166 from $147 and maintained a Buy rating on HOOD. The new target suggests about 13% upside from current levels. The TipRanks A.I. analysis points to strong financial performance and positive technical signals, though it cautions that HOOD’s high valuation could become a risk if growth slows.

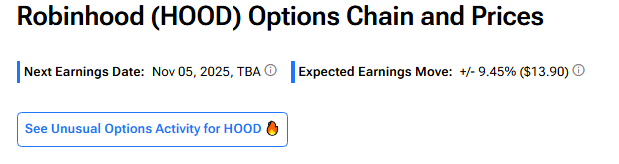

Options Traders Anticipate a Large Move

TipRanks’ Options tool offers a quick way to gauge what options traders anticipate from the stock following its earnings report. The expected earnings MOVE is calculated using the at-the-money straddle of the options set to expire closest to the announcement. While this may sound complex, the tool handles the calculations for you.

Currently, it indicates that options traders are predicting a 9.45% swing in either direction.

Is HOOD a Good Stock to Buy Now?

According to TipRanks, HOOD stock has received a Moderate Buy consensus rating, with 13 Buys, four Holds, and one Sell assigned in the last three months. The average share price target for HOOD is $144.29, which implies a 1.90% downside potential over current trading levels.