Fiserv Stock (FI) Plummets as Analysts Slash Ratings and Targets Following Q3 Earnings Catastrophe

Wall Street turns ruthless on Fiserv after disastrous quarterly results trigger massive downgrades across the board.

The Bloodbath Begins

Analysts wasted no time swinging the axe—multiple firms simultaneously cut their price targets and ratings on FI stock. The Q3 earnings shockwave sent traditional finance players scrambling while crypto markets continued their steady ascent.

Numbers Don't Lie

Target prices got slashed by brutal percentages across major institutions. The downgrades hit hard—transforming previous bullish outlooks into cautionary tales overnight.

Traditional Finance's Reckoning

While legacy payment processors stumble through earnings season, decentralized finance platforms operate 24/7 without quarterly report drama—another reminder that traditional finance moves at dinosaur speed while digital assets evolve in real-time.

The fallout exposes how vulnerable traditional payment stocks remain to single-quarter performance—meanwhile, cryptocurrency ecosystems grow whether Wall Street analysts wake up bullish or bearish.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Several Analysts Weigh In on FI Stock

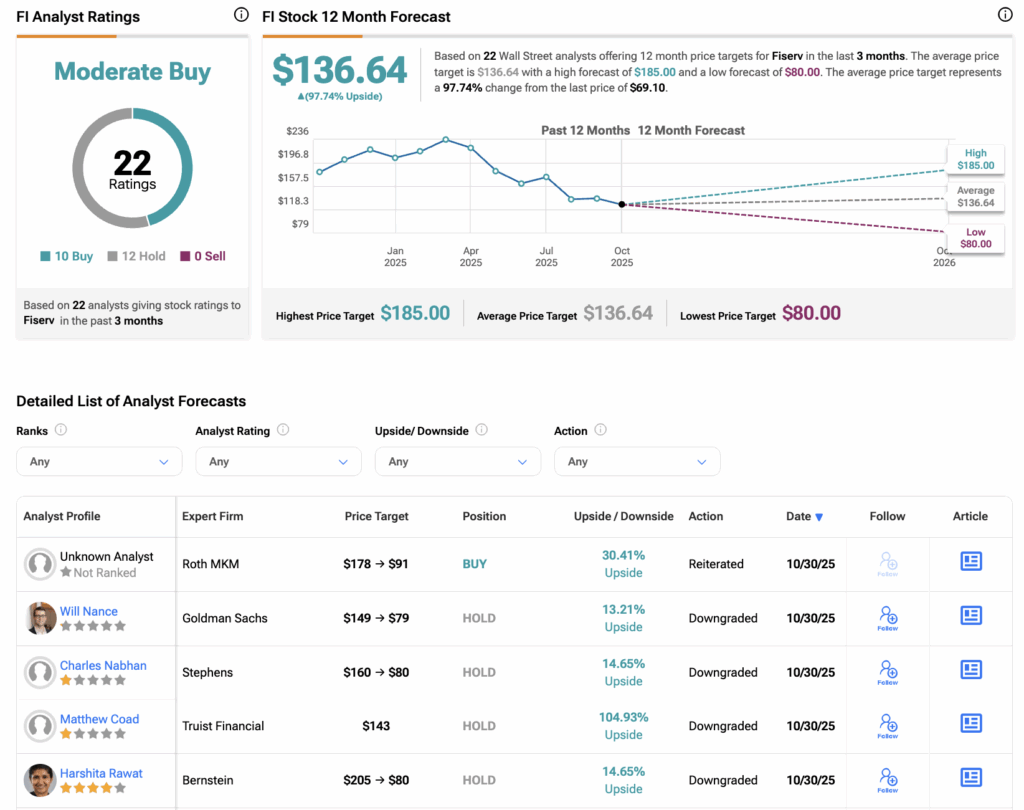

Following the results, four-star-rated analyst Harshita Rawat at Bernstein downgraded her rating on FI stock from Buy to Hold, while trimming her price target from $205 to $80. She described the magnitude of the Q3 miss as “hard to explain” and a “180-degree turn under the new management.” Rawat added that she now has reduced confidence in the company’s visibility into its own business operations.

Likewise, analyst Charles Nabhan at Stephens downgraded to Hold and reduced the price target by 50% to $80. Nabhan said that while the company’s baseline has been “appropriately reset,” he doesn’t expect the stock to re-rate until the second half of 2026, when growth acceleration may become clearer. Stephens added that although recent management and board changes show a “commitment to change,” it will likely take several quarters for Fiserv to regain market confidence in its strategy.

At the same time, J.P. Morgan’s Tien Tsin Huang at J.P. Morgan cut his price target from $155 to $85 but kept his Buy rating on FI. The four-star-rated analyst expected the company’s Q3 report to be a “clearing event,” but says the quarter “felt more like a necessary washout for Fiserv to cleanse itself, return to its roots, and be a high-quality compounder.” Meanwhile, he believes that yesterday’s selloff likely already accounts for the earnings revisions and lower valuation. Nonetheless, Huang added that Fiserv’s new, more realistic targets could help the company deliver clearer and more consistent results going forward.

Is Fiserv a Good Stock to Buy?

According to TipRanks, FI stock has a consensus Moderate Buy rating among 22 Wall Street analysts. That rating is based on 10 Buys and 12 Holds assigned in the last three months. The average Fiserv stock price target of $136.64 implies an upside of 97.74% from current levels.

Year-to-date, FI stock has declined by 67%.