Vertical Aerospace (EVTL): The Stealth eVTOL Play Wall Street’s Whispering About

While crypto traders chase the next shiny token, smart money's eyeing a different kind of disruption—one that actually flies.

The Sky's New Currency

Vertical Aerospace isn't just building flying taxis—it's constructing the infrastructure for urban air mobility while crypto projects struggle to deliver working products. EVTL's stock represents tangible innovation in a sea of speculative assets.

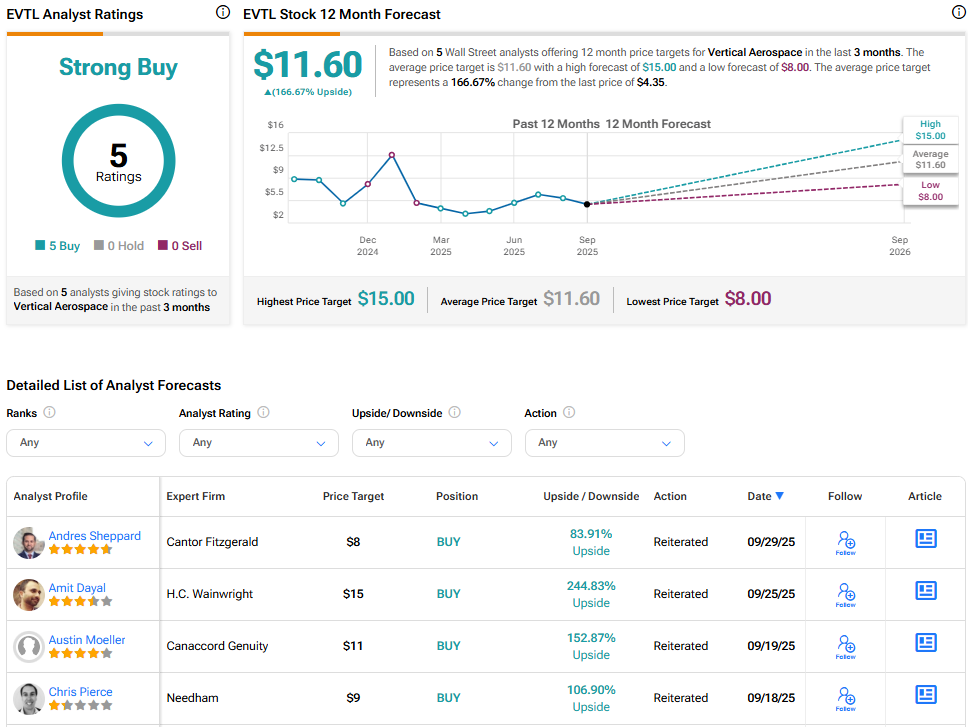

Analysts See Clear Air

Multiple firms have slapped 'Strong Buy' ratings on this eVTOL contender, betting on technology that could actually transport people rather than just digital promises. The company's progressing toward certification while your average DeFi project can't even pass a basic security audit.

Ground Floor or Basement?

Unlike crypto's constant cycle of hype and disappointment, Vertical Aerospace offers something radical: actual aircraft orders and regulatory progress. Because nothing says 'serious investment' like a vehicle that won't crash when the market dips 5%.

Sometimes the best moonshot isn't a token—it's a machine that literally reaches for the sky while traditional finance still can't figure out stablecoins.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Founded in 2016 and headquartered in Bristol, the company’s main product is the eVTOL VX4. Vertical Aerospace aims to make zero-emission air travel a reality while keeping costs efficient and design practical. Stuart Simpson serves as CEO.

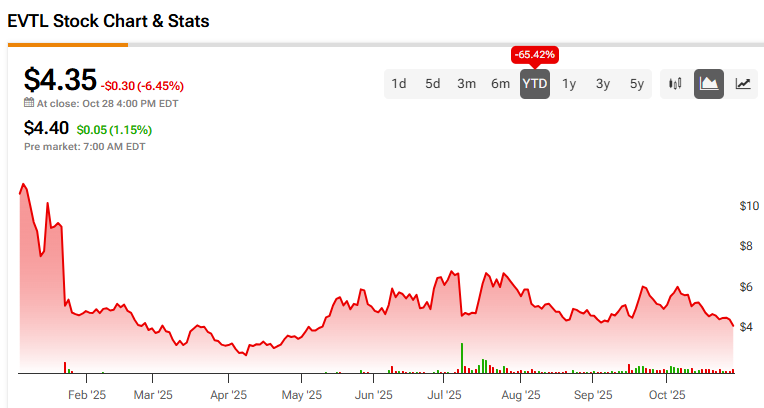

EVTL shares have had a rough start to 2025, with a 65% year-to-date decline.

Why Analysts Are Bullish

On the analyst front, the company boasts a Strong Buy consensus rating. For instance, four-star analyst Austin Moeller of Canaccord Genuity maintained a Buy rating with an $11 target, citing the company’s lean approach to achieving certification for its VX4 aircraft. Vertical expects to need about $700 million in total additional funding to complete the process, which is notably lower than most peers. This disciplined funding plan has strengthened analysts’ confidence in the company’s ability to execute without overextending its finances.

Moeller also pointed to Vertical’s “FlightPath 2030” plan, which includes early cash breakeven by 2029 and projects $1 billion in annual revenue by 2030. This roadmap combines financial discipline with clear operational goals, making the case for long-term value creation.

What the Bulls and Bears Say

Bulls say management’s raised delivery goals show confidence in future growth. They also note that the company pulled forward its breakeven target by one year, suggesting an improving financial outlook. Furthermore, partnerships with firms like Honeywell (HON), Bristow, and Aciturri Aerostructures enhance production and market reach, supporting a capital-light model.

Bears say the main challenge remains capital requirements. While most of the estimated $700 million certification cost is already contracted, future cash use will stay high. Persistent losses, negative equity, and a long path to certification mean the financial picture will likely stay fragile for some time.

Certification Remains Complicated

Vertical Aerospace’s most recent earnings call in August 2025 carried a positive sentiment. The company highlighted progress with flight testing, including the world’s first piloted eVTOL airport-to-airport flight. It also reported advancements in battery technology and raised about $160 million in 2025 to extend its cash runway into mid-2026.

However, certification remains complex and is not expected before 2028. High engineering and production costs will likely keep pressure on operating cash flow. Despite the decline, analysts continue to see the long-term opportunity. Vertical’s steady progress toward certification, growing partnerships, and strategic expansion into the defense sector are key reasons behind its Strong Buy outlook.

Bottom Line

Vertical Aerospace is still an early-stage player in the electric aviation market, but its strategic funding plan, industry partnerships, and long-term revenue goals have drawn strong analyst support. While the path to certification and profitability remains challenging, analysts believe the company’s disciplined approach and clear milestones could help it emerge as a leader in the growing eVTOL industry.

Is EVTL Stock a Buy?

As stated above, Vertical Aerospace boasts a Strong Buy consensus rating, based on five analysts. The average EVTL stock price target stands at $11.60, implying a 166.67% upside from the current price.