Turkish Bitcoin Researcher: If the FED Does This, BTC and Altcoins Could Soar!

Federal Reserve's Next Move Could Trigger Crypto Market Frenzy

A prominent Turkish cryptocurrency analyst reveals the single Federal Reserve action that could send digital assets skyrocketing. While Wall Street remains cautious about inflation data, crypto markets are poised for explosive growth under the right monetary conditions.

The Fed's Interest Rate Dilemma

Market watchers suggest that any dovish pivot from the Federal Reserve could unleash billions in sidelined capital directly into Bitcoin and alternative cryptocurrencies. Traditional finance institutions continue underestimating crypto's reaction speed to macroeconomic shifts—meanwhile, retail investors are positioning for what could be the next major bull cycle.

Timing the Crypto Surge

Historical patterns show cryptocurrency markets often anticipate Federal Reserve policy changes weeks before traditional assets react. This forward-looking behavior creates opportunities for early movers while leaving conventional investors playing catch-up. The analyst emphasizes that specific Fed actions, rather than vague statements, will determine the magnitude of the coming rally.

As central bankers debate their next move, crypto traders are already placing bets—proving once again that while traditional finance hosts the meetings, cryptocurrency markets write the headlines.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

California Secures ‘Concessions’ after ‘Robust Investigation’

Reacting to the deal, Rob Bonta, California’s attorney general, said his office will continue to ensure that OpenAI remains committed to its public-benefit roots. OpenAI was founded in San Francisco in 2015 as a nonprofit research lab to ensure that artificial general intelligence benefits mankind.

“We will be keeping a close eye on OpenAI to ensure ongoing adherence to its charitable mission and the protection of the safety of all Californians,” Bonta said in a statement, adding that the public prosecutor’s office obtained “concessions” in that regard.

OpenAI has also pledged to remain in California, Bonta said. The Attorney General’s office had conducted over a year and a half of “robust investigation” into the first for-profit deal announced last month and the latest revised version.

Bonta also pledged that his office “will not be in court opposing OpenAI’s recapitalization plan” so long as the concessions are in place.

Wall Street Cheers Microsoft’s Deal with OpenAI

The new arrangement between Microsoft and OpenAI includes terms such as Microsoft committing $135 billion in investment, or a 27% stake, in OpenAI when it becomes a for-profit corporation. OpenAI will also purchase Microsoft’s Azure cloud services incrementally, up to $250 billion — which is crucial for the startup’s heavy AI workloads.

The deal has been praised by Wall Street analysts as highly beneficial for Microsoft, including by strengthening its Copilot initiative and unlocking additional monetization opportunities in Azure and OpenAI. However, the Wall Street Journal reports that Microsoft’s disclosures about its OpenAI investments are “scant”, with $4.7 billion in OpenAI-related losses tucked under the tech company’s “other” expense line in its most recent fiscal year ended June 30th.

What Are the Best AI Stocks to Buy Now?

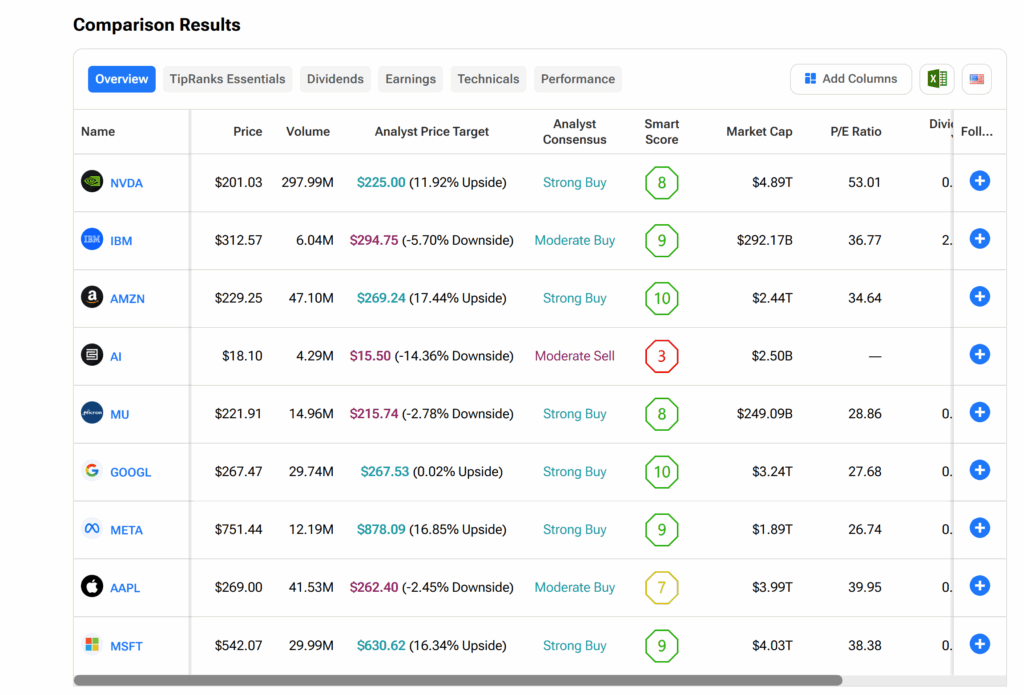

As the race to develop artificial intelligence intensifies, identifying the stocks that offer the best exposure and investment returns remains critical. TipRanks’ Stock Comparison tool provides guidance and insight in this regard based on Wall Street analysts’ estimates.

Kindly refer to the graphics below.