Tea-Fi Revolutionizes DeFi: Single SuperApp Delivers Infinite Yield Through $TEA Token

DeFi just got its morning wake-up call—and it's steeped in innovation.

The All-in-One Powerhouse

One platform consolidates everything—swaps, farming, lending—eliminating the endless tab-hopping that plagues traditional DeFi interfaces. No more wallet-draining gas fees or security vulnerabilities from connecting to multiple protocols.

$TEA Token Mechanics

The native token doesn't just sit there looking pretty—it actively generates yield through multiple revenue streams. Staking rewards, protocol fees, and cross-chain arbitrage opportunities create a compounding engine that makes traditional savings accounts look like medieval banking.

Market Disruption Underway

While legacy finance institutions are still figuring out blockchain, Tea-Fi's superapp architecture demonstrates what happens when user experience meets serious financial engineering. Banks take six months to process a loan—this ecosystem settles transactions in seconds while generating returns that would make Wall Street analysts blush.

The future of decentralized finance isn't just decentralized—it's deliciously efficient. Though if past crypto cycles taught us anything, even the most elegant protocols can't escape the oldest rule in finance: if it seems too good to be true, it probably is—until it isn't.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nio and XPeng Outperform Again

Nio delivered a record 40,397 vehicles in October 2025, surging 92.6% year-over-year and climbing 16.3% from September. This growth was powered by its flagship Onvo and Firefly sub-brands. Nio recorded the third consecutive month of Onvo L90 deliveries crossing 10,000 units, confirming its successful launch in the family SUV segment.

Meanwhile, XPeng’s October deliveries reached 42,013 vehicles, an impressive 76% jump year-over-year, though sequential growth moderated to just 1%. XPeng’s global strategy remained in focus, with the brand launching in seven new markets in October, aiming for broader international recognition. Investors have responded positively for much of 2025, with XPeng stock up 98.7% year-to-date.

Li Auto Extends Its Losing Streak

Li Auto’s October deliveries fell sharply to 31,767 units, down 38.3% year-over-year and 6.4% compared to September, as weak demand impacted its extended-range EVs. The company is responding with new SUVs and aggressive pricing but has yet to reverse the trend.

BYD Stays on Top Despite Headwinds

BYD delivered 441,706 vehicles in October, down 12.13% year-over-year, even though sales ROSE 11.4% month-over-month. The dip reflects rising competition in the mass-market EV space and slower growth in China’s domestic market.

Still, BYD remains the country’s largest EV Maker by volume and continues to grow internationally. The company’s year-to-date deliveries have already topped previous records, supported by expanding exports and its strong battery division.

Which Is the Best EV Stock?

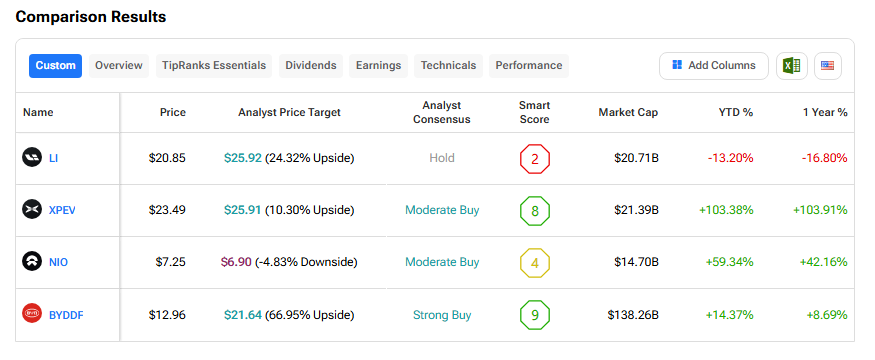

Using TipRanks’ Stock Comparison Tool, let us take a look at Wall Street’s ratings for the four EV stocks mentioned above.

BYD stands out with a Strong Buy consensus and the highest upside potential, showing analysts’ strong confidence in its long-term growth. XPeng also holds a Moderate Buy rating, backed by strong sales and global expansion. Li Auto carries a Hold rating, while NIO has a Moderate Buy rating but faces a slightly weaker outlook, with analysts projecting limited near-term gains.

Based on these ratings, BYD and XPeng appear to be the preferred picks among Wall Street analysts, while Li Auto and NIO face a more cautious outlook despite recent delivery strength.