Crypto Traders Brace for Wild Ride as Bitcoin and Ether Dance on Knife’s Edge

Markets hold their breath while digital gold and silver flirt with danger zones

The Tension Builds

Trading desks buzz with anticipation as Bitcoin and Ethereum hover near critical support levels. Every chart pattern screams volatility—traders either see massive opportunity or impending disaster. No middle ground here.

Positioning for the Storm

Options markets flash warning signs while leverage ratios suggest someone's about to get liquidated. The perpetual funding rate tells its own story—greed and fear wrestling in plain sight.

The Waiting Game

Institutions watch from the sidelines, ready to pounce on any significant move. Retail traders check their phones every thirty seconds. The entire ecosystem holds its collective breath, waiting for that first major candle to break the stalemate.

Meanwhile, traditional finance veterans sip their lattes and mutter about 'speculative bubbles'—proving once again that missing the biggest wealth transfer in history builds character.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

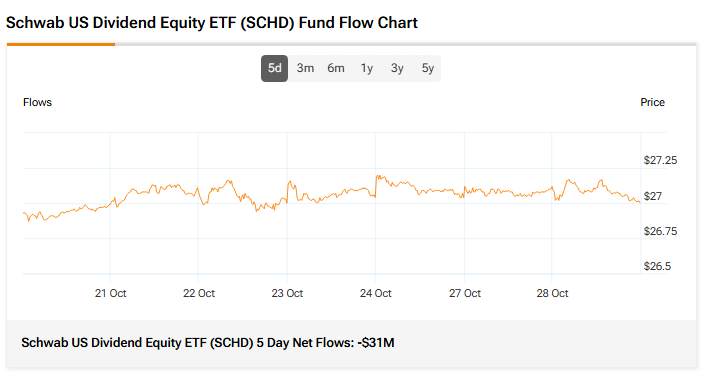

Meanwhile, the SCHD is up 0.26% in the past five days and 1.66% year-to-date.

Fund Flows and Sentiment

The SCHD ETF tracks the performance of high-dividend U.S. stocks from the Dow Jones U.S. Dividend 100 Index. According to TipRanks data, SCHD recorded 5-day net flows of about -$31 million, indicating that over the last five trading days, investors withdrew more money from the SCHD ETF than they added.

SCHD’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, SCHD is a Moderate Buy. The Street’s average price target of $30.56 implies an upside of 13.20%.

Currently, SCHD’s five holdings with the highest upside potential are Coterra Energy (CTRA), Ovintiv (OVV), AMERISAFE, Inc. (AMSF), Kforce (KFRC), and Inter Parfums (IPAR).

Meanwhile, its five holdings with the greatest downside potential are Skyworks Solutions (SWKS), Best Buy Co. (BBY), Carter’s (CRI), Western Union (WU), and Ford Motor (F).

Revealingly, SCHD ETF’s Smart Score is seven, implying that this ETF will likely perform in line with the market.

What to Watch Next

All eyes are on the Fed’s interest rate decision on October 29, which could determine whether dividend yields stay attractive relative to bonds.

Power up your ETF investing with TipRanks. Discover the Top Equity ETFs with High Upside Potential, carefully curated based on TipRanks’ analysis.

Disclosure