Home Depot Stock (NYSE:HD) Tumbles as Immigration Fears Spark Investor Boycott

Retail giant takes unexpected hit as political tensions spill into markets

The Backlash Begins

Home Depot shares slipped sharply today as immigration concerns and layoff rumors triggered a wave of investor anxiety. The home improvement retailer found itself caught in political crosswinds that traditionally wouldn't touch hardware stores.

Market Jitters Spread

Trading floors buzzed with speculation about potential workforce disruptions and consumer boycotts. When immigration debates hit Main Street retailers, you know we've entered uncharted territory—Wall Street hates uncertainty more than it hates paying taxes.

Retail Sector Ripple Effects

Analysts watched closely as the sell-off threatened to spread across the retail sector. Nothing makes investors nervous faster than the prospect of customers actually thinking about where they shop—usually they just chase the lowest price.

The episode serves as another reminder that in today's market, even the most stable blue-chip stocks can't escape becoming political footballs. Maybe they should start accepting cryptocurrency payments—at least those investors are used to volatility.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Basically, a growing number of potential protesters is convinced that Home Depot has an obligation, somehow, to protect the people hanging around in its parking lots who may be in the country illegally but want to make a living regardless. And they are prepared to back their assertions by refusing to shop there.

From there, things start to get fractured, as the people convinced that Home Depot should be “doing something” immediately begin to debate just what that “something” is. For instance, what kind of protection should Home Depot extend to, say, customers who walk in and out of stores who are arrested over matters of “mistaken identity”? And what can the company even do about any of this? Home Depot has made it clear numerous times that the government does not involve Home Depot in decision making, so can Home Depot even do anything to begin with?

Then The Layoff Concerns Hit

It got worse from there, as the word we brought out recently about Home Depot’s planned closure of an HD Supply outlet NEAR La Vergne, Tennessee prompted concerns about its overall supply chain. Some might call these concerns overblown; after all, the La Vergne closure is only partially a closure. The operation being closed is instead being incorporated into a second operation in the same town, which suggests some duplication of effort.

Still, the concerns that emerged at the time—shutting down any part of logistics suggests a reduced demand for it—seem to be gaining ground. This is particularly true given that there were signs that consumers were starting to take on home improvement projects again, of the kind that commonly required loans to accomplish. Throw in the holiday shopping season arriving, when Home Depot should need a supply chain running full-tilt, and the end result is unnerving for investors.

Is Home Depot a Good Long-Term Buy?

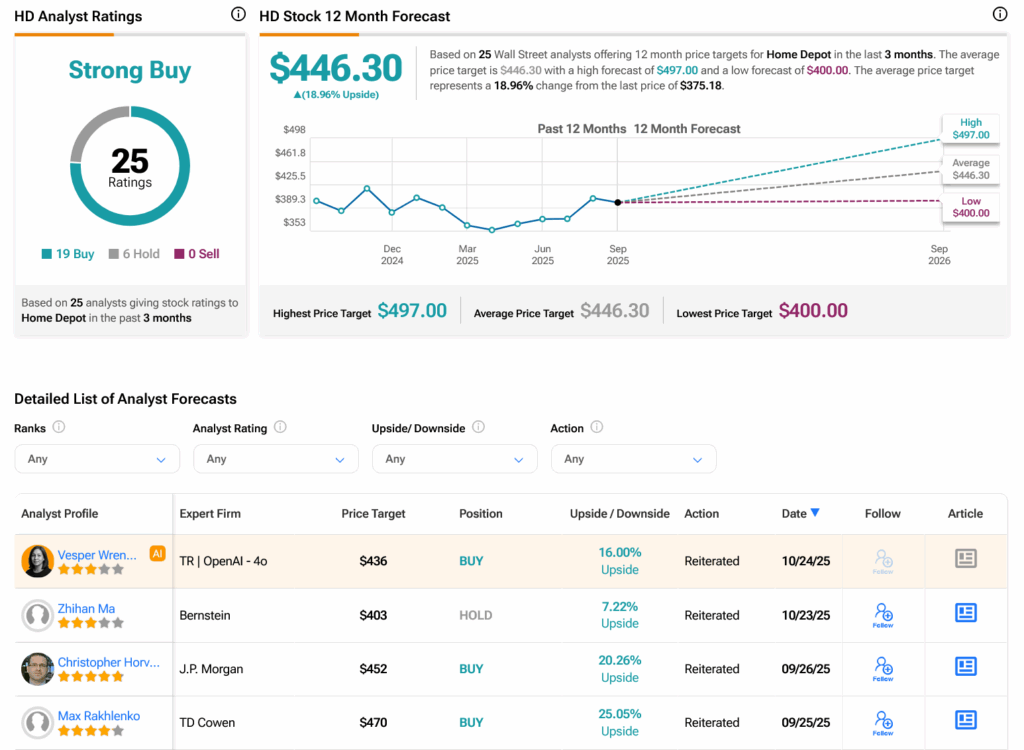

Turning to Wall Street, analysts have a Strong Buy consensus rating on HD stock based on 19 Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 4.04% loss in its share price over the past year, the average HD price target of $446.30 per share implies 18.96% upside potential.

Disclosure