Trump Declares Nvidia Blackwell AI Chips Off-Limits to Foreign Markets, Signaling Major Export Restrictions

Trump drops export ban bombshell—Nvidia's cutting-edge Blackwell AI processors now designated domestic-only technology.

The Geopolitical Power Play

Washington's latest move puts artificial intelligence development squarely in the crosshairs of national security policy. The Blackwell chips—reportedly 30x more powerful than previous generations for AI workloads—suddenly become America's most guarded technological crown jewel.

Market Shockwaves Expected

Global tech manufacturers from Shenzhen to Seoul now face catastrophic supply chain disruptions. Nvidia's stock dipped 8% in after-hours trading as analysts scrambled to reassess the $2 trillion company's growth projections.

Meanwhile, crypto miners eye the situation with familiar irony—another case of regulators treating advanced computing like nuclear weapons while letting actual financial weapons of mass destruction roam free in traditional markets.

The AI arms race just got real borders.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Aboard Air Force One, Trump remarked, “The new Blackwell that just came out, it’s 10 years ahead of every other chip… But no, we don’t give that chip to other people.”

Are Trump’s Comments Directed to China?

Trump did not explicitly mention whether his comments targeted China in particular. However, the U.S. administration has always been concerned about the misuse of AI chips for the advancement of China’s military operations. Republican Congressman John Moolenaar, chairman of the House Select Committee on China, recently compared the proposal to “handing Iran weapons-grade uranium.”

If implemented, Trump’s position could impose tighter export limits than current U.S. policy, potentially blocking not only China but also other nations from accessing Nvidia’s most advanced products. The remarks come shortly after Trump and Chinese President Xi Jinping agreed on a one-year deal addressing rare-earth minerals and fentanyl-related trade measures. Though Trump earlier suggested that Nvidia’s chip exports might be discussed during their meeting, he later clarified that the topic did not arise.

Questions have arisen over whether Trump would permit shipments of a scaled-down version of Nvidia’s Blackwell chips to China, following his earlier suggestion that such sales might be allowed. In the interview, Trump left open the possibility of access to a downgraded model, saying “We will let them deal with Nvidia but not in terms of the most advanced.”

Nvidia’s Position and Global Market Exposure

Nvidia has acknowledged U.S. concerns about technology transfer and has refrained from obtaining U.S. export licenses for the Chinese markets. At the GTC event last week, CEO Jensen Huang said, “They’ve made it very clear that they don’t want Nvidia to be there right now.” However, Huang has argued that American chipmakers need global access to sustain their research and maintain leadership in AI innovation.

China remains one of Nvidia’s largest markets, providing critical revenue to finance research and development in the U.S. At the same event, Nvidia announced plans to supply about 260,000 Blackwell AI chips to South Korea, including to companies such as Samsung Electronics (SSNLF). It is unclear whether those sales will MOVE forward if the administration enforces new restrictions.

Nvidia recently became the world’s most valuable company, surpassing $5 trillion in market capitalization. The company’s rise has been driven by strong demand for its AI chips, which underpin much of the global boom in AI development.

Is Nvidia Still a Good Stock to Buy?

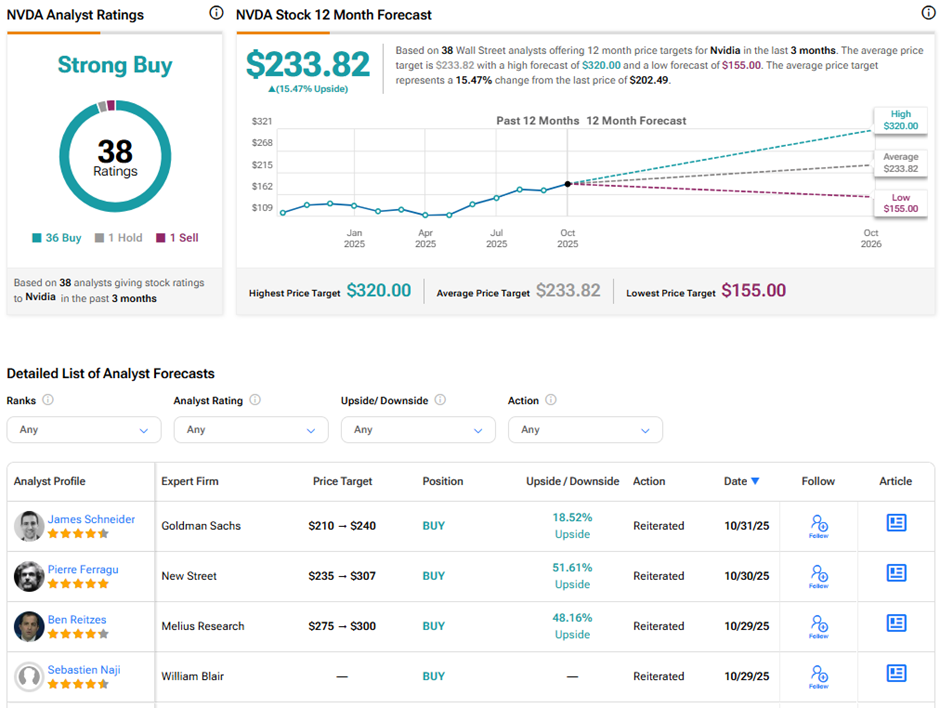

On TipRanks, NVDA stock has a Strong Buy consensus rating based on 36 Buys, one Hold, and one Sell rating. The average Nvidia price target of $233.82 implies 15.5% upside potential from current levels. Year-to-date, NVDA stock has surged nearly 51%.