Nvidia Soars After CEO’s Stunning $500B AI Order Announcement — Top Analysts Predict Further Gains

Nvidia's stock just caught rocket fuel — CEO drops bombshell $500 billion AI order that sent shares screaming upward.

The Chipmaker's Power Play

Forget incremental growth — we're talking about the kind of order that rewrites market expectations overnight. Five-star analysts who called this move early are now pointing to even more upside potential.

Market analysts scramble to adjust price targets while Wall Street tries to comprehend the scale of this AI infrastructure demand. The numbers don't lie — $500 billion represents the kind of corporate confidence that makes traditional tech investments look like pocket change.

AI's insatiable appetite for processing power meets its match in Nvidia's manufacturing capabilities. This isn't just another quarter — it's a fundamental shift in how enterprises are betting on artificial intelligence infrastructure.

Of course, the finance bros who missed the initial surge are now desperately searching for the 'next Nvidia' — because nothing says smart investing like chasing yesterday's news at tomorrow's prices.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The massive $500 billion order update quickly caught Wall Street’s attention, with several Top analysts saying the figure points to stronger growth and higher earnings potential than current forecasts suggest.

For reference, the Blackwell chip is expected to launch later this year, while Rubin, due in 2026, will build on Blackwell’s design to extend Nvidia’s lead in data center and AI computing.

Wolfe Research Sees Big Upside Potential

Wolfe Research analyst Chris Caso reiterated an Outperform rating on Nvidia (NVDA) with a $230 price target, noting that the company’s latest disclosure of $500 billion in expected chip orders points to “significant upside compared with current Wall Street forecasts.”

The 5-star analyst estimates Nvidia may ship $500 billion worth of Blackwell and Rubin chips in calendar years 2025 and 2026, compared to his current forecast of about $360 billion for the same period. That difference could add roughly $140 billion in data center revenue and around $3 per share of additional EPS in 2026 if Nvidia’s outlook holds true.

The analyst noted that even a conservative interpretation of Huang’s remarks points to meaningful growth beyond Wall Street’s current models.

Cantor Fitzgerald Calls Estimates “Way Too Low”

Cantor Fitzgerald analyst C J Muse kept its Overweight rating and $300 price target on Nvidia, arguing that Wall Street’s current earnings estimates remain “way too low.” The 5-star analyst noted that Nvidia’s $500 billion in chip orders, along with new AI and supercomputer deals, point to much stronger growth than analysts now expect.

Cantor said that with over $500 billion in chip business booked through 2026, Nvidia’s earnings potential remains underappreciated. The firm added that, even with talk of an “AI bubble,” Nvidia still trades at roughly 21 times its projected 2026 EPS of $9–$10, calling the stock “too inexpensive to ignore.”

Is NVDA a Good Stock to Buy Now?

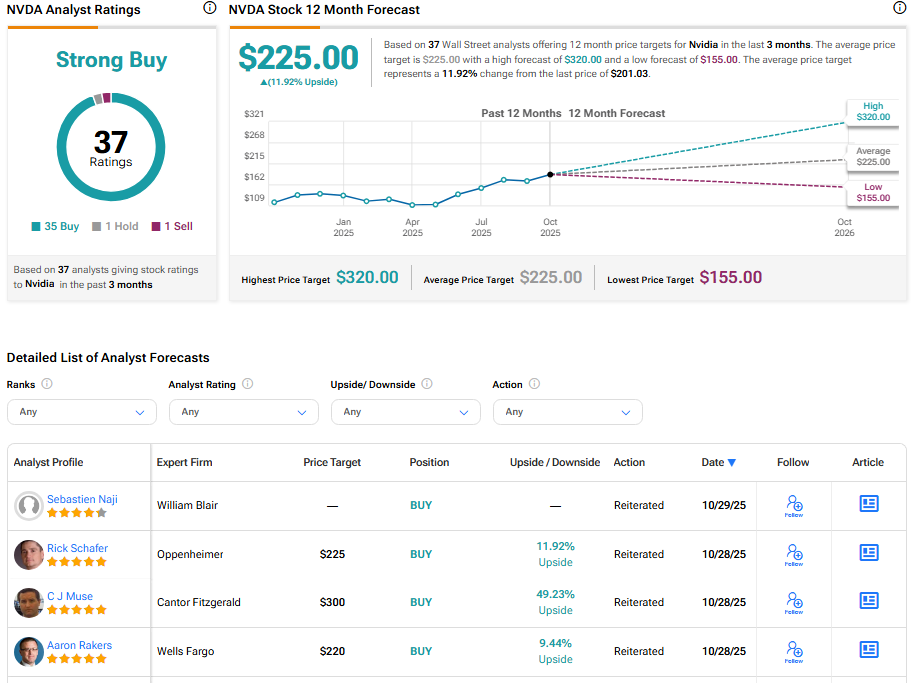

Analysts remain highly optimistic about Nvidia’s long-term outlook. On TipRanks, NVDA stock has a Strong Buy consensus rating based on 35 Buys, one Hold, and one Sell rating. The average Nvidia price target of $225 implies nearly 12% upside potential from current levels. Year-to-date, NVDA stock has gained nearly 50%.